Your Future Paychecks and Raises

I’ve been amused with a television ad where one neighbor asks another about his financial retirement plans. As the other neighbor is trimming his hedge, he replies, rather hesitantly, that he’s shooting to save about a gazillion dollars and he plans to just throw money at it and hope he hits it.

The gist of the ad, and something you and I probably agree on, is that he really doesn’t have a plan. I might say that another way as well. Which is that he does not have a clear line of sight on how he’s going to get paid in the future when he retires.

So I’m going to give you an absolutely clear line of sight on this. Now there are other ways you might get paid as well, but I like this one for its simplicity and clarity (and many of the other methods are just variations on this theme).

But first, let me ask you a simple question.

Have you ever looked at your past pay raises at work and figured out what they might be in the future. In other words, how much bigger your paycheck might be next year, and the next year, and maybe five years from now.

I think most people do this.

And there’s nothing wrong with it. You’re just projecting out into the future what your income might be.

So wouldn’t it be nice if you could do that with a stock investment? That is to say, sit down and figure how much your stocks will pay you every month when you retire. And maybe wouldn’t that be a smart way to look at things?

I’m talking about dividend paying stocks here. So with that in mind, and to continue with our paycheck analogy, the dividend a stock pays you in retirement will be your paycheck. And the dividend increase each year will be your raise.

The good news is that you can estimate this when you invest in good dividend paying stocks. And you can also estimate how much of a dividend pay increase you might get from them year by year.

Because good dividend paying stocks are usually the stocks of solid businesses that grow every year, and make more money every year, and pay greater dividends every year.

And they have a track record.

Which can give you a clear line of sight to what your future paychecks (dividends) and raises (dividend increases) might be.

Just like you’ve done with your paychecks at work, and your projection of future raises.

So let’s take a real stock as an example and get a clear line of sight on what it may pay us (our paycheck) and what future pay raises (dividend increases) it may give us.

Let’s look at Intel stock as our example. And in the interest of full disclosure here, I personally own Intel stock as of this writing.

Now Intel creates microchips for computers and other electronic devices. And they dominate this market. It’s unlikely you haven’t used some of their products.

And at their current stock price, in the low twenties per share, they pay a 4.25% dividend. Now that’s a decent dividend and a better return than you get today on savings, money market and many bonds and other investments.

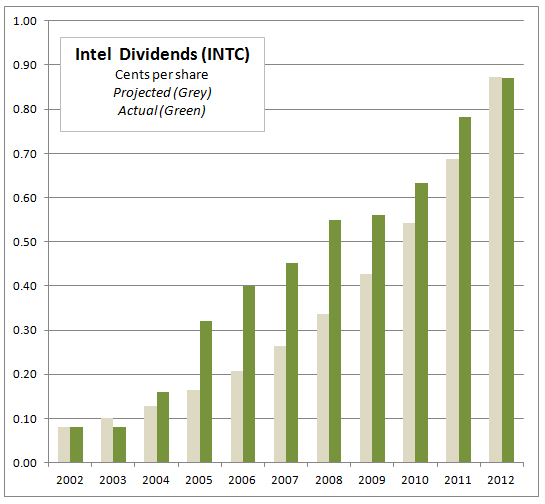

But it gets better. Because Intel has pretty consistently raised its dividend over the years, and by a substantial amount. For example, ten years ago they paid $.08 a share. Today they are paying $.87 a share.

Nice. In ten years their dividend payment has gone up more than ten times – it’s ten times bigger. They’re acting like a money machine if you ask me.

So can you guess how much the dividend payment would have to increase year by year to do that?

I’ll tell you.

It had to increase 27% per year!

Now, back to our paychecks and raises analogy – how would you like the dollar amount of your annual raise to go up by 27% from the previous year – year after year? I think “yes” is a good answer here, don’t you?

Now just look at the Intel Dividend Chart to see what that looks like. The light colored bars just show a straight, calculated increase of 27% year after year, starting at $.08 and ending at $.87 a share.

Now reality is a little messier than theory, but still, looking at the real dividends paid (shown in the darker green bars), it’s clear that dividends have gone up virtually every year and pretty much track the projected dividends overall.

