How To Reduce Your Stock Risk – Affordably

With the large up and down swings of the stock market over the past year, many stock investors have concerns about risk to their stock portfolio.

Of course, stock investing always carries risk, but there are a number of ways to reduce it. We’ve written about some of these in the past, like using position sizing and stop losses.

In this issue we’ll cover another risk reduction practice called diversification. Diversification spreads your risk by owning shares in more than one or a few company’s stocks. In other words, you don’t put all of your eggs in one basket. Instead, you own a larger number of different company’s stocks.

So we’ll look at a class of stock investments that have diversification built right into them. And while many investors at all levels invest in them, they are particularly useful for beginning and small investors. So we’ll focus on that aspect for now.

The type of investments I’m talking about are called Exchange Traded Funds (ETF’s). And they help reduce risk by making diversified stock investing more affordable.

THE RISK OF NOT BEING DIVERSIFIED

To illustrate, let’s say you’re a beginning investor and you only have $500 to invest. So you might start off by buying just a few shares of one stock.

For example, you might buy a couple of shares of McDonalds stock at $252 a share. So that’s your $500+ spent right there.

Now if shares of McDonalds go up, that’s great, because your entire portfolio (of just one company’s stock) went up. But if McDonalds goes down, your entire portfolio went down.

If you had a bigger portfolio with many different companies’ stocks, some of them might have gone up. And that would kind of balance out the drop in your McDonalds stock. Or at least reduce the loss.

So that’s how diversification works and reduces your risk. When some of your stocks go down, others may go up. It kind of evens out the ride.

Okay, great, but you’re just getting started. You know you need to buy more stocks of different companies over time. And your portfolio will become more diversified as you do this. But the reality is, right now, you have more risk because you’re not diversified.

CAN WE GET DIVERSIFIED FAST?

But wouldn’t it be great if you could just start off invested in a bunch of stocks all at once? Better yet, be invested in 30 well known top companies in the US from the very start?

Now that would really be spreading your risk. I mean, even if you only bought one share of each company. Because then you would be pretty diversified from the beginning.

Okay, great idea, and there just happens to be an existing list of 30 prominent companies across key industries in the US. That list (known as an index) of stocks is called the Dow Industrial Average or DOW.

And it’s very well known. Literally, if you tune into any financial show on TV, you will hear about it all of the time – see https://livelearnandprosper.com/what-are-the-dow-and-the-sp-500

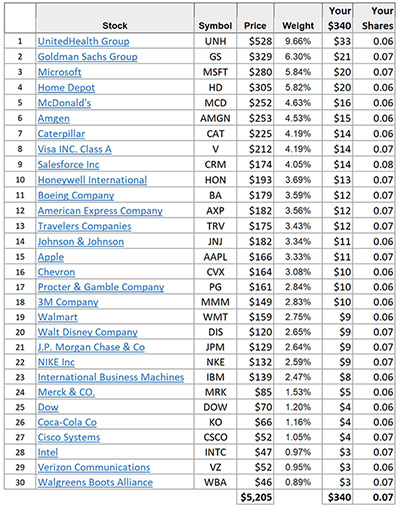

And you probably know many of the companies in the list, too. So let’s look at it and see what they’re talking about. Here are the 30 stocks in the DOW, and their share prices.

Figure 1: Dow 30 ETF Stocks – Cost Per Share

So that certainly looks diversified, doesn’t it. There’s healthcare (United Health Group), tech (Microsoft, Apple), energy (Chevron), retail (Walmart), beverages (Coke) and even tennis shoes (NIKE). And many other companies in different market sectors. So yeah, pretty diversified and spreading your risk across many companies and industries.

Hmmmm… but there’s a problem, isn’t there? Because adding up the cost of just one share each of these top thirty companies costs $5205. And that’s well over your $500 budget right now.

So what’s a beginning investor to do?

ETF’S MAKE DIVERSIFICATION AFFORDABLE

Well, here’s where ETF’s can make diversification possible. Because there are ETF’s made up of these specific 30 large, publicly-traded U.S. companies. So let’s look at a very popular one right now.

It’s called the DOW Jones Industrial Average ETF, or sometimes the DOW 30 for short. And it pools thousands of investors dollars into the DOW 30 fund. Which gives the fund literally billions of dollars to buy those 30 large, publicly-traded U.S. companies’ stocks.

And they will let you buy a small (or large) part of that huge fund. You can buy shares in it, just like you buy shares in a stock. You can buy one share or many shares. And when you buy shares in that fund, you own a piece of each of those 30 companies’ stocks.

The fund even has its own stock symbol, DIA, which you use to buy shares in it. And one share of DIA costs $340. So with your $500 starting investment, you can buy one share of DIA (the DOW Jones Industrial Average ETF) with money left over.

And with your one share of DIA, you now will own a fraction of a share of every one of those 30 large publicly traded stocks.

Voila, instant diversification!

