The Crisis Investment I Continue To Make

These are strange investing times, with the COVID-19 pandemic, damaged economy, and a volatile stock market setting record extremes in both directions. And while I remain fairly optimistic we’ll pull through this, at the moment there’s real doubt on where to invest, or not, while we’re going down this path.

That’s because investors are living under great uncertainty right now. The stock market crashed a few months ago, and then made an amazing comeback. So people wonder if they should jump back into stocks, so they won’t lose out on more gains. Or should they stay on the sidelines for now because another crash, possibly worse, could be coming.

Personally, I’m a bit inclined toward the second case. That is to say, another possible crash. So I keep most of my powder dry, and go easy on stock investing for now.

My thought is that no one has seen the full effect of this yet. And when the second quarter financial results start coming out, there could be some serious shortfalls the market could react to. So my stock investing, while not totally stopped, is pretty limited for now. Because no one really knows how this thing is going to play out yet, myself included.

But let’s set all of that uncertainty aside for the moment, and look at some things we do know. Because that leads to one investment I have continued to make through this challenging time.

So what do we know? Well, we know that an enormous amount of government money has been poured into the economy, creating more debt. Specifically, the CARES act, providing assistance to American workers and industries, just added $2 trillion to the deficit. And the Congressional Budget Office had already projected a $1.1 trillion deficit for the year. So just those two things right there come out to around $3 trillion more in government debt.

Now, we may think that financial stimulus and debt is justified, or not. But regardless, that’s a whopping 14% of the production of the economy. That’s huge, but no surprise, really. Because, like they say, a trillion here and a trillion there, and pretty soon it adds up to a lot of money.

| How Much Is A Trillion???- Okay, it’s difficult to get our heads around how big a trillion of anything is. So let’s do a little thought experiment to put it into perspective. Let’s think about this in seconds, a familiar unit of time.A million seconds ago was 11 days ago. So that doesn’t seem like such a big number. And easy for me to remember that far back. Around that time, I pulled off of Highway 528 south of Cape Canaveral, with hundreds of other cars, and watched the historic Space X launch to the International Space Station. So a million is easy to visualize in that context.A billion seconds ago was in 1988. Okay, so that’s a comprehendible number too. I mean, that was the year the movie Die Hardwas released, the Pan Am Lockerbie Flight 103 exploded over Scotland, and to help us all cope, the drug Prozac sold for the first time as an anti-depressant.But a trillion seconds ago was in 30,000 BC. Hmmmm… okay, now that’s a BIG number. The Neanderthals (cavemen) had just gone extinct! So I have no memory of that. But it was certainly a long, long time ago… and probably a big deal to the Neanderthals. |

And here’s something else we know. And that is throughout modern history the Federal Government has been creating money out of thin air to cover all that debt. And the result has always been the same. And that is to dilute the value and purchasing power of our dollars. So future inflation will be one of the side effects of this massive $3 trillion cure.

Which leads us to one final thing we know in these uncertain times. And that is that precious metals, like silver and gold, have held their value over time. The government can’t just go out and print more silver and gold. And so these precious metals have acted as true, honest money. And today, silver is the most undervalued of the two.

So maybe that answers our question of where to invest? Maybe buying some silver in this chaotic market is a good way to go. And in fact, silver is one of the few things I have continued to invest in throughout the pandemic and market turmoil.

Because over time, silver holds its value. But the dollar just keeps losing value due to increasing debt. And we certainly have plenty of that now.

I explain this and many more reasons why to invest in silver in my recently published book Silver Investing For Beginners. You might find it interesting, and useful. So I’ve included a couple of free chapters for you below.

So keeping that $3 trillion government deficit spending in mind, check them out, and see if the case for silver in today’s uncertain market makes sense to you.

WHY INVEST IN SILVER?

So why bother investing in silver? What’s in it for you?

And the answer is that investing in silver can increase and preserve your wealth over time when done properly.

And it does this for you in a number of ways.

For example, back in 1964 I could buy a gallon of gasoline for a quarter ($.25) in Springfield, Missouri. Today, many decades of inflation later, gasoline is now at about $3.00 a gallon. But as I stand at the gas pump, filling my tank with that $3.00 gasoline, I find it interesting that you and I can still buy a gallon of gasoline with that same 1964 quarter.

Because that 1964 quarter was made of 90% silver, and that silver is worth $3.00 dollars today. Which means gasoline is still $.25 a gallon in terms of silver quarters.

So you can look at this rather astounding fact a number of ways.

One is that the silver in that quarter has gone up by 1200%, from $.25 to $3.00. So that’s definitely increasing your wealth.

