Silver Can Be A Volatile Investment

I first started investing in silver in 1980 and have been involved with it off and on since then. That has given me some sense of market history about the metal.

And one of the things I will tell you is that the price can be quite volatile. In my personal history with it, the price has been as low as $11 an ounce to about $48 an ounce. This is why one of my preferred, although not only, ways of investing is in buying physical silver in the form of pre-1965 U. S. coins and pure bullion — like Mercury dimes, American Silver Eagles, Canadian Silver Mapleleafs, etc. When you own it physically, you can just buy less when the price is high, and buy more when it goes down.

Also, when the price is low, you have staying power, i.e. the silver you own is not going to go away. And you can add more to your position at the discount prices.

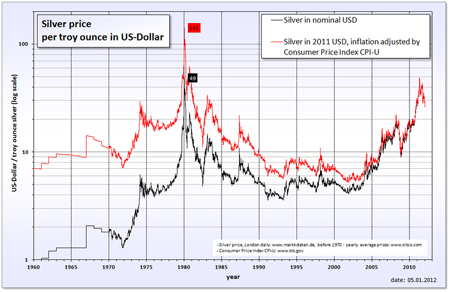

A few points about the silver chart pictured above are of interest. One that stands out is the big spike around 1980. This occurred when the two Hunt brothers allegedly tried to corner the silver market. The price went up to around $50 an ounce. In today’s dollars, that would be about $150 an ounce.

So at today’s price of around $33 an ounce, historically, silver could have a good distance to run up in price. This is why I feel that silver going to $50 an ounce in the next year or two is not a wild-eyed prediction. It’s certainly possible, and could go even higher.

Another point of interest, which we discussed in a previous post on the Y2K incident – see http://livelearnandprosper.com/silver-for-survival-and-the-y2k-incident, was how the price of silver dropped off right after the turn of the century. You can see this in the chart at the year 2000 mark. This occurred because when people realized the Y2K situation had been successfully passed, they liquidated their emergency holdings in silver. But in 2003, silver started a long climb back up; eventually hitting around $48 an ounce, before the commodity exchanges raised the margin limits to drive speculators out of the market. The effect of this can be seen in the sharp drop in 2011.

Silver seems vulnerable to external rule changes like this. And I keep reading reports of alleged silver market manipulation – some from credible sources. One in particular, Sprott Resources, describes an unusual event around February 29, 2012.

The selloff appears to be mostly a paper affair. By this I mean there were many parties selling – about 173 million ounces – and they couldn’t possibly have had the physical silver to back this up. To put this in perspective, the world only produces 730 million ounces of silver a year. And unlike gold, silver gets consumed. So how could the price of silver take such a hit if real silver was not involved?

I have a word for that. Peculiar. Most peculiar indeed.

That said, I still believe silver is a good long term investment for a portion of your portfolio. After all, manipulation cannot continue forever. Eventually the law of real supply (physical silver) and demand exerts itself in the markets, and the manipulators can no longer hide that economic truth.

However, it’s a cautionary fact to remind us to always invest just a reasonable position in any one thing, i.e. not putting all of our eggs in one basket. This is called position sizing, and always a good thing.

To your health and prosperity – John