How Dividend Stocks Grow Your Wealth Faster and Faster

One of the keys to buying dividend stocks is to buy those that increase their dividend. That way you will be making more and more money, because the dividend checks keep getting bigger every year.

Here’s how that works. Let’s say you buy a dividend paying stock, and the stock price never changes (most unusual). And you just spend the dividend checks whenever they hit your mailbox.

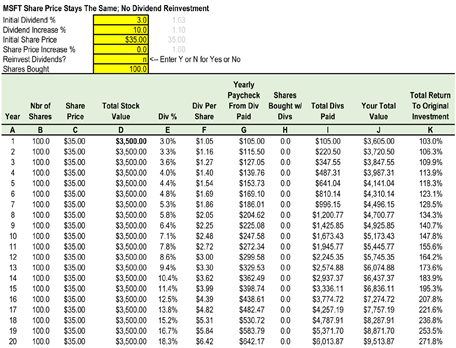

So more specifically, we’ll say you bought 100 shares of Microsoft (MSFT) for $35 a share. It pays a 3% dividend when you buy it, and has been increasing the dividend by 10% a year. And the stock price never changes from $35 a share.

The table above shows the results. Now before you look at it, understand this is a pretty conservative scenario. Actually, Microsoft has been increasing their dividend by 12% a year. And historically, stock values have gone up about 7.5% a year on average, instead of staying the same. And again, you are just spending the dividend checks when they come in, not using them to invest in more stock.

So here’s what happens…

NOTE: To keep the illustrations simple, I’ve just calculated and shown the dividend payments year by year – like Microsoft was paying their dividend annually. Actually, Microsoft, and most dividend stocks, pay quarterly. So the real results would be a little different. But this is pretty close, and easier to visualize than a table of 80 quarterly compounding dividend entries.

In the first year, Microsoft pays you a 3% dividend, and you get a $105 check in the mail. Your total return on your $3500 investment is 103% (column K). Your stock is still worth $3500 (D), so you still have 100% of your initial investment, plus you got a 3% dividend (E, G). So that’s your 103% Total Return To Original Investment (K).

Then you cash the $105 check, and take someone special to a nice lunch at a restaurant on the beach, or something fun like that. In other words, you don’t reinvest the dividends, you just spend them.

Year by year, your dividend checks keep increasing. By year 8, they have almost doubled, to $204.62. Okay, so you can take someone special to a nice dinner.

And by year 15, you have received a total of $3336.11 in yearly dividends. Your $3500 investment has almost totally paid for itself. The dividends have bought the stock for you. And from now on it’s just all free money. I like that free money thing, don’t you?

Finally, by year 20, your $3500 investment, which you still own, plus dividends of $6013.87, has resulted in $9,513.87 total value to you.

That’s not too bad for a $3500 investment. And $6013.87 in free dinners.

Or had you not spent the dividends, and left the money in your account, your balance would be $9,513.87.

But you can do a lot better than that.

Because instead of spending the dividends when you get them, or just leaving them in your account, you can use the dividends to buy even more Microsoft stock each year.

And that’s when things get really interesting. Because you start making more money even faster. To learn more about making money even faster with dividends, you might want to check out my latest book called Your Future Paychecks And Raises: Get Dividend Checks In Your Mailbox Paid To The Order of You!

You can browse though it for free right here. And the promotional price for the next few days is ridiculously cheap – virtually free.

To your health and prosperity – John