Another is that it has preserved your wealth and purchasing power through all of those years. Because, over fifty years later, you can still buy a gallon of gasoline for the same amount of silver (.18 of an ounce, or about a fifth of an ounce in that quarter). So that silver has protected you from inflation.

And finally, you can see that the dollar has seriously dropped in value over the years. Because a gallon of gasoline used to only cost a fourth of a dollar (twenty-five cents). Now it costs three whole dollars. That’s a 92% loss of value.

So let’s not mince words here. That’s a serious loss of purchasing power and devaluation of currency. Our currency is literally going broke. Our dollars have clearly dropped in value. By quite a lot, actually.

But not silver. Silver hasn’t dropped in value at all in this example. So silver, as money, has given you a profit, financial security and clearly stood the test of time.

But the dollar (and other paper currencies) have not. We know that because we see inflation in the prices of all of the things we buy with our dollars. Year by year, little by little, our paper currency has been debased and diluted, and literally been going broke in front of our eyes.

So how did we get this way? What’s going on here? And what’s causing this?

The Problem: Our Currency Is Going Broke

Well, it turns out that governments are the cause of all of this currency debasement and inflation. They’ve done this for thousands of years, and the story is ALWAYS the same.

It goes something like this. In the beginning, a country creates money so their citizens can buy goods, do business, save, and of course, pay their taxes. And typically that money is in the form of coins made of precious metals like silver or gold. It’s good, honest money and the citizens know they can count on it.

And prices are pretty stable too. I mean, if a gallon of milk costs one silver coin, ten years later, it still costs about one silver coin. Ditto for savings. If people hide away a thousand silver coins under their mattress for a rainy day, then ten years later, if they take them out to spend, they’re still worth about the same. They’ve not lost value.

Of course, lugging around a thousand silver coins (about 60 pounds at one ounce each) is kind of inconvenient. So the government creates paper currency too. Let’s call this paper currency dollars, with each paper dollar worth one silver coin.

| SILVER AND DOLLARS: The word dollar is of German origin from the beginning of the 16th century. It was named after a town called Joachimsthal, or Joachims Thal, which meant Joachim’s Valley.Why was this town so important? Because it had a silver mine, and they began to produce silver coins of uniform weight and fineness. These coins were of such quality they came into good repute all over Europe and were called Joachim’s thalers.Over time they just started calling the silver coins “thalers”. Thaler eventually changed to daler, and finally dollar.The term was later applied to a coin used in the Spanish-American colonies. It was widely used in the British North American colonies at the time of the American War of Independence, and was adopted as the name of the US monetary unit in the late 18th century. |

The government makes sure that for each dollar they print, they have a silver coin in the banking system to back it up. So if you want to, you can just go to the bank and give them a paper dollar, and they’ll give you a silver coin. Or you can give them a silver coin and they’ll give you a dollar.

It’s all the same, really. The paper dollar is just a claim check on one silver coin.

So now you don’t have to lug around all of your silver coins any more. You just carry your paper dollars and buy things with them. And everyone accepts them instead of silver coins, because they know they can just go to the bank and get the silver coins any time they want.

And the government accepts these paper silver dollars too, when you pay your taxes. And the government only spends as many dollars each year as they get in taxes. And they are always careful to only print as many paper dollars as they have silver coins in the banking system.

So everyone is confident in the money system. It’s good, sound money. And things go along just great for a while.

But then, some of the country’s politicians get worried about winning their next election. And so they start promising benefits to the citizens, that the country can’t afford, in order to get re-elected. In other words, they’re promising benefits that cost more than the taxes they are going to receive. They are creating debt – a national debt.

Essentially, they’re trying to buy votes, with your money, to stay in power. And if enough citizens are good with that, because hey, who can say no to “free” benefits, then they get re-elected and stay in power.

| Panem Et Circenses (Bread and Circuses): There’s actually a phrase for these free benefits called “bread and circuses.” And you may hear it from time to time today. I heard “bread and circuses” mentioned on the news just the other day.It captures a certain cynical view that the masses can be kept happy with free benefits and diversions provided by the government.It was first used around A.D. 100 by a Roman poet who was poking fun at the populace. He deplored how shallow and unheroic the Roman citizens had become after the Roman Republic ceased to exist and the Roman Empire began.He said, “Two things only the people anxiously desire — bread and circuses.”The government at that time kept the Roman populace happy by distributing free food and staging huge spectacles at the coliseum. Meanwhile, they were stealing from the citizens by devaluing their currency, and getting away with murder (literally). |

And along the way, these politicians also get the country involved in some expensive wars that the country can’t afford either. These wars may be for legitimate defense reasons, or ideological reasons, or because some of their big campaign contributors make money from the wars, or for some other reason.

