Exchange Traded Fund’s Are Transparent: You Know What You Own

Another great feature of Exchange Traded Funds (ETF’s) over traditional mutual funds is transparency. By this we mean you can see the different stocks held in an ETF.

Contrast that to some stock mutual funds which are not so transparent. Because often, the mutual fund managers are not so up front about the investments they are making. So you really may not know what stocks you are invested in.

But ETF’s are quite transparent with their holdings. This is important for fund investors vs individual stock owners. Because when you own shares of an individual stock, you know exactly what stock you are invested in. For example, if you own 3 shares of Microsoft, you are invested in Microsoft. Period.

But if you own three shares in a stock ETF, you own shares (or fractions of shares) in a number of different stocks. And it’s nice to know what they are. Or put another way, it’s always nice to know what you are invested in.

LET’S LOOK INSIDE AN ETF – WHAT STOCKS DOES IT HAVE

So let’s look into that. Let’s say you have a $1000 to invest, and you want to buy an ETF that has some of the biggest and most widely traded US stocks in it. To do that, your $1000 can buy about three shares of an ETF called the DOW Jones Industrial Average ETF (DIA), or The DOW 30 for short.

So let’s say you bought three shares of DIA. Great. So what stocks are in the fund?

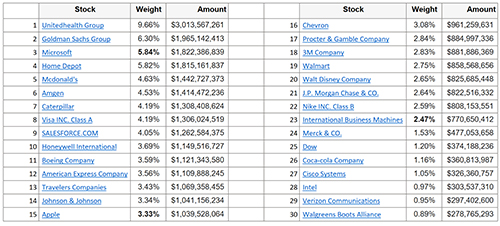

Well, these thirty stocks below are in the fund – hence the name DOW 30. And I’ll bet you recognize many of the companies in the list. And you’ve invested in all of these stocks, all at once, when you bought your three shares of DIA ETF.

The 30 Stock Holdings In the DOW Jones Industrial Average ETF

AND WE CAN FIGURE HOW MUCH WE OWN OF EACH

And not only can you tell what stocks are in the fund, but you can tell how much of each stock the fund is invested in. For example, you can see that 5.84% of the total fund is invested in Microsoft. And 3.33% is invested in Apple. And 2.47% in IBM.

So since you bought three shares of DIA (roughly $1000) you know that you own part of all of those companies. For example, you own about $58 worth of Microsoft ($1000 x 5.84% = $58.40). And about $33 worth of Apple ($1000 x 3.33% = $33.30). And about $24 worth of IBM ($1000 x 2.47% = $24.70). And a portion of all the other companies you see listed above.

How’s that for visible? And specific?

So investing in ETF’s clearly gives you transparency into your investments inside the fund.

HOW TO FIND THE STOCK HOLDINGS IN STOCK ETF’S

But how do you find the list of stocks in an ETF like the DOW Jones Industrial Average ETF (DIA)? Well, there are a number of ways. Here’s one of my favorites.

You can go to the web site ETFChannel.com. to find out what stocks the DIA ETF has in it. Then at the top of the page, key in DIA in the box that says “Enter ETF or Stock Symbol.” Then click the “What’s In This ETF button.”

Then you will see a section that says Top Stock Holdings, and it lists the top five stocks. But if you want to see all of the stocks, like we did, then click the link near the top 5 list that says “List of all 31 stocks held by DIA.” And it will list them all out for you.

Another place to quickly see the top ten holdings is to go to ETF.com/DIA. Then scroll down into the page to see the list.

So that’s how to see inside a stock ETF. See how visible they are? And isn’t that a good thing.

EXTRA CREDIT: By the way, in case you just noticed above, and were wondering what the 31st stock was, when we said this was the Dow Jones 30 ETF, it is the US Dollar, i.e. cash, held in the fund. And if you noticed that, you are really paying attention. Good job!

NOTE: Earlier, we generically referred to the DOW Jones Industrial Average ETF (DIA) to keep things simple. However, the official name of the DIA ETF is the SPDR Dow Jones Industrial Average ETF Trust (DIA). It is also referred to (informally) as the Diamonds ETF. It is managed by State Street Global Advisors.