Rocks, Stocks Or ETF’s: Which Are Better?

I recently took a vacation in Utah where I admired the big sky country, and amazing rock formations, out in Arches National Park. When I returned and went through my email, I’d received the following note and great question from a reader named Leeka.

Leeka asked about investing in stocks versus funds, so I thought to share it with you because it’s worth discussing…

“Mr. Roberts,

I’m a big fan of your books. I started learning about investing a few months ago, and your books really helped me get a basic understanding, particularly of dividend paying stocks.

However, you don’t talk much about ETFs in your books. Is it a better idea to buy individual dividend stocks or invest in a dividend ETF?

I’m in my late 30s and simply looking to move some money from savings accounts, since I’m getting very low interest there.

Also, I would be reinvesting any dividends I get, so I was just wondering, which is the better option, ETF’s or individual dividend stocks.

I’m interested in your thoughts. Thanks for your time, Leeka H.”

The ETF’s Leeka is referring to are Exchange Traded Funds. We’ll explain ETF’s in a minute, but the short answer is that both ETF’s and individual stocks can be good investments. I do some of both myself.

However, I focus on individual stocks in my initial investing books because I want people to first understand the basis of stock investing. That is to say, I want them to understand that they are buying part of a company. And by buying it’s stock, they really become a partial owner of the company. And so, as an owner, they share in the company profits (through dividends, and indirectly through stock growth).

And discussing individual stocks makes that easy to illustrate. For example, talking about investing in McDonalds stock is easy to visualize. Everyone knows McDonalds, and that they make hamburgers. And you can just visualize their golden arches. And it’s kind of nice to think that you can be a partial owner of that company if you want to, just by buying their stock.

But it can be harder for beginners to visualize investing in the ACME Diversified Small Cap Short Term High Yield Extended Emerging Markets Double Inverse Fund at first. Because that just sounds like investing in a blob of something.

And yeah, okay, I just kind of made that fund name up. But I’ve seen some just about as complicated. And you get the point — it sounds like a blob, and it’s hard to visualize or understand.

But once you have the basic stock investing concept down, then investing in funds that are made up of individual stocks (and funds made up of other types of investments) can make sense for many investors.

LET”S TALK ABOUT FUNDS

So let’s talk about funds because they can be good investments too. And let’s stick with “stock funds”, because we have the stock concept down. And we’ll also talk about a stock fund because it can solve a problem many beginning investors face.

For example, beginning investors may not have much money to invest when they start off. So they can only buy a few different stocks at the start. Which means their risk isn’t spread across very many stocks. So their portfolio is not as diversified as it will be when they’ve invested in more stocks in the future.

Now, it’s still very good that they’ve started investing. And they’re probably better off than many company employees who are only invested in just their employers stock through a company stock investment plan. Because those employees have their investments, and job income, tied to one company. And that’s a real concentration of risk.

| Now, it’s still very good that they’ve started investing. And they’re probably better off than many company employees who are only invested in just their employers stock through a company stock investment plan. Because those employees have their investments, and job income, tied to one company. And that’s a real concentration of risk. |

But how can investors get diversified across more stocks in the beginning? One easy way to do this is to invest in shares of a “stock fund.”

SPREADING YOUR RISK AND GETTING DIVERSIFIED

Stock funds are created by investment management companies that pool investors’ money and buy stocks in many different companies. So when you buy shares of an investment companies fund, you buy into of their pool of stock investments.

It’s like you went out and bought shares in all kinds of stocks all at once. Except they’ve already done this for you. So you can think of buying shares of a fund as buying a stock of stocks. Of course, you only own a tiny little sliver of each of the different stocks. But still, by doing this, you have become instantly diversified.

VANGUARD TOTAL STOCK MARKET ETF

A good example of this is an investment management company called Vanguard. And they have a fund you can buy shares of called the Vanguard Total Stock Market ETF (VTI). So let’s explain that.

Vanguard is the name of the investment company. Like McDonalds is the name of the hamburger company.

Total Stock Market is the name of one of their many funds / products – like a double cheeseburger is one of McDonalds many products. Also, Total Stock Market suggests that the fund is made up of a bunch of different stocks.

