You Can Make Money When A Stock Goes Down

Dividend stocks offer a number of ways to make money. This is even more apparent when you reinvest your dividends. That is to say, you don’t spend them, but use them to buy even more stock.

Of course, you can make money with them when the price goes up. And you can make money with them even when the price stays the same – because you are still collecting the dividend.

But what if the stock starts going down every year after you invest?

Well, here’s where it gets really interesting. So interesting, in fact, I think you’re not going to believe the answer.

The short answer is that you can often still make money in this situation. Believe it or not.

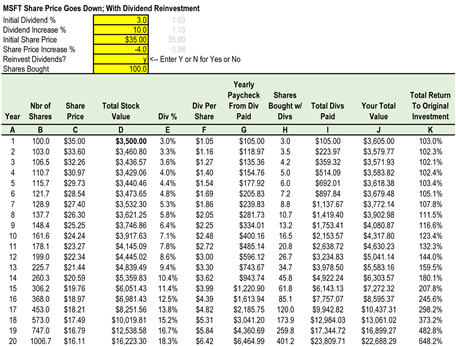

So let’s look at this. We’ll use all the following assumptions and Microsoft stock as an example. That is, you buy 100 shares of Microsoft (MSFT) at $35 a share. And the dividends increase 10% a year and you reinvest them. But this time, we’ll assume the stock GOES DOWN 4%, year after year.

So here’s what happens…

NOTE: To keep the illustrations simple, I’ve just calculated and shown the dividend payments year by year – like Microsoft was paying their dividend annually. Actually, Microsoft, and most dividend stocks, pay quarterly. So the real results would be a little different. But this is pretty close, and easier to visualize than a table of 80 quarterly compounding dividend entries.

So in the first year, everything starts out like before. Microsoft pays you a 3% dividend, and you get a $105 check in the mail. Your total return on your $3500 investment is 103% (column K). Your stock is still worth $3500 (D), so you still have 100% of your initial investment, plus you got a 3% dividend (E, G). So that’s your 103% Total Return To Original Investment (K).

But then, since you are reinvesting the dividends, you don’t cash the $105 check and spend it. Instead, you buy three more shares of Microsoft stock with it (3 @ $35 = $105). So now, starting in year 2, you have 103 shares of stock generating dividends, instead of just the original 100 shares like in our earlier example.

Year by year, your dividend checks keep increasing, and you keep reinvesting

them into more shares. But look at year 2. The stock price dropped from $35 a share to $33.60. So when you reinvest your dividends and buy shares, because of the lower price, you buy 3.5 shares instead of 3.4 shares.

OK, no big deal, right? You only bought a tenth of a share more. And like before, your dividend has grown and doubled two years sooner, by year 6 instead of year 8 in our original “spend your dividends” example. But you can see the dividend has grown a little bit.

And here’s the thing. These numbers, your dividends and the number of shares you are buying, are going to start growing faster and faster. Remember we said that compounding starts off slow, and then begins to grow faster and faster, right?

And by year 15, you have received a total of $6,143.13 in yearly dividends, vs. our last example at $4779.95 when the stock price was going up. And by year 20, your total value for your account is $22,688.29 vs. $20,986.86. Wow. You made even more money when the stock was going down than when the stock was going up. And, you now own 1006.7 shares vs. just 261.8 shares when the stock was going up. And those 1006.7 shares are generating $6,464.99 in dividends for the year vs. $1681.25 when the stock was going up.

In other words, just this one stock is giving you over $500 a month in income if you chose to take it. And this happened when the value of the stock, the stock price, was going down!

How is that possible?

And the answer is that since the stock price is going down, you are accumulating more and more shares. And these shares are still paying increasing dividends. So the more shares you own, the bigger the dividend checks. Which means you can buy even more, cheaper priced shares.

And the thing just kind of snowballs once it gets started. It’s the old “buy low, sell high” investing maxim on steroids. Except you aren’t selling, you are buying lower and lower each time.

Which means when you are doing your original investing, that is, you aren’t yet using the dividends for income, it’s actually better if the share price doesn’t go up much. In this accumulation phase, you want to buy as many shares as possible, as cheaply as possible, so eventually you will get bigger dividend checks when you start relying on them for income.

Now, realistically, you probably won’t run into this situation of buying and reinvesting in a stock that keeps going down 4% a year for twenty years. And a stock going down 4% a year for twenty years could indicate problems with the company and the dividends get cut. But it clearly illustrates the point that it is theoretically possible to make money with some dividend stocks even when the price goes down.

Which is quite different from a speculator, who would have lost a lot of money in this situation instead of making money. Our hapless speculator, who invested $3500 in a non-dividend paying stock, would now only have $1611 (100 shares X $16.11 a share), for a loss of over $2000. That’s a huge difference compared to our $22,688.29 total value in this last example.

So we’ve discussed where you have a good chance to make money with dividend paying stocks, with dividend reinvestment, if the stock stays the same, or goes up. And crazy as it sounds, even when it goes down.

But what’s real? What is a realistic scenario and expectation?

Well, here’s a realistic assumption about our Microsoft example. Say you bought it at $35 a share. This is real. I did this a few years ago. And it pays a 3% dividend. Also real. But it increases the dividend by 12% – which is real as well. And the stock price goes up on average of 7.5% – which is what the stock market has historically averaged over time.

Now note, there are no guarantees on this investment outcome, but all the assumptions are based on historical data. So that could be how it realistically plays out. And we’ll look at what that does for your wealth in a future post.

To your health and prosperity – John

P.S. To learn more about making money even faster with dividends, you might want to check out my latest book called Your Future Paychecks And Raises: Get Dividend Checks In Your Mailbox Paid To The Order of You!

You can browse though it for free right here. And the promotional price for the next few days is ridiculously cheap – virtually free.