Get Paid To Tap Into This Silver Stream

Most investors should have a portion of their investments in precious metals like silver and gold. And that’s because precious metals can offer you unique protection from inflation over time. After all, precious metals cannot be inflated. That is to say, you can’t just print more of them like you can dollars and other paper currencies.

And precious metals may protect your portfolio from wild market swings (known as volatility) by going up when the market or economy is going down. So even a small percentage of precious metals may reduce your risk. And from time to time, their price goes on a real upward tear, so you may also make a lot of money with them.

Gold, silver, platinum and palladium are the top precious metals people invest in. They currently cost around $1200 an ounce for gold, $15 an ounce for silver, $850 an ounce for platinum, and $900 and ounce for palladium. And of those choices, I favor silver because it’s underpriced. So it’s usually the best deal out there. Also, it’s the most affordable, so just about anyone can get started investing in it.

| Of course, everyone’s situation is unique, so you’ll have to decide if silver investing is for you. But for those starting out, it’s often best to buy “hold in your hand” silver first, like silver bars and silver bullion coins.But not rare coins. Just keep it simple and buy well known coins strictly for their silver content and value, like American Silver Eagles or Canadian Silver Maple Leafs. Then you can move on to other silver investments if you like.Or if you just don’t want to bother with physical silver, you can invest in stocks like the one in this article. |

So in today’s article we’ll go into an easy way to invest in silver with a special kind of company. I think you’re really going to appreciate their unique way of doing business. Because they let someone else do all of the hard work, and they just haul in the profits. And you get paid to invest in them, too. So what’s not to like about that?

The name of the company is Wheaton Precious Metals (WPM), formerly known as Silver Wheaton (SLW). And if you have a stock investing account, you can invest in them with the click of a mouse. But before we get into Wheaton, let’s talk about silver mining for a minute. Because Wheaton is involved in the mining business in a special way.

SILVER MINING IS A TOUGH BUSINESS

In theory, silver mining is pretty simple. You just go get some land you think has silver in it, dig a hole and take the silver out. Of course, silver mining is a lot more complicated than that. Because after you start digging, you may find out that your mine has no silver at all. Or maybe very little silver.

And even good silver mines are hard work, because many of them only get around 10 ounces of silver from a ton of ore. So they have to move tons of rock to get any worthwhile amount of silver.

And speaking of rock, since silver is typically embedded in it, you have to use explosives to break it up. So that’s kind of dangerous. And then there can be some pretty nasty substances like cyanide and mercury involved to separate the silver from the broken rock.

| It’s estimated that between 1860 and 1889, more than 20.5 million pounds of mercury was used just in the huge silver strikes in the Comstock Lode in western Nevada. Also, speaking of mercury, it’s often called “quicksilver.” |

And if you’re investing in a silver mine, well, some of these can be pretty dodgy. So unless you’ve really done some serious research, you may invest in a fraudulent mine.

Because many such mines always seem to be short of cash. So to keep operating, they make exaggerated claims of how much silver they have in the ground to get people to invest in them. Or like Mark Twain said, “a mine is a hole in the ground with a liar standing next to it.” So beware, because you may invest and lose your money.

And even if you’re investing in a legitimate mine, most of them don’t pay a dividend. So your money is just sitting there. And you’re just hoping the price of silver goes up so you can sell your stock at a higher price to get a return on your investment.

THERE’S GOT TO BE A BETTER WAY

Now don’t get me wrong, there are legitimate silver miners out there. But with all the complications involved in mining, there’s a better way to invest.

And that’s what’s so unique about Wheaton Precious Metals (WPM).

Because here’s what they do. Wheaton does the serious research to find the best mines out there. So while you and I are going along, living our daily lives, Wheaton is doing the research for us. It’s what they do.

Then they make good deals with these mining companies to buy part of their silver for a ridiculously low price. For example, with the price of silver today at around $15 an ounce, they may contract with a mining company to buy 20% of all the silver they mine for $4 an ounce. For the life of the mine! And that may include any new discoveries in the mine too!

That’s kind of like someone telling you, “Hey, if you give me four dollars, I’ll give you fifteen.” That’s a good deal if you can get it.

So then Wheaton just takes delivery of the silver every month, at $4 an ounce. And they sell it in the market for $15, and pocket the $11 profit. They’re letting someone else do all that hard work, and getting part of their silver for a song. Like I said, it’s good work if you can get it.

| There are all kinds of technical variations on how these royalty deals are made. For example, agreements may be based on Net Smelter Return, or Net Royalty Interest, or Net Profit Interests. And rights to purchase in future mines, at varying per cents and prices. The list goes on and on.But we won’t get all hung up on that, and instead just focus on the big concept. Which is that they make up-front deals with miners to get silver (and other precious metals) on the cheap. |

About now, you’re probably wondering why a mine operator would agree to giving up some of their hard-earned silver to a company like Wheaton?

