Use This Oldest Investment Trick In The Book

Miguel De Cervantes Circa 1615

Miguel De Cervantes Circa 1615

“Don’t put all of your eggs in one basket,” comes from an old Spanish proverb that’s been around for centuries. It first appeared in print in 1615 in the classic book Don Quixote by Miguel de Cervantes.

This age old idiom is good life advice, and it’s good investing advice as well. Indeed, what we’ll describe here is the single most important factor to your investing success, and one of the oldest tricks in the book. It’s far more important than any stock you pick, and ignorance of it has probably ruined more investors than any other factor.

So how do you invest without putting all of your eggs in one basket? You do it by spreading your money and risk around. That is to say, by allocating your investments across different assets like stocks, bonds, cash and precious metals.

Not surprisingly, this technique is called asset allocation and it’s easy to understand. It’s just common sense, really. But it’s very powerful.

| NOTE there are other asset classes as well, such as commodities, real estate, art, etc., which I have excluded to keep things simple. Commodities are complex, and few beginning investors should invest in them. And real estate and art, respectable in their own right, have their own set of complications, and are beyond the scope of this article. But stocks, bonds, cash and precious metals are four widely held asset classes. And most can be bought and sold within seconds in your online trading accounts. |

Asset allocation is powerful because it reduces your risk and forces you to buy low and sell high. And it does this for you even though you cannot predict the future of the economy or the investment markets. So how does it do that?

Well, these assets tend to rise and fall in value at different times from each other. For example, when stocks are high, then precious metals may be lower. When stocks are failing, then bonds may feel more secure and not lose money. Or when the interest rate on bonds falls, then precious metals may go up.

So with your investments allocated across all of these assets, you reduce your overall risk. If some investments are going down, then others are going up to compensate for that. That’s much better than having all of your investments in just one asset class. Because if it falls, your entire portfolio falls with it. You broke all the eggs in your basket. You took an unnecessary risk, and had a big loss.

| Like ENRON, for example. There were people that had their entire retirement investment in this one company’s stock. Then one day they woke up and there was that bad headline in the news. It said that the management had been cooking the books and reporting profits that were completely made up.The stock value dropped, plummeted actually, and lost half of its value in just one week. And by the end of the scandal, and bankruptcy, the stock had dropped from $90.00 to $.61 a share. That’s right, sixty-one cents. It was a total wipeout.So whenever you are tempted to put all your eggs in one basket, you might take a minute to read about the Enron scandal. It’s a sobering and cautionary tale for all investors. You can read about it here at https://en.wikipedia.org/wiki/Enron_scandal. |

Okay, so we don’t want that to happen. So how do we spread our risk around to stocks, bonds, precious metals, and cash. How much of these assets should we own and in what proportions?

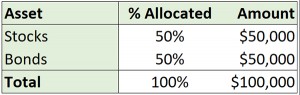

Well, that’s a very individual question depending on your personal circumstances and age. But let’s start off with something just dead simple and go from there. Using a sample portfolio of $100,000, how about if we just invested half in stocks and half in bonds. That seems pretty balanced.

Figure 1-1. Balanced Portfolio

Figure 1-1. Balanced Portfolio

Actually, as simple as that is, it might work for some people. But not most, because we haven’t taken in consideration the age and risk factor. Because when you are young, the thinking is that you can invest more in stocks. They are riskier than bonds, but grow more over time. Younger investors have many years of investing to make up for any downturns in the stock market.

However, older investors are advised to invest more in bonds (less risky) than stocks. While bonds don’t pay off as much, they are considered to be safer. Which is good because older investors have less time to recover from market downturns.

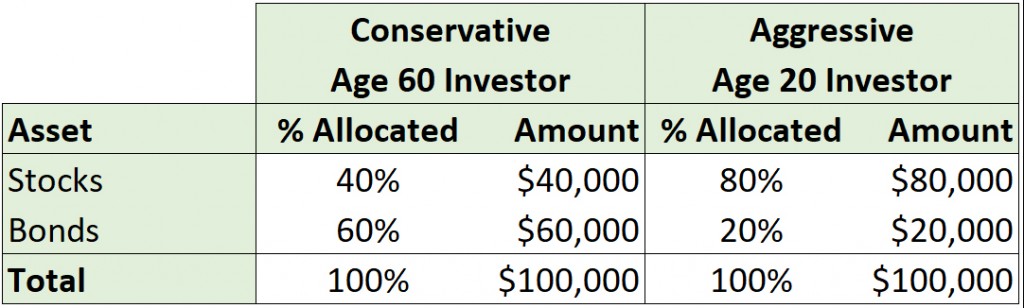

So a rule of thumb is that investors should have as much of their portfolio in bonds as their age, with the rest in stocks. So, using that rule, a sixty year old investor would have 60% in bonds and 40% in stocks (fairly conservative). A twenty year old investor would have 20% in bonds and 80% in stocks (real aggressive).

| This rule of thumb is often stated as subtract your age from 100 and that is the percent you should have in stocks, with the rest in bonds. I’m not sure why they insist on doing the math (chuckle). The investment community just seems bent on making things complicated. Just using your age as the percent of bonds you should have gets you the same result. |

Here’s how those two portfolios would compare (ignoring the fact many 20 year old investors would not have $100,000 yet).

Figure 1-2. Age Balanced Portfolios

Figure 1-2. Age Balanced Portfolios

Now that age based rule of thumb is just that – a rough guide, not a mandate. So it’s a good place to start, but you have to adjust it to your situation, time horizon, and temperament.

Because some younger investors might be too worried about aggressive investing and feel more comfortable with a more conservative portfolio with more bonds and less stocks. And some older investors might be more aggressive and have more stocks than bonds, and still be able to sleep at night.

