How A Janitor Became A Millionaire

Ronald Read, a former janitor and gas station attendant in Vermont, who died a few years ago, surprised everyone by leaving an $8 million fortune to his local library and hospital.

What was his secret, everyone wondered? And the answer turned out to be pretty basic. Because, besides being industrious and frugal, which you may have guessed, he had invested in the stock market throughout the years.

This is actually not as surprising as it may sound. According to a recent World Wealth Report, the wealthy invest the largest part of their money into stocks and businesses. Our wise janitor had simply done what the wealthy do. So he got a similar result. That is, he grew his money into considerable wealth.

Ronald Read’s story illustrates why stock market investing is one of the best tools you can use to build a more secure financial future for you and your family.

And he achieved his success by doing two things that you can do too. First off, he invested in many basic dividend paying stocks. And second, he showed perseverance – he hung in there for the long haul.

BASIC DIVIDEND PAYING STOCKS

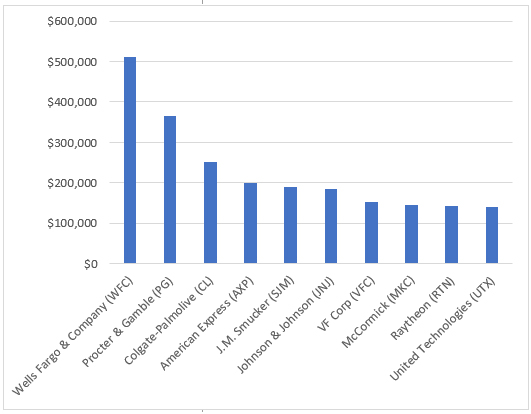

Of course, we’re all impressed with Read’s $8,000,000 portfolio. This was widely reported in the news. And for the curious, here’s a chart of the top ten stocks in his portfolio.

Ronald Read’s Top Ten Stocks

What stands out about them is just how basic these stocks and businesses are. But what is not so apparent is that every one of them is a dividend paying stock. And what was not so widely reported was just how much they were paying him.

And they were paying him handsomely. Because by the time he passed away in 2015, at age 92, his entire portfolio was paying him around $20,000 a month in dividends.

That’s $240,000 a year in income. All because Ronald Read invested in many basic, dividend paying stocks. So he was being paid to invest.

Because by buying these stocks, he became a part owner in the companies he invested in, just like any stock investor. And so he was paid a portion of their profits. So every three months, these companies would send him dividend checks.

And you can start building a stream of checks just like he did. After all, it’s just as easy to invest in dividend paying stocks as to invest in non-dividend paying stocks.

So why were his large dividends not as widely reported? Well, because dividend investing is not a flashy way to invest.. It’s kind of a steady as you go type of investing. And the dividends are typically not very large at first. But as the companies grow and become more profitable, your total dividends grow as well. So you’re building a steady, increasing income, just like Ronald Read did.

Now I’m not saying you will hit his numbers. After all, he had an unusual level of success. But most people can grow a good income this way over time.

But you have to stick with it, and you need to invest for the long haul. Which leads us to the second point, and that is perseverance.

INVEST FOR THE LONG HAUL

And perseverance is clearly something Ronald figured out all by himself. Without the benefit of an MBA or finance degree, he seemed to know that if he stuck at it, year by year, most of the companies he had invested in would grow, and so would their value, and his income.

For example, he invested in the Pacific Gas & Electric company in 1959, and still owned it in 2015. That’s 56 years. Now that’s perseverance for you. Which is right in line with the philosophy of Warren Buffett, one of the world’s greatest investors, who says, “If you aren’t willing to own a stock for 10 years, don’t even think about owning it for 10 minutes.”

So Ronald just continued to pick quality stocks, and hold onto them, eventually owning around 95 stocks. And they were paying him $240,000 a year.

That’s slow and steady investing for you. It’s not flashy, but it’s clearly profitable. And while this is simple enough to understand and do over time, it does takes self-control. Otherwise, you do things that sabotage yourself.

Like these two self-sabotage deal killers you’ll want to avoid. The first of these is obvious, and it is panicking when the market is going down. And the second one is not so obvious, but just as bad. It’s the opposite of panic. It’s acting out of boredom.

I’ll share a personal experience with the boredom thing in a moment. But first, let’s look into investor panic, because there’s a lot of that going around these days.

