Keep More Cash In Your Stock Market Account – Part 2

In an earlier post we talked about why it’s smart to keep more cash in your stock market account. This idea runs counter to what most investors think because they always want to be “fully invested.”

But we described how Warren Buffett feels much more favorably to cash than the average investor, and that he views cash as the ultimate call option. That is to say that cash gives him the future ability to buy ANY stock by ANY date at a deep discount when the market tanks.

And in the vein of cash and call options, I mentioned that this is brilliant another way due to a thing called time decay.

So what is time decay?

Well, when you buy a call option, all other things being equal, it starts losing value day by day because as each day passes it gets closer to expiration — and then it is worthless.

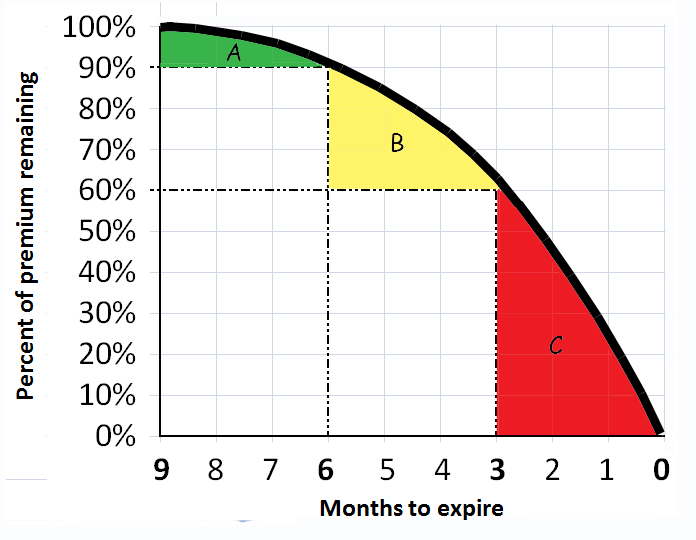

The time decay of an option is pretty dramatic, too. Just look at the time decay chart below.

You can see from the chart that in the last three months of an option’s life, it loses fully 60% of it’s value. This is shown in the red zone. Even in the first three months, the green zone, it is losing 10% of value.

So what about cash? How much value does cash lose?

Well, this loss of value is called inflation, and you can use a ballpark figure of 3% a year.

So let’s think about this. A call option is ultimately losing 60% of value in three months. Cash is losing 3% in an entire year.

Which time decay value do you want working against your opportunity to buy stocks at a discount in the future.

I’m thinking 3% sounds way better, aren’t you?

Apparently so does Warren Buffett.

And this is yet another way of supporting his view that cash is the ultimate call option. Because it has a dramatically lower time decay value.

So keep a higher balance of cash in your investment account. That way, you’ll be able to buy into great stock bargains as they occur in the future. And you’ll only have a small time decay.

To your health and wealth – John