But that’s a basic breakdown of a simple asset allocation technique for you. And it’s fundamentally how many of the age based 401k funds you may have seen work. Based on some rule of age, they constantly adjust your funds to more bonds and less stocks.

But we can refine it further. For one thing, I would add a certain amount of cash to the mix.

Why cash? Well, because it’s really safe. It’s not going to move up or down when bonds or stocks move up or down. It’s going to stay pretty much the same. And having a certain amount of cash in your portfolio gives you the ability to buy stocks on the cheap if the market goes down (that buy low, sell high thing).

Of course that’s the last thing most people want to do when the market is tanking. They’re panicked and can’t bring themselves to buy heavily discounted stocks. But in a market downturn, there are always some quality stocks that can be bought for a good discount. And that’s where you can set yourself up for some big gains.

And it’s what the pros do too. Legendary investor Warren Buffett is known for this. He has said to, “be greedy when others are fearful, and fearful when others are greedy.” So having some cash handy in your account gives you that option to buy at a discount when the opportunity arises.

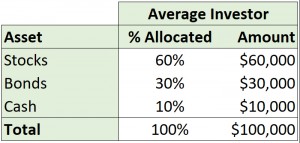

So how much cash should you keep in your account? Well, there’s a wide range of recommendations on how much cash to keep in your portfolio. I typically range anywhere from 10% to 25%. I’ve been at 25% before when I was really concerned about the market. But I’m usually around 10%. So let’s go with that for now. Let’s pick a middle age, middle risk-tolerant investor, and add 10% cash to their portfolio.

Figure 1-3. Average Investor Plus Cash

Figure 1-3. Average Investor Plus Cash

Now that looks a bit aggressive when you see only 30% in bonds, which are considered pretty safe. But remember, the 10% cash is even safer. So between that and the bonds, 40% of the portfolio is in a relatively safe position. And that still leaves over half (60%) in stocks, so the portfolio can really take advantage of the higher growth they may offer.

And again, the cash gives us the option to buy heavily discounted stocks in the future, should they become available. So the asset allocation of this portfolio seems to have a good balance of pluses.

Okay, good so far, but I think we can do even better. And here’s why.

I said the cash was pretty safe… and that’s still true for the short term. But over time, cash slowly loses its purchasing power due to inflation. Even when inflation is fairly low, like 2-3%, that adds up over time. For example, a dollar today is only worth $.83 of a dollar ten years ago.

It’s already lost 17% in purchasing power. That’s why you see prices constantly going up, and feel like you can’t get ahead. So we need to add an investment that can help us keep up with inflation. And that investment would be precious metals like silver and gold.

Silver and gold are real money, as opposed to our paper dollars. They’ve been used by mankind as a store of value for thousands of years. The government can corrupt our paper dollars by printing more of them to cover excessive spending and borrowing, which causes inflation. But they can’t print silver and gold.

So in that same ten year period, when the dollar lost 17% in value, silver increased by 23%, and gold by 39%. So maybe we should have some precious metals in our portfolio too.

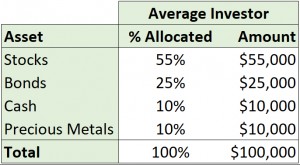

Now there’s a wide range of recommendations on how much precious metals should be in a portfolio. I tend to have about 10%. So let’s go with that for now to keep it simple, and you adjust to your preference. So that would look something like this…

Figure 1-4. Average Investor Plus Gold

Figure 1-4. Average Investor Plus Gold

Now that’s starting to look like a real asset allocated portfolio. Note that I trimmed stocks and bonds each 5% to make room for the precious metals. But we still have over half in stocks, so the portfolio can really take advantage of the higher growth they may offer. And we have 35% in bonds and cash which are considered pretty safe. And over time, precious metals are safe, although they can bounce up and down quite a bit in the short term.

But when people start worrying about the stock market or economy, they often start buying bonds and gold or silver, so those could go up when everything else is going down. And our cash will just be sitting there, ready for us if we spot a real bargain in stocks we want to take advantage of.

So that’s a sample asset allocated portfolio for you. You can use that as a starting point. Then adjust the % Allocated column to fit your personal situation, age and risk tolerance. Now you have your personal asset allocation plan – the right mix for you.

Once you have your plan, you need to take the next step. And that is to see how your current investments stack up to it. You do this by listing all of your investments. Then mark by each of them if they are stocks (or stock funds), bonds (or bond funds), cash, and precious metals (or precious metals funds).

Then add up each category and compare it to your personal asset allocation plan you created above. You’ll probably discover that you are over in some categories, and under in others. Which means you’re going to have to make some adjustments. You’ll want to sell part of your asset categories that are up, and buy some more of those that are down to get your portfolio back in line with your plan.

Making these adjustments, called reallocating your portfolio, is where you make your money over time. Because it forces you to buy low and sell high. And it keeps you from becoming overweight in one or more categories.

We’ll refine this idea in future issues. We’ll look at diversifying your investments within each asset class. And how frequently you should reallocate (hint – some people only do it yearly).

But for now, it’s a good idea to create your personal asset allocation plan and see how you stack up against it. And then bring it in line with your plan.

Because you don’t want to keep all of your eggs in one basket. So use Asset Allocation – the oldest investment trick in the book. It’s a simple concept and the single most important factor to your investing success.

To your health and prosperity – John

P.S. Note that in the portfolio category of stocks, some of the best types of stocks to buy are dividend paying stocks. Not only can they grow in value, but they keep putting cash into your account every month or quarter, year after year.

And this builds your cash asset for free. To learn more about these cash generating stocks, you may want to read my book Your Future Paychecks And Raises: Get Dividend Checks In Your Mailbox Paid To The Order of You! You can preview it for free right here.