Your 401k’s Shortcomings – Lack of Transparency

In reviewing a friends 401k the other day, I noticed yet another thing about 401k’s that bothers me. That is a lack of transparency in what they were invested in.

The company had moved it’s existing investment choices to something called Collective Investment Funds (CIF). As they said in the employee material, a CIF is like a mutual fund in that it has a stated investment objective and strategy and performance and fees. But it only sells to institutional investors, like 401k plans offered by companies to their employees.

So why would I care about that?

Well, because these CIFS don’t have a ticker symbol I can look up to evaluate their historical performance on my own, as evaluated by third parties that are not a) the employees company offering the fund and b) the 401k management company.

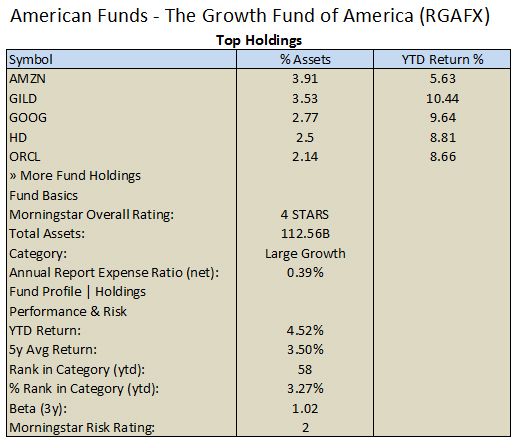

To my way of thinking, it is far better to offer employees securities that are actually listed, with ticker symbols, so they can go research them on their own if they wish. For example, the publicly sold American Funds – Growth Fund of America has a symbol of RGAFX.

This is handily looked up at all kinds of web sites like Yahoo Finance, your own online trading account, anywhere, really. It is totally transparent. You can see information such as pictured below and more with a mouse click or two.

You can see here at a glance that the fund is invested in Amazon, Google, Oracle and other stocks, how much they are invested and how each of these have performed.

Not so with the CIFS. They have no symbol. So you may eventually be able to find out what funds they are composed of (I finally did for one of these) but then you have to research the individual funds as well. It makes the process of knowing what you are buying and investing in with your hard earned money very opaque and indirect.

What’s that Latin phrase that keeps going through my mind … ah, caveat emptor … let the buyer beware.

I’m not too sure why companies would move to these CIFS yet. I have my suspicions but will hold my tongue until I find out more.

In any event, I see it as making the investors (that’s you and me) one step further removed from our investing choices at a time when I believe investors (that’s you and me again) should be more aware of what we are investing in and making the best choices we can.

To your health and prosperity – John