ETF means it’s a fund, and a special type of fund called an Exchange Traded Fund. There are a number of different types of funds, like mutual funds, closed end funds and exchange traded funds. What I like about ETF’s is they trade instantly, just like a stock, and they have pretty low expenses.

Contrast that to mutual funds where your buys and sells don’t happen until overnight. Also, some of them have pretty high expenses that you pay.

And VTI is the unique symbol for the fund – just like any individual stock has a unique symbol (you can look up VTI at Yahoo -> Finance – or just click here https://finance.yahoo.com/quote/VTI?p=VTI.

Okay, so the Vanguard Total Stock Market (VTI) fund sounds promising for our diversification goal.

And sure enough, looking into VTI, they’ve bought stocks in just about the entire investable U.S. stock market, including large, medium, small and micro stocks traded on the New York Stock Exchange and the NASDAQ exchange.

That’s why they call it the “Total Stock Market” fund. Because it’s like they pretty much went out and bought shares of every stock out there. And in fact, that’s what they’ve done.

To put that in perspective, there are about 4000 stocks traded in the U.S. And looking at Vanguard’s VTI’s profile sheet, they list the number of stocks at 3599. You can check out their profile sheet here https://investor.vanguard.com/etf/profile/VTI.

| Buying All Those Stocks: Just think, it would take you a long time to go buy shares in all of those stocks. And your commissions would be pretty high for all of those stock transactions. For example, let’s say your commission to buy a stock is $10 (just to keep the math easy). That means to buy all 3599 stocks, you would pay $35,990 in commission expense. That’s too expensive for me.But instead, you get exposure to all of those stocks in one purchase and one $10 commission. That’s the same as if you just went out and bought one individual stock. That’s some savings, yes? |

Wow, that’s some instant diversification. You pretty much own the U.S. market with that fund. Which is why it’s one of the more popular funds in the world.

So let’s carry on with Vanguard’s VTI fund because it can illustrate some other points about ETF’s and other funds as well.

LOW EXPENSES

Of course, funds don’t do all of this work for you for free. They have expenses that are baked into the price you pay (known as the expense ratio). These expenses can typically range from around 2.5% down to .2%.

So another reason that Vanguard is popular is because they’re known to have some of the lowest expenses in the industry. Which means more of your money is working for you instead of paying for expenses.

And the good news is that their VTI fund beats the low end of that range at an extremely low expense ratio of just .03%.

GROWTH AND DIVIDENDS TOO

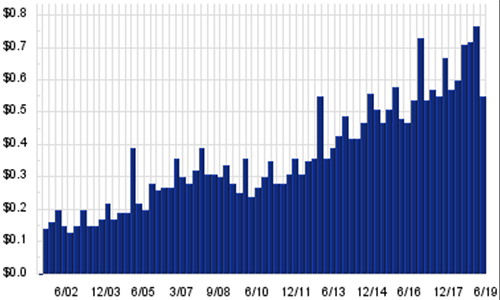

The VTI fund also pays a 1.8% dividend. That’s not too bad, and right in line with the average dividend paid by U.S. stocks. And it’s 22 times greater than the .08% average rate on savings accounts.

Better yet, the dividend has steadily been increasing, so your income from the fund grows. And you can grow it even faster by reinvesting the dividends. I give some rather stunning examples of how that builds wealth in my book Your Future Paychecks and Raises (which you can browse for free here – https://read.amazon.com/kp/embed?asin=B0721G77CD&preview=newtab&linkCode=kpe&ref_=cm_sw_r_kb_dp_stfnDb4E569RG.

Finally, Vanguard pays their dividend monthly, which is something I always like (as opposed to quarterly like most dividends are paid).

Vanguard VTI Fund Dividend Increases – Courtesy of DividendChannel.com

Vanguard VTI Fund Dividend Increases – Courtesy of DividendChannel.com

So that’s an overview of an ETF which gives you exposure to the entire US stock market. And as the market goes up, the value of your ETF goes up. And if the market goes down, the value of your ETF goes down.