DON’T PANIC

It’s easy to panic when you’re investing. Recently, as I was writing this, the stock market dropped over a thousand points in just two days. And that drama was being reported all over the news.

And speculation as to why the market dropped was rampant. Some said it was because the Federal Reserve keeps raising interest rates. Other’s pointed to the recent tariffs we’ve imposed related to trade agreements. Some said it was a long overdue market correction. And there were many other reasons too numerous to mention.

And there was a bit of panic in the air.

But the real news should have been to just keep a clear head. Sure, when your stocks have been going up for a while, and then they start going down dramatically, it doesn’t feel so good. But that doesn’t mean we should follow the crowd and start mindlessly selling and bailing out.

Instead, we use a very simple “stop loss” strategy to guide us. That is to say, we hang on to our dividend paying stocks unless we have lost 25% from our purchase price. Then, at the close of the day, if we have a stock that has lost 25% overall, we sell it the following morning.

But if we have not hit our 25% stop loss, then we do one of the most important things you can do in investing. And that is to do nothing. We hang in there.

Sounds simple, doesn’t it? And it is simple, but it’s not always easy. Because doing nothing can be hard to do when everyone around you is panicking. But we resist panic. Because that’s how people kill their future investment success.

Okay, so avoiding panic is the right thing to do. But here’s another deal killer that’s not so obvious. And that is boredom. And it can kill your investment success too.

RESIST BOREDOM

We live in an age of instant gratification and short attention spans. Our news is fed to us in 30 second sound bites. And most of us seem to be immersed in our iPhones, clicking buttons that give instant gratification, popping up one new screen after another.

But the real world doesn’t necessarily work that way. It doesn’t always give instant results. And that goes for the investing world as well.

Here’s a startling statistic for you. It shows that the average time someone used to hold a share of stock back in the ’60s was eight years. Now, the average time is four months.

It’s that kind of short attention span that can really cost you money. And it’s an easy trap to fall into, and few are immune to it. So here’s a real world example for you of how I almost fell into that trap myself.

Some years ago, I bought stock in the Chicago Mercantile Exchange (CME) because I thought that investment had a good story behind it. The story, and a brief explanation, went something like this.

You can think of the CME as an exchange, something like the New York Stock Exchange, except instead of being a place where people buy and sell stocks, they buy and sell contracts of things like cattle, hogs, butter and cheese.

We’ll keep it simple and just say if you have ever eaten a cheeseburger, the CME helped provide the beef and cheese for you and millions of other people as well.

Now you’ll note that’s a pretty basic business, right? I was investing in a business that supplies the basic ingredients for cheeseburgers. That’s not a flashy investment like buying into the next Silicon Valley “get rich quick” startup would be. But it’s definitely the type of basic business Ronald Read would have invested in.

So anyhow, what I really liked about their business was that they took a fee for every contract bought and sold on their exchange. That’s just like the New York Stock Exchange charges a fee for every stock transaction. So whether the price of cattle or cheese went up or down, the CME got paid their fee either way, on every transaction.

And it was a pretty safe bet that people weren’t going to stop eating cheeseburgers any time soon. So that looked like a pretty good, profit generating story to me.

And even better was the fact that they paid a dividend. So they were willing to share those profits with me as a stockholder.

The Chicago Mercantile Exchange is part of the commodities market. And the commodities market is huge. It’s 16 times the size of the stock market. And that makes sense, because we all use the basic products that go through these commodity exchanges. Typical commodities are wheat, corn, crude oil, soy beans, live cattle, gold, silver, hogs, butter, cheese, etc.

So if you eat a cheeseburger, the bread was made from a contract of wheat (5000 bushels per contract) that was bought on the commodities market. And the beef came from one of those cattle contracts (40,000 pounds per contract), and the cheese from a cheese contract (20,000 pounds of cheese per contract).

By the way, here’s one of my favorite commodities – and that is pork bellies. You may have heard of these and wondered what they were. Well, pork bellies are the cut of pork that comes from the belly of a pig, and they are what bacon is made from. And who doesn’t like bacon.

Anyhow, as you may have guessed, there are a number of exchanges that handle these various commodities. And the CME is the largest exchange of this type in the world.

The nice thing about investing in the CME is that you don’t have to set up a commodities account (which is complicated and risky). You can just invest in their business by buying their stock, and share in their profits from the dividend checks they send you.