And that’s because Wheaton gives them money up front to help finance their operations. And since silver mining is expensive, and many mining companies are strapped for cash, they find it beneficial to sell some of their future silver to get that financing.

So, having gotten the financing and cash they need, they promise some of their future stream of silver to companies like Wheaton in exchange. By the way, you notice that I just used the phrase “future stream of silver.” So it won’t surprise you then that companies like Wheaton are called silver streaming companies, or streamers.

For fun, go ahead and Google “silver streaming companies.” You’ll see many entries come back, and some of them will refer to Wheaton Precious Metals, or their older name Silver Wheaton. And you’ll see this concise definition at Wikipedia too…

“Silver streaming is the term often used when a company makes an agreement with a mining company to purchase all or part of their silver production at a low, fixed, predetermined price to which both parties agree.”

| By the way, there’s another, similar type of company called a royalty company. Roughly speaking, the royalty company gets the mining company to agree to pay them part of their revenue (i.e. money). A streaming company gets the mine to pay them in the physical metal (i.e. silver) at a low price.And some companies do both. So I tend to just treat these as the same type of investments, although there are subtle differences. But we’ll just keep using the term streamers to keep it simple. |

There’s another reason mining companies will part with some of their hard-earned silver as well. And that’s because silver is often a by-product of mining for other metals, such as gold, copper, lead and zinc. For example, about 35% of silver comes from lead and zinc mines. And approximately 10% comes from gold mines. And another 20% from copper mines. The rest comes from primary silver mines.

So it’s often the case that these miners just don’t want to deal with the silver. Because it’s not their core business. It’s not what they are mining for, or set up to deal with. So they’re happy to cheaply sell off their silver to streaming companies to be done with it, and get the extra income. And of course, the silver streamers, and us, the investors, are happy to take all of that pesky, bothersome silver off of their hands (big grin).

So silver streaming companies seem to be a great way to go when investing in silver. Because they do all of the research to find the good mines for us. And that lowers our risk.

And they make agreements with a number of different mines. So we don’t have all of our eggs in one basket. And they make profitable deals.

THEY ALSO PAY A DIVIDEND

And here’s another advantage. A common complaint about investing in silver (and other precious metals) is that it’s just dead money – there’s no return on it. You buy them and they just sit there.

But many silver streamers pay dividends. So we’re paid to invest in them while we wait for the silver price to go higher. And Wheaton Precious Metals is one of those streamers that pays a dividend too.

Now, dividends in the silver investment arena are not as high as typical dividends. The average dividend paid by the top 500 US companies (the S&P 500) is 1.81%. But Wheaton is pretty close at 1.6%.

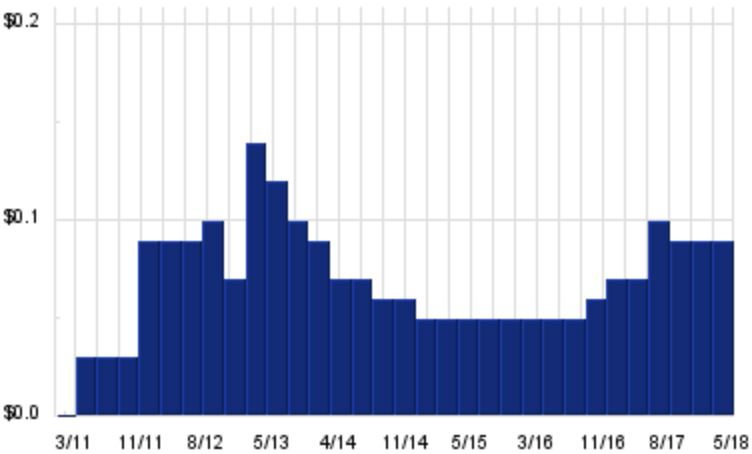

OK, so looking at their dividend chart below, it’s bounced around a bit. But they have consistently paid a dividend over the past seven years. And since the price of silver can bounce around too, that’s pretty good.

Wheaton Precious Metals Dividends – Chart courtesy of DividendChannel.com

But I wouldn’t invest in Wheaton just for the dividend. If you’re investing just for dividends, there are many more businesses that pay better, and have been paying dividends longer. And it’s a standard practice to determine reliable payers by looking at a 10-year minimum track record. So at seven years of paying a dividend, the jury is still a bit out on Wheaton.

So I’d look at the dividend more as an extra bonus, while getting the advantages of exposure to silver in your portfolio.