So let’s play the pay raise game again. That is to say, what might the dividend for 2013 be? And the answer is $1.10 per share if the dividend increases another 27%. And in just three more years it could be $2.26 per share.

Let’s say you had bought Intel at $21 a share in 2012 when it was paying 4.25%. So your cost from now on is just that $21 per share. But four years later it could be paying you $2.26 per share. Which means it would be paying you 10.8%.

Wow. Getting almost 11% on your money is good by just about any standard. And the dividend could keep increasing.

Let me break here and tell you a little heart-warming dividend story.

It’s a true story.

And it’s about a guy named Warren Buffett. You may have heard of him. He’s one of the wealthiest men in the world and one of the best investors of all time.

Now once upon a time, between 1987 and 1989, Warren invested in the Coca-Cola Company. He liked it as an investment for a number of reasons; one being that it paid dividends THAT INCREASED year over year.

And as of 2011 he owned 200,000,000 shares in his Berkshire Hathaway fund. And Coke paid dividends of $1.88 a share. So that’s $376,000,000 in dividends – in one year. And 50% of his total investment cost, coming back to him – EVERY YEAR.

Clearly Coke is it! And increasing dividends are too!

Now, there’s no guarantee that Coke or Intel will continue to pay increasing dividends like our examples year over year in the future. In fact, 27% a year for Intel seems like a blistering pace. But what if it was 10% instead? That’s still very good indeed.

And companies like Intel and Coke do have a real track record going back years. And they are dominant players in their business area. So the odds seem pretty good that they will continue to increase dividends at a decent rate over time, don’t you think?

Which means there’s a good chance that you would continue to get pay raises in your dividend checks with solid stocks like these. It certainly makes for better odds than the hot stock tip old Uncle Harry gives everyone at Thanksgiving after having an extra glass or two.

So let’s play this one out with Intel. Let’s say you bought 100 shares of Intel for $2100 in 2012. They paid you $87 in dividends, then they pay, $110 in 2013, $140 in 2014, $178 in 2015, $226 in 2016, and so on.

Interesting. In just five years (2012 – 2016) you have been paid $741 in dividends. In other words, over a third of your purchase price has now been paid back to you with profits – and you still own the stock. You can see that in a few years your entire cost of buying the stock will be paid back to you, you’ll still own the stock, and it could continue to pay you increasing dividends.

They used to call these kinds of stocks “Widow Stocks” back in the day, because widows could count on them for income after their husbands passed away.

So to summarize, isn’t this a clear view of how you will get pay checks and raises in retirement from investments like this? You buy shares of quality companies like Intel that pay dividends and that consistently raise the dividends.

That’s paychecks and raises folks. That’s how it can work in the real world.

Now before I close, I have one final question for you. Did you notice THE ONE THING I NEVER TALKED ABOUT?

I never mentioned buying Intel stock because the share price was going to go up so I could make a profit on it, did I?

That’s how everyone else looks at stocks, isn’t it? Maybe you do that as well.

But instead, I looked at a company and how much it would pay me, and how much more it would pay me in the future as its earnings and dividends increased.

That’s kind of like I had a “business owner” point of view, isn’t it?

Which I did.

And I am.

Because I own Intel stock.

And because no one buys a business if it won’t pay them.

And when you buy a stock, you become a business owner.

So the choice is yours in the end. You can take a business owner view to buying stocks, and have a clear line of sight to how you will get paychecks and raises in retirement.

Or you can be like the guy trimming his hedge, shooting for a gazillion dollars by throwing money at his investment account, hoping the share prices go up, and somehow… not sure exactly how, but somehow, that’s going to turn into his future paychecks.

Personally I favor the business owner view and a clear line of sight to my future paychecks and raises.

Come to think of it, I think Warren does too.

To your health and prosperity – John

P.S. Okay – about the one thing I never talked about — that the stock price could go up. That’s important, and good, and will probably happen with solid companies that continue to grow earnings and dividends.

But I think there is way too much emphasis on this. Focus on being a business owner and how much the company can grow and pay you. And it will buy the shares for you over time. And keep paying you more and more money with increasing dividends… did I mention that already? ![]()