So I bought their stock and eagerly awaited its price to go up. And I waited. And I waited some more. I waited for an entire year. And at the end of a year I was right back to where I had started. Here’s what that looked like.

My CME Stock Going Nowhere – Uggghhh!

My CME Stock Going Nowhere – Uggghhh!

And I confess, I actually thought about selling it all because it just wasn’t going anywhere. But I knew that wasn’t the right thing to do because the story hadn’t changed. They still kept collecting a fee on every contract of cattle and cheese bought and sold. And people kept eating cheeseburgers. And that wasn’t going to stop anytime soon.

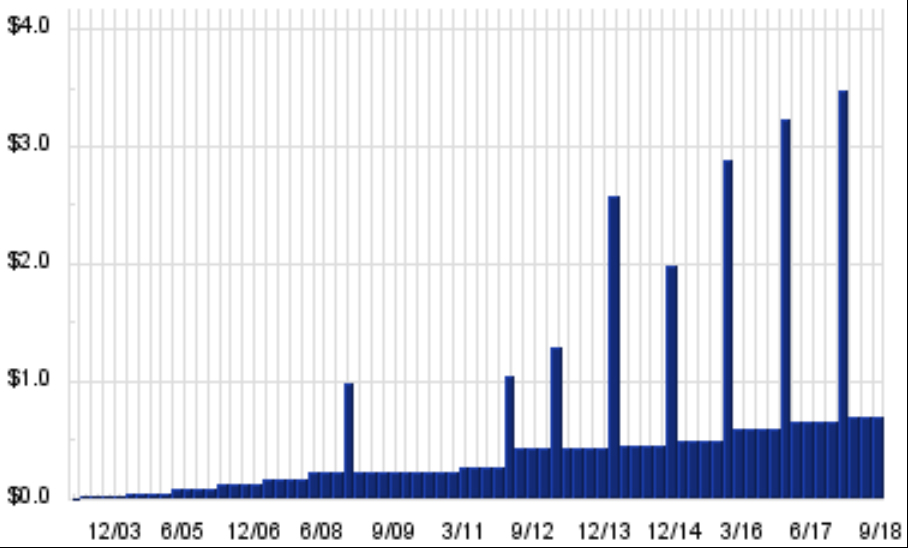

So I cooled my jets and did the right thing. And the right thing was to do nothing. So I let it ride. And here’s how that investment turned out.

About six months later their stock started a long multi-year climb. And today, my CME stock has appreciated by 131%. And I’ve received 20 dividend payments worth $2060, or 24% of my initial investment.

And they keep growing and paying bigger and bigger dividend checks too. Here’s what those dividends look like. Note the extra, big, fat dividend payments each December – just in time for Christmas!

Courtesy of DividendChannel.com

Courtesy of DividendChannel.com

That’s a good investment by any standard. But I would have missed out on all of it had I given into boredom and sold my stock.

Instead, as I write this, I still own the stock. And people still keep buying and eating cheeseburgers. And the CME just keeps collecting fees on those thousands and thousands of cattle and cheese futures contracts. And paying out increasing dividends.

FINAL THOUGHTS AND WHAT YOU CAN DO

One of the things that sustained me was the fact that I was being paid those dividends. So even though the stock was going nowhere for over a year, I was being paid to stay in the game. And this is another clear advantage of investing in dividend stocks. They give you staying power.

And it’s clearly an advantage that Ronald Read understood as he collected his $240,000 a year in dividend checks. That’s some incentive to stay invested, wouldn’t you say.

So the next time you’re tempted to sell a stock, take a deep breath and think it through. Now, if you’ve hit your 25% stop loss limit, by all means, sell the stock. You’ll want to cut your losses and live to invest another day.

But if you haven’t hit your stop loss, then check the reason you invested in the stock in the first place. Is the story still the same? Does it still make sense? And if it does, then just do the right thing.

And the right thing, the millionaire janitor thing, the Ronald Read thing… is to just do nothing.

To your health and prosperity – John

P.S. To discover how to START BUILDING YOUR INCOME STREAM of dividend checks with dividend stock investing, you may want to check out my latest book, Your Future Paychecks and Raises: Get Dividend Checks In Your Mailbox Paid To The Order Of You!. You can browse it for free right here – http://a.co/d/5EhE3gP.