What Do Bull And Bear Markets Mean To You?

With all of the wild swings in the stock market recently, there’s been much speculation about whether we’re in a bear market or a bull market. That is to say, is the market going to go further down from here, or turn around and go back up?

And there have been many questions on how investors should be handling their individual stocks and overall portfolios in this uncertain situation. So more on that in a moment, but first, just what are bull and bear markets, and how did we come to use these terms?

Well, in general, the terms bulls and bears are used to describe if the market is going up (bull), or the market is going down (bear) over a period of time – usually a few months or years. Put another way, are the stock prices going up, so you’re making money with your investments, or are the prices going down, so you’re losing money on your stock investments.

|

OK – SO SOME PEOPLE DO MAKE MONEY IN BEAR MARKETS… I’m keeping it simple here by saying people make money in bull markets and lose money in bear markets. Because the way most people invest, this is true. But there are some savvy investors that actually make money in bear markets. You may wonder how they do that. So here’s how. They anticipate that a stock is going to fall in price. And so they borrow (don’t buy) shares of the stock, and sell them at the current high price. Then if the price falls, they buy shares at the lower price, and return them to pay back the shares they borrowed. The difference in the price is their profit. This is called short selling. In other words, they sold something they didn’t even own (they were short). You’ve heard the phrase “buy low, sell high” to make money, right? Well, they did the same thing – they just did it in reverse order. They sold high, and then bought low. As long as you are buying stocks lower than you are selling them, you are making money, no matter what order you do this in. If this sounds too complicated, don’t worry. Beginning investors, and probably most investors, don’t need to do this to be successful. |

And to keep it simple, you can usually just substitute the word “up” for “bull” and the word “down” for “bear.” For example, here’s a headline from a recent Wall Street Journal Article… “Small-Cap Stocks Teeter on the Edge of a Bear Market.” You can change that headline to “Small-Cap Stocks Teeter on the Edge of a Down Market,” and it means pretty much the same thing.

So that said, why do we talk about bulls and bears?

Well, no one knows for sure the origins of these terms, but here are a couple of my favorites.

One is that the terms are thought to come from the way these animals attack their opponents. For example, a bull will thrust his horns up, and a bear will swipe its giant paws and claws down. So these up and down motions are used as a metaphor for the actions of the stock market.

Another explanation for the origins of the terms may come from the London stock market at the turn of the 17th century. Way back then, before databases and the internet, there was a bulletin board where traders posted offers to buy different stocks. When traders were optimistic and wanted to buy many stocks, the board was full of these bulletins. These bulletins were commonly called “bulls.”

And when the market was going down, and traders were pessimistic, the bulletin board was “bare” because no one was posting offers to buy. So using the bulletin board, a “bull market” came to describe when the market was up, and there was a lot of enthusiasm to buy stocks. And a “bare or bear market” came to describe when the market was down, and buyers were pessimistic.

Interestingly, even today, hundreds of years later, the “Big Board” is a nickname for the New York Stock Exchange (NYSE). The New York Stock Exchange, or Big Board, is the oldest stock exchange in the United States.

Okay, so much for the origins of bulls and bears. But are we in a bear market today, and how should investors react when we are?

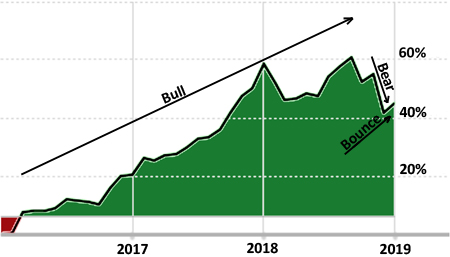

Well, technically, we did touch bear market territory on Christmas Eve, 2018 (Merry Christmas!) when the market closed down 20.3% from its intraday high of 2940 set back on September 20, 2018.

But the honest answer is it’s too soon to tell if we are truly in a bear market for the long haul. No one knows for sure. Because many times the market bounces back quickly and moves on up, resuming the bull market it was in.

And that seems to be the case at the moment. But it could also start dropping again, so we’ll have to wait and see. But there are things we can do in the meantime.

The first is a defensive move. And that is to make sure we sell any stocks that go 25% below our purchase price. That’s sticking to our stop loss discipline.

Or if you’re a more seasoned investor, selling those that have dropped 25% from the highest price they’ve been since you owned them, i.e. sticking to our trailing stop loss discipline.

And the second thing we can do is go on the offense. We can buy some good stocks that are currently on sale due to the overall drop in the market. Because even though the market has started going up, it is still down from its highs, so there are some bargains out there.

For example, I bought more AT&T (T) stock recently to take advantage of that. And at writing, AT&T is down to $30.45 per share. At that price, it will pay you a generous 6.7% dividend. And AT&T has a long history of raising that dividend year over year, so that payoff could get even better over time.

Buying discounted stocks like this is a good way to take advantage of the bear market opportunities. But its best to go easy here as well, and just pick off a few quality stocks at a discount. Because sometimes, after the market has bounced up, the bear roars and it turns around and drops even lower.

And you’ll regret going whole hog into a stock buying spree.

Because there’s another animal in the stock investing equation. And its introduced in the pithy maxim that “Bulls make money, bears make money, but pigs get slaughtered.” In other words, don’t get too greedy.

So to sum it all up, whether we are in a bull or bear market, don’t panic. Stick to your stop loss discipline and sell your losers. And take advantage of a few stocks selling at a discount.

And we’ll just see how the market goes from here.

To your health and prosperity – John

P.S. Dividend paying stocks are often less affected by a market downturn than stocks that don’t pay their owners dividends. To learn more about them, you may be interested in my latest book Your Future Paychecks And Raises: Get Dividend Checks In Your Mailbox Paid To The Order of You! – and how they can help you build your wealth and future income. You can browse through the book for free right here.