The reason doesn’t really matter. Because the bottom line is that now the government has created even more debt than it can pay with the taxes it receives.

So some of the politicians propose raising taxes to pay that debt. But this idea is not so popular with the citizens, and so those politicians don’t get re-elected.

Other politicians, seeing the fate of their peers, think of another way to pay the bills. They tell the Treasury to just print more paper dollars, even though they don’t have enough silver coins to back them up. And then they pay the government’s bills with these new, watered down, diluted dollars.

This looks like it solves the problem because all of the bills get paid and they don’t have to raise taxes. And they can keep giving out these “free” benefits and get re-elected.

But of course this doesn’t really solve the problem. Because those new paper dollars are not backed by silver. So ALL of the dollars in the country become worth less than before.

Here’s why. Let’s say that in the beginning the country was very small and the government had a million silver coins in the banking system. And they printed a million dollar bills. So a dollar bill was worth one silver coin. Okay, good so far. That’s good, sound money.

But then the government created another million dollars in debt, and printed another million paper dollars to pay it. So now there are two million paper dollars in circulation. But there are still only one million silver coins in the banks. So now a paper dollar is only worth half of a silver coin. It has lost a lot of value.

That’s kind of a big deal. Because now, if you had saved a thousand paper dollars and kept them under your mattress, or in your savings account, your savings have lost 50% of their value. Your savings, which used to be worth 1000 silver coins, are now only worth 500 silver coins. You just lost half of your savings.

And as you will see, that’s what’s going on today. The government keeps spending more and more that it can’t pay for. So it keeps printing more and more new currency out of thin air. And the banking system is flooded with more and more dollars that are worth less and less.

Actually, the situation is even worse, because the government, through the Federal Reserve, doesn’t even need to bother with printing all of those pesky paper dollars. In our computerized age, they can just create electronic deposits. This is essentially the same as printing dollars, but happens with no printing cost at all, at the click of a mouse. And the banking system is flooded with even more, less valuable, electronic dollars.

And so your savings, wealth and purchasing power are getting destroyed, year by year. And prices keep going up, because the dollars are worth less and less.

That’s called inflation, and it’s why you feel like you just can’t get ahead.

But this is not a new thing. Like I said earlier, governments have been doing this for thousands of years, even before there were paper and electronic currencies.

So why would they do this?

To pay the bills, of course. And because throughout history, rulers and governments just can’t resist the temptation to overspend to stay in power. So they steal money from their citizens by devaluing the currency. Rinse and repeat… history is littered with this same story, again and again.

So okay, where do we stand in modern times? And how does this affect you, and your purchasing power and investing in silver today?

| $833 Cup Of Coffee – Now That’s Inflation! Inflation and price increases can go to incredible levels. And it’s happening right now in Venezuela. While the US currently has averaged an inflation rate of around 3% per year, as of this writing Venezuela has a rate of over 43,000% per year – and rising.Okay, so that’s a big number, but what does it really mean? Well, in 2016 a cup of coffee costs around 450 Venezuelan Bolivars. And as I write this book, just two years later, that same cup of coffee costs 1,000,000 Bolivars. Since the average Venezuelan wage is $5,000,000 Bolivars per month, it takes a full month’s wages to buy just five cups of coffee.So how much would a cup of coffee cost in the US if five cups cost a month’s wages? Well, if we say the average monthly wage is $4166 ($50,000 per year / 12) then five cups of coffee would be $4166.So one cup of coffee would cost $833 ($4166 / 5). Hey, even Starbucks doesn’t charge that much. |

The Dollar And Silver Today

You would think that governments and citizens would learn a lesson from thousands of years of currency devaluation and bad endings. But that’s not the case. Sadly, our modern situation seems headed in the same downward direction.

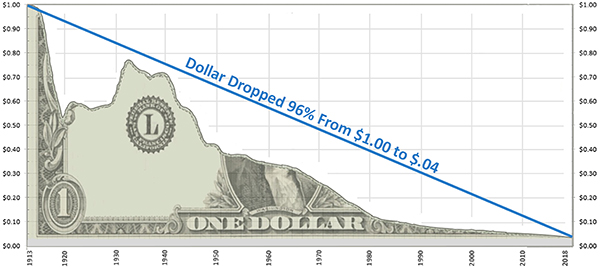

Figure 2-2. 1913 To 2018 – The Dollar Today Is Only Worth 4 Cents

This is apparent when we look at the dollar in the modern era from 1913 to today. The dollar has lost 96% of its value since 1913. So a dollar today is only worth 4 cents of what it was worth in 1913. That’s a pretty serious decline in purchasing power.

And as more government debt is created by overspending, more dollars are printed or electronically created. So they continue to lose even more value.