THE STOCK PRICE

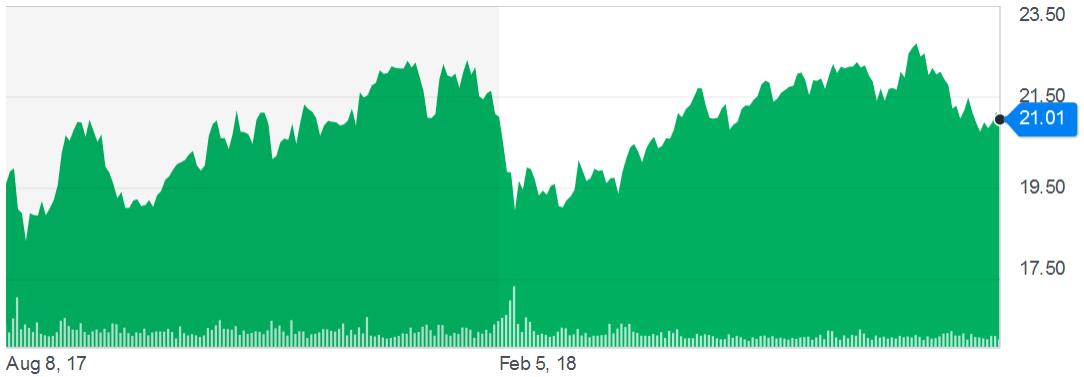

That said, we only want to buy stocks when they are selling at a good price. And right now, the stock price seems pretty reasonable at $21 a share. With a 52 week range of $18.32 – $22.87, it’s just slightly above the mid-point of $20.60.

Of course, I like to buy stocks at a discount, so I’ll put an order in for $19.75 and see how that goes over the next month or so. And you’d be surprised how often these lowball orders get filled.

Chart courtesy of Yahoo.com Finance

That said, if you want to stick your toe in the water at this price, it wouldn’t seem to be overpaying for the stock.

SO WHAT ARE THE RISKS?

Well, there isn’t much in life that’s guaranteed. And all stocks and investments carry a risk.

The most obvious risk is that mining is a risky business. Mines can play out, and the price of silver could drop, making Wheaton’s profitability go down.

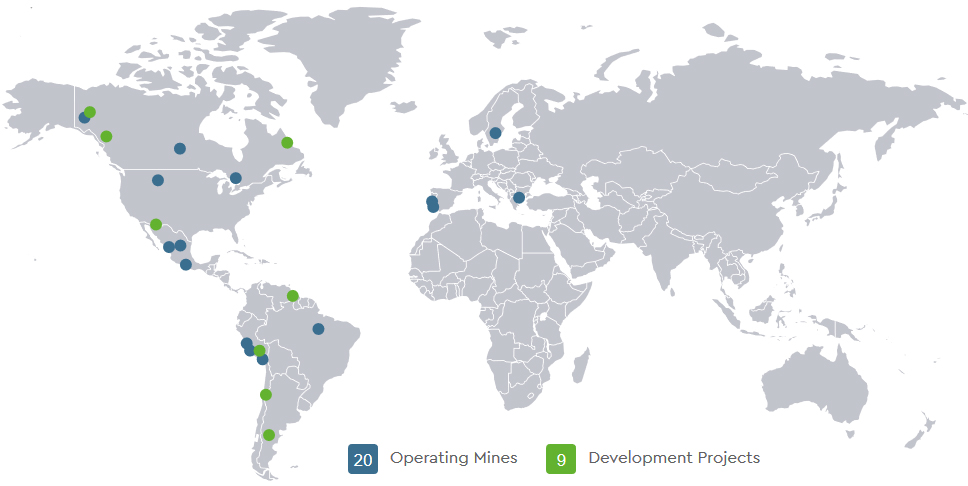

But since they have interests in twenty mines, there’s protection through diversification. So if one mine is disappointing, others may pick up the slack. And they also have nine development projects too.

Courtesy of Wheaton Precious Metals – www.Wheatonpm.com

Courtesy of Wheaton Precious Metals – www.Wheatonpm.com

And concerning the price of silver, well, the price of all precious metals goes up and down. But silver is sitting at an historically pretty low price. It spiked to over $48 an ounce back in 2011 during the U.S. debt ceiling crisis. So at around $15 per ounce today, it’s not like we’re anywhere near buying at the top of the silver price.

Another risk is that Wheaton Precious Metals has acquired a gold and palladium stream on Sibanye Gold Limited’s Stillwater mine in the U.S. They will pay $500 million upfront to purchase 100% of the life-of-mine gold and 4.5% of palladium (decreasing to 2.25% and then 1%) at Stillwater. And their cash payment of $500 million will be paid by using amounts drawn from the company’s $2 billion revolving credit facility.

That adds quite a bit of debt. But then, the company will make ongoing payments of 18% the spot gold price ($225/oz at current prices) and 18% of spot palladium price ($163/oz). So with gold at $1200 an ounce, and palladium at $900 an ounce, those are some pretty nice profit margins.

And there’s more diversification safety as they move into different precious metals too. And even more profit if the price of silver, gold and palladium goes up. And that’s not unreasonable to assume over time.

WHAT TO BUY

So with all those things in mind, you might want to check out Wheaton Precious Metals (NYSE:WPM) and see if it fits your unique investment needs and risk tolerance.

But don’t go crazy with this. Most advisors recommend just a 5 – 10% exposure to precious metals in your portfolio. And 10% may be