What I Look For In A Good Financial Newsletter

Good financial newsletters can be a real key to your stock investing success. But not all newsletters are created equal.

I look for a few key items in a newsletter. They are …

- A story

- The recent and historical company performance

- The researcher’s rational for why it should do well in the future

- A specific buy recommendation at the end

Below is a sample newsletter I paraphrased to illustrate all the key points I look for. Please note that the newsletter is a mockup, and the companies are fictitious, so don’t place a trade based on this example.

Penny Stock Demo Newsletter

July, 2011

Finding Safe, High Potential Stocks Around the World

Recently, one of my favorite rules was confirmed yet again in the stock market. Technology stock XYZ, a popular favorite, was riding high, up 110% from two years ago. It is what I call a high expectation stock.

Because of its popularity with the public, it was very expensive. It never ceases to amaze me that the crowd of investors only gets interested in buying stocks when they are high and overpriced. Whatever happened to the concept of buying things on sale?

These stocks always eventually get crushed, along with their investors. Sure enough, XYZ started taking a swan dive two months ago and has lost over half of its value. So all the eager investors at the top have taken huge losses. So much for high expectation stocks.

I learned long ago to look for just the opposite, what I call low expectation stocks. For example, in my last issue, I listed a number of low expectation stocks like Office Maxx and BankZ. They were at the lowest price in twenty years and well worth more than the market was willing to pay. After all, with the economy worried about a possible second depression, who would want to buy an office supply or banking stock?

But this is just when and where we can pick up incredible values. I’m talking stocks that have a potential to rocket up 400 to 800% in twelve months. I have seen this happen time and again. These are low expectation stocks. They are low and unloved by the public. They are the epitome of what Warren Buffett is talking about when he says, “Be greedy when others are fearful.”

These stocks are among the safest, highest-performing stocks you can buy. When low-expectation stocks do something wrong, the shares won’t fall much. But when they do something right, shares can soar.

This Month’s Recommendation

This month my recommendation is just such a low expectation, high value stock. The company I am talking about is SprintFast, the communications service company. It is a top brand name under $10 a share, so it fits our Penny Stock profile.

SprintFast provides cell phone and telephone services to roughly 50 million people around the world – mostly in the U.S. It has a market cap of $9.7 billion and revenue of $33.6 billion over the last 12 months.

Its services include local and long distance calling as well as voicemail and internet access. Customers can get the services by long term contracts or pay as they go. Last year the customers averaged spending $59 per month.

SprintFast Has Had Its Share of Problems

SprintFast has been part of a number of mergers that have not yielded the synergy and economies of scale expected. Additionally, the mergers have caused complication and confusion with its customer base.

So business started to fall apart. To compound the problems, the company faced a steep debt service burden from its acquisition costs. And to make matters worse, executives of the newly merged company were at odds with each other.

Things got so bad the company lost 80% of its value.

But these problems that dragged down SprintFast’s stock price no longer exist.

They have been focusing on their customer service and aggressively paying down debt. And reorganization has eliminated the internal executive squabbling.

Reasons Shares Are Headed Higher

Earlier in the year, SprintFast did not have any significant products to launch. But now they have the SuperPhone and the SuperDuperPhone, both rolled out three months ago. Both of these phones have been certified to be more reliable than competitor’s offerings and have triple the battery life.

Last quarter, SprintFast sold more than 820,000 of these devices and the forecast is to quadruple these sales by the end of the year.

With the huge customer loyalty of their remaining base, slowing of customer outflows and a high level of prepaid subscribers, this unloved, undervalued, low expectation stock is set to soar like an eagle.

Right now, SprintFast trades at an 80% discount to book value and just 4 times earnings before interest, taxes, depreciation, and amortization (EBITDA). This is a steep discount to the industry average of over five times EBITDA.

(Note: EBITDA is usually a better proxy than actual earnings when comparing valuations between companies. It excludes tax rates and interest, which can sometimes be volatile for each company quarter to quarter.)

This favorable risk/reward is what we look for in under $10 stocks.

Action to take: Buy SprintFast Nextel (S: NYSE) up to $5.75 a share. Place a 25% trailing stop on your position.

—–

So the sample newsletter you read has all of the components I look for. It has a story, the recent company performance and the researcher’s rational for why it should do well in the future.

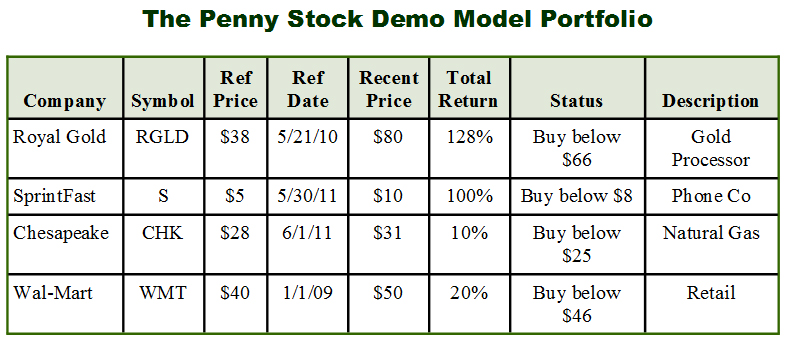

Then they end with a specific buy recommendation. And at the end of the newsletter you can review all of their active recommendations in case some of these might interest you too.

In a future post, we’ll look at some of my favorite newsletters. I’ve done well with them, and you can too.

To your health and prosperity – John

This is a test comment – Dan R