You can see how fast our debt is increasing by looking at the US National Debt Clock here – http://www.usdebtclock.org/. Be sure and look it up. Because it’s staggering how fast our debt is increasing right in front of your eyes. For example, in the five minutes it takes you to read this chapter, our debt increased by about $10,000,000 dollars.

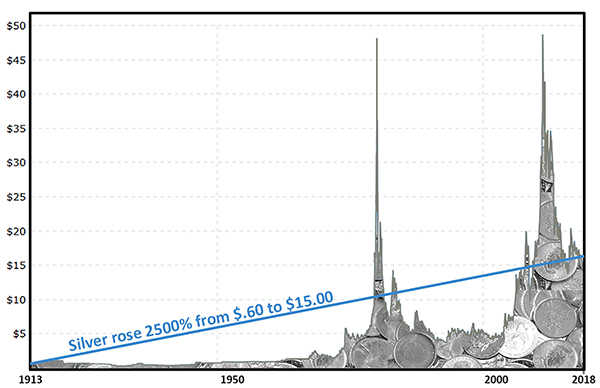

But what about silver over the same time period? Well, unlike the dollar, which has declined in value, silver has gone up. By quite a bit, actually. The price of silver looks like this.

Figure 2-3. 21913 To 2018 – Silver Has Gone Up 2500%

Silver has gone up from 60 cents an ounce in 1913 to $15.00 per ounce in 2018. That’s a whopping 2500% increase in value ($.60 X 2500% = $15.00).

So if someone (a really long-lived person) had put 1000 dollar bills under their mattress in 1913, then in 2018 that $1000 would only be worth $40. But they could have bought 1667 ounces of silver back in 1913 at $.60 per ounce with their $1000. And if they had done that instead, their $1000 of silver would be worth over $25,000 in 2018.

So, $40 or $25,000. Which would you rather have today?

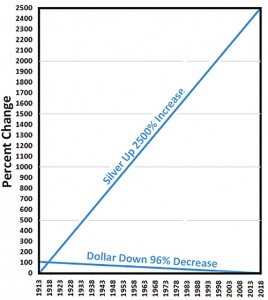

Let’s put the two charts together and ask the same question. Just looking at the increase in silver and the decrease in the dollar (in percents), which is the better place to put your money?

And the answer is silver, of course.

Figure 2-4. 1913 To 2018 – The Dollar And Silver – Where Would You Like Your Money To Be?

Now as a smart reader you might say, well, yes, but that $25,000 today is only worth 4 cents on the dollar of 1913 dollars. And that’s another way to look at it. That $25,000 today would be worth $1000 1913 dollars (.04 x $25,000 = $1000).

But that’s actually good news, and the point of this exercise. Because you can say their money, through all of those years, had not lost value.

| Car Prices In Silver:Let’s cross-check those prices. So in 1913, you could buy a new Model T Ford for about $500, or a Chevy for $1500 or more, depending on the model. So a rough average of the car price back then could be around $1000 (or 1667 ounces of silver at $.60 an ounce).And today, over 100 years later, you can still buy a new car for 1667 ounces of silver. With silver at around $15 an ounce today, that’s $25,000. Now that’s preserving purchasing power! |

Which is one of main reasons we invest in silver and other precious metals – to preserve our wealth and purchasing power over time.

Okay, so preserving purchasing power is great, but how about making money? Well, this is where it gets really interesting. Because the silver price could explode sometime in the future.

You Could Make A Lot Of Money

As we’ve said earlier, leading experts today think future silver prices could eventually increase as high as 5000%, and they are calling this the opportunity of a lifetime.

And while it’s more reasonable to shoot for a more modest 500% over time, 5000% is not as outlandish as it may sound. For example, many people don’t realize this, but silver rose 3,646% in the 1970s, from its November ’71 low to its January 1980 high. So there’s already an historical precedent for huge price increases.

But today the general public is unaware of silver’s value, and the forces that could propel it to great heights…

~~~~~

Okay, so those were the free chapters for you from Silver Investing For Beginners. I hope you enjoyed them. And there’s much, much more in the book too, such as…

• Why the price of silver could explode in the future.

• Why silver offers greater profit potential than gold.

• How silver could help protect you in a financial crisis.

• How to find and buy your first silver bullion.

• The best silver coins to invest in when you start.

• How you can even open an automated silver buying account.

• How to invest in silver related stocks and funds.

• And how to protect your silver investments.

If these topics interest you, you can preview the book for free right here.

Okay, so to wrap up here, now you know why I’ve kept investing in silver. It’s something to think about. Of course, everyone’s situation is different, so you’ll have to decide if silver is right for you.

That said, wishing you the best through these turbulent times…

…and to your health and prosperity – John