How To Reduce Your Stock Risk – Affordably

One way to reduce your stock investing risk is to own a number of different company’s stocks. That is to say, to diversify the stocks in your portfolio.

And a great advantage of Exchange Traded Stock Funds (ETF’s) is they make diversified stock investing possible, by making it more affordable.

RISK OF NOT DIVERSIFIED

To illustrate, let’s say you are (or were) a beginning investor. Maybe you only have $500 or less to start investing with. So in that case you might start off buying a few shares of just one stock. Let’s say you buy a couple of shares of McDonalds at $252 a share. So that’s your $500+ spent right there.

Now if shares of McDonalds go up, that’s great, because your entire portfolio (of two stocks) went up. But if McDonalds goes down, your whole portfolio went down. Not so great. If you had some other stocks, maybe they would have gone up, to kind of balance out the drop in McDonalds. Or at least reduce the loss.

So anyhow, nice start on your portfolio with your McDonalds stocks, and now you’re in the game. And you know you’ll need to keep buying more stocks of different companies over time, so your portfolio grows and becomes more diversified.

But right now, since you’re just getting started, you’re invested in just one stock. So you have more risk because you’re not diversified.

CAN WE GET DIVERSIFIED FAST?

But wouldn’t it be great if you could just start off invested in a bunch of stocks all at once? Like maybe invest in stocks of some of the top 30 companies in the US from the start? I MEAN, even if you just bought one share each? Because then you would be pretty diversified from the start.

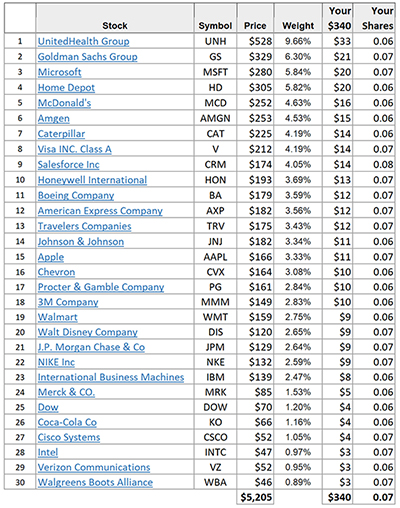

Okay, great idea. So let’s look into that. Here’s a list of top thirty stocks and their share price.

Dow 30 ETF Stocks – Cost Per Share

Hmmmm… but that’s a problem, isn’t it? Because adding up the cost of just one share of the thirty top companies costs $5205. And that’s well over your $500 budget right now. It’s impossible. So what’s a beginning investor to do?

ETF’S MAKE DIVERSIFICATION AFFORDABLE

Well, here’s where ETF’s can make diversification affordable and possible. So let’s look at a specific ETF made up of 30 large, publicly-traded U.S. companies. It’s called the DOW Jones Industrial Average ETF, or sometimes the DOW 30 for short. And it’s made up of 30 large, publicly-traded U.S. companies. And just like a stock, it has its own stock symbol, which is DIA.

And one share of DIA costs $340. So with your $500 starting investment, you can buy one share of the DOW Jones Industrial Average ETF (DIA).

And doing that will buy you part of a share of every one of those 30 stocks.

Voila, instant diversification!

So how much of each stock will you own? Well, it’s a little over 1/20 of a share of each stock, or about .07 of a share each ($340 / $5205 = 0.07).

So that’s how you can reduce your risk and diversify from the very start. And that’s how ETF’s make that possible and affordable.

EXTRA CREDIT: Buy ETF’s Or Individual Stocks?

Now back to your $340 investment in one share of DIA. That means you have $160 left over. So maybe you invest it in a couple of shares of Coca-Cola at $66 a share because 1) you like the company, 2) Warren Buffett is invested in it, and 3) you also like the control of investing directly in some companies and actively following them, as well as using ETF’s.

So now you own 2.06 shares of Coke. Where did the .06 come from? Well, that’s how much of Coke you own in the fund (see DOW 30 YOUR SHARES below).

So we see where you can invest in ETF’s affordably to diversify your stock investments. Or you can be an individual stock investor in specific companies. Or you can be both.

Investing in individual stocks can be more interesting because you have more focus and control. And you don’t have fund fees. But then, investing in ETF’s gives you affordable diversification and some ETF’s have very low fees.

So in general, either way is fine. It all depends on what fits your individual needs. And that’s for you to decide.

Or like me, you may just want to do both.

To your health and prosperity – John

DOW 30 YOUR SHARES: You may recall that the DOW 30 ETF has some stocks more heavily weighted than others. That means it has more money invested in some stocks than others. For example, about 10% (9.66) of the ETF is in United Health, while only about 1% (.89) is in Walgreens.

So using the actual weighted stock values, here’s how much of each stock your one $340 share of DIA would give you. For example, looking at the first stock, you own $33 dollars of UnitedHealth Group, which is 6/100 (.06) of a share.

Your Shares In The DOW 30 Exchange Traded Fund (ETF)