THERE’S AN ETF FOR JUST ABOUT EVERYTHING

But there are many different ETF’s to choose from that focus on other investments besides the total U.S. Stock market.

For example, smaller U.S. companies (called “small cap” – for small capitalization) tend to show more growth than larger companies. So if you want to invest in them, there are ETF’s that do that. One such ETF is the Vanguard Small Cap (VB) ETF.

Or maybe you want to diversify out of just the U.S. stock market (not a bad idea) so you buy some of the Vanguard European (VGK) ETF too.

Or if you want to play it a bit safer with bonds, then you can invest in the Vanguard Total Bond Market (BND) ETF.

And finally, just for fun, let’s say you want to invest in agricultural stocks. Then you can invest in the VanEck Vectors Agribusiness (MOO) ETF. (Yes, that’s MOO, not a typo – these guys are not without a sense of humor).

So you can see the flexibility and investment choices that ETF’s can offer you.

BACK TO STOCKS

So with all of those options, why would you buy individual stocks?

Well, because the ETF’s are kind of giving you an average of the performance of many stocks (and bonds, etc.). So some individual stocks may do better or pay higher dividends.

For example, one of the stocks in the VTI fund is the telecommunications and media giant AT&T (T). And AT&T pays a 6.2% dividend. And they increase that dividend by about 6% per year. Contrast their dividend to VTI’s 1.8% dividend.

That’s a considerable difference. To put that in perspective, based on dividends alone, you would double the value of your AT&T stock in 11.6 years. But it would take 40 years with the VTI fund (again – ignoring stock increases and just focusing on dividends you’d receive).

So you may have a bigger dividend and / or profit potential with some individual stocks. Of course, that can mean bigger risk too.

Another advantage is that you have more of a “connectedness” to individual stocks. For example, take Microsoft (MSFT). I use their software every day, and you probably do too. So we have an innate feel for how good their product is. And their pricing. And their new releases.

And the fact that most people use the software, so no upstart is going to be able to compete with them in the near future. So they’re going to be around for a while.

See all of those intuitive things you and I know, which gives us a sense of how good of a company Microsoft might be?

Now it’s not a perfect sense, and it could be wrong. So we should also do research before we invest. But none the less, that connection to an individual companies’ products is worth something. And in this case, our sense about Microsoft’s stock is right. Their stock, and dividends, have grown dramatically over the years.

And Peter Lynch, one of the great investors of all time, felt the same way. He said things like, “Buy stocks with products you know,” and “Only buy what you understand.”

According to Peter, our best stock research tools are our eyes, ears and common sense. And he was proud of the fact that he discovered many of his great stock ideas while walking through the grocery store or chatting with family and friends.

And that product connection also keeps us interested. So those are some of the benefits of investing in individual stocks.

SO ROCKS, STOCKS OR ETF’S?

So what can we conclude about Rocks, Stocks and ETF’s? Well, rocks are great for viewing, and pretty inspirational if you’re looking at formations like they have out in Utah. But they’re not particularly good investment vehicles.

But individual stocks and ETF’s? Well, that’s another story. They can both lead to investment success. Either way works. And I don’t think it has to be an either/or decision.

I personally invest in individual stocks AND funds, although I own more individual stocks than funds. But that’s just my preference. And while we’re talking about preferences, virtually all of my investments, whether they are individual stocks, or funds, pay dividends. Because I like to get paid to invest.

So that said, consider the advantages of stocks and ETF’s for your personal situation, and you decide. And while I can’t give personalized advice, I do plan to write more about funds in the future. So stay tuned.

To your health and prosperity – John

P.S. Full disclosure – I have positions in Vanguard’s Total Stock Market (VTI) fund, Microsoft (MSFT), and AT&T (T) stock. Or as I say, I eat my own cooking. But also note I have no affiliation with those companies, or Vanguard funds, aside from being a satisfied customer / investor.

P.P.S. You can see a list of all of the different Vanguard ETF’s here at https://investor.vanguard.com/etf/list#/etf/asset-class/month-end-returns.

Note that I am no longer a licensed stockbroker or affiliated with any broker / dealer. And any books, newsletters, correspondence or writing from me should not be considered personal advice or a recommendation.