Figure 2. Your Shares In The DOW 30 Exchange Traded Fund (ETF)

So how much of each stock will you own? Well, it’s a little over 1/20 of a share of each stock, or about .07 of a share each ($340 / $5205 = 0.07). So you’ll own $33 of United Health group – about 1/20th of a share at $528 share. And $20 of Microsoft at $280 a share, etc.

So that’s how you can reduce your risk and diversify from the very start. By buying shares of a stock ETF like DIA. And that’s how ETF’s make that possible and affordable. Because you can buy a small piece of all 30 companies, all at once, for only $340.

SHOULD YOU BUY ETF’s OR INDIVIDUAL STOCKS?

Okay, so you have a $340 investment in one share of DIA and you have $160 left over. So maybe you also invest it in a couple of shares of Coca-Cola at $66 a share because 1) you like the company, 2) Warren Buffett is invested in it, and 3) you also like investing directly in some companies and actively following them, as well as using ETF’s.

So now you own 2.06 shares of Coke. Hmmm – so where did the .06 come from? Well, that’s how much of Coke you own in the fund (see Figure 2). Plus the two shares you just bought directly.

So you see, you can invest in ETF’s affordably to diversify your stock investments. Or you can invest in shares of individual companies. Or you can do both.

Investing in individual stocks can be more interesting because you can follow them to see how they’re doing. And you don’t have fund expenses.

But then, investing in ETF’s gives you affordable diversification. And many ETF’s have very low expenses (called the “Expense Ratio) so they aren’t much of a drawback, really. For example, the expense ratio for DIA is quite low at only 0.16%.

So in general, either way is fine. I tend to own some ETF’s and more individual stocks. But it all depends on what fits your individual needs. And that’s for you to decide.

OTHER ETFS WITH MORE DIVERSIFICATION

Now we’ve only talked about the DIA Exchange Traded Fund so far. And that’s because, with just 30 stocks, it was easy to show them all and discuss them.

But also because the DIA is a popular ETF that many people invest in. And it’s has been around since 1998, so it has some history behind it. Indeed, the list of blue chip stocks it’s based on (The Dow Jones® Industrial Average) has been used for over a hundred years, and become the most recognizable stock indicator in the world.

But it’s not the only stock ETF people can invest in. There are many others.

For example, how about a fund that has 500 large US stocks, instead of 30. Now that’s some diversification for you!

It’s called the SPDR S&P 500 ETF with a stock symbol of SPY. It’s not as old as DIA, but it is the largest ETF at $381 billion (known as assets under management). That’s over a third of a trillion dollars. And it has the most shares traded daily of all of the ETF’s.

And the SPY expense ratio is just 0.095%, so it’s even lower than DIA at 0.16%. So you get more stocks in your portfolio at less expense. And a share of SPY cost around $395, so a share is still affordable for our beginning investor example.

DIVERSIFICATION HELPS – BUT NOT A GUARANTEE

Now diversification just helps lower your risk, but it’s not a guarantee against losses. ETFs go up and down in value too. Because the sum of the stocks in the ETF go up and down in value.

But it’s generally accepted that ETF’s can lower risk overall, compared to owning only one or a few stocks. Indeed, if you owned only one stock, and the company went bankrupt, you could pretty much lose all of your money.

But a bankruptcy of one company out of 30, or 500, etc., would not affect you so dramatically. And by pooling others money with yours, ETF’s make investing in this many stocks more affordable.

OTHER DIVERSIFICATION

Now, what we’ve discussed here gets you diversified in stock investments. But overall, diversification should include more than just stocks. It should also include other types of investments like bonds, real estate, precious metals and perhaps even commodities.

And fortunately, there are ETFs for all of these other types of investments too. And we’ll cover some of them in future issues.

But using stock ETFs is a good place to start, and gets you well down the road to diversification. And the ease of investing in them, and the low initial cost, help you get there from the very start.

To your health and prosperity – John

EXTRA CREDIT – Diamonds And Spiders: Here’s a fun fact for you. The DIA fund is also informally called “Diamonds.” Now this has nothing to do with gemstones. It’s just that its stock symbol of DIA looks like the start of the word diamonds.

Similarly, funds like the SPDR S&P 500 ETF (SPY) are informally called “Spiders” because of the SPDR prefix. But they have nothing to do with spiders, or bugs either. The name is an acronym for the Standard & Poor’s Depositary Receipts, now the SPDR S&P 500 Trust ETF, and usually associated with the Exchange Traded Fund SPY.

You will hear diamonds and spiders mentioned from time to time on the financial news shows. So now you’re in the know.

P.S. Note that share prices and other amounts used at writing will vary based on changes in the market.

P.P.S. Many people invest in DIA or SPY and similar ETF’s. However, note that there are literally thousands of different ETF’s, and everyone’s situation is different. So this article is not a recommendation to invest in DIA or SPY. You will have to consider and decide if they are suitable to your unique investment requirements.