Exchange Traded Funds Reduce Risk With Diversification

Another great feature of Exchange Traded Funds (ETF’s) is diversification. This is important because one common mistake many stock investors make is to concentrate too much of their money into just one or a few stocks. In other words, they are not diversified.

This is actually pretty easy to do if you aren’t paying attention. For example, maybe you’re just really taken with a stock and that’s all you focus on. Or you’ve been making good money with a stock, so you just keep adding to it. Or another common way is people investing just in their companies stock in their 401k’s. And pretty soon you have a really concentrated position in that stock.

DON’T TAKE THIS UNNECESSARY RISK

But you should never invest all of your money in one single stock. If you do, you are taking unnecessary risk, and could have a big loss.

Why? Because none of us can predict the future. And you never know if there will be a headline tomorrow that says something really bad just happened at that one company that you are invested in. Worse yet, if it’s the company you work for.

Like ENRON, for example. There were people that had their entire retirement investment in this one company’s stock. Then one day they woke up and there was a bad headline in the news about ENRON. It said the management had been cooking the books and reporting profits that were completely made up.

The stock value dropped, plummeted actually, and lost half of its value in just one week. And by the end of the scandal, and bankruptcy, the stock had dropped from $90.00 to $.61 a share. That’s right, sixty-one cents. It was a total wipeout.

So whenever you are tempted to put all your eggs in one basket, you might take a minute to read about the Enron scandal. It’s a sobering and cautionary tale for all investors. You can read about it here at https://en.wikipedia.org/wiki/Enron_scandal.

ETF’S GIVE YOU INSTANT DIVIERSIFICATION

One of the advantages of investing in ETF’s is that you are instantly diversified when you invest in them. Because when you buy shares in an ETF, you are buying into a group of stocks, and often a large group of stocks. So viola, instant diversification.

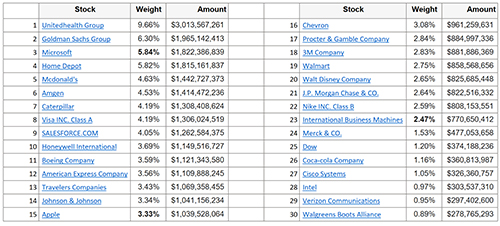

Like earlier when we discussed investing in the DOW Jones Industrial Average ETF (DIA) http://livelearnandprosper.com/etfs-are-transparent-you-know-what-you-own. Just buying shares in that one fund gives you stock ownership into 30 companies. Here they are again…

Stock Holdings In the DOW Jones Industrial Average ETF

So if one or two of the stocks are having a down day, maybe a couple of them are having an up day. So that kind of cancels out the losses. And keeps you portfolio from swinging wildly.

So you can see that having these 30 stocks cuts down on your risk. And cuts down on your stock market drama. And makes it easier for you to sleep at night.

DIVERSIFICATION IN DIFFERENT KINDS OF BUSINESSES

But it gets better yet. Because the thirty stocks are all in different kinds of businesses as well. I mean, they’re all over the place. So you are instantly invested in healthcare, with the UnitedHealth Group, and technology, with Microsoft. And construction and home improvement with Home Depot.

And hamburgers with McDonalds, fighter jets with Boeing, Sticky Post-It Notes with 3M, tennis shoes with Nike, soft drinks with Coca-Cola, cheap stuff at Walmart, drugs with Walgreens, cell phones with Verizon and Mickey Mouse with Disney.

Okay, so that may have been a superficial representation of what some of these companies do. But going from fighter jets to hamburgers to Mickey Mouse has a real diversified feel to it, right?

And that’s what we’re talking about. Because there’s safety in spreading your investment money around like that.

ETF’s ARE WELL SUITED FOR BEGINNERS AND PROS

Which makes ETF’s particularly well suited to help beginners out. Because if you’re just getting started, you’ll probably have just a few stocks when you first start to build your portfolio. So in the beginning, you’ll not be as diversified as you should be.

But throw in an ETF or two and you cut that risk quickly with diversification.

And experienced investors can use ETF’s for diversification too, as well as many other advantages ETF’s give them.

So to summarize, one of the big advantages of ETF’s is to reduce your risk through diversification. And many of them do that automatically with all of the different stocks they have in their portfolio.

And they also make doing so affordable, and possible. Because it would be impossible for most investors to buy all of the stocks some ETF’s invest in. Just think of owning 500 different stocks. Or 2000. Whew! Now that’s diversified. And we’re going to explore how ETF’s make that possible in our next post.

EXTRA CREDIT: Most funds will at least give you diversification by owning shares in a number of different companies. But there are some that focus on a specific industry, so they are not diversified across different business types (market sectors) on purpose. They focus on one market segment, like Energy stocks, for instance. But we know when we’re doing that – deliberately. And even then, we get some diversification by getting many different stocks in the energy sector. So diversification within that sector.

NOTE: If you are an individual stock investor, you want to work toward diversifying into more different stocks as soon as you can. You should really shoot for having no more than 4-5% of your portfolio in any one stock. So practically speaking, I tend to stay invested in 20 – 25 stocks. That keeps my exposure to any single stock to no more than 4 – 5%.

But I also invest in ETF’s. Which gives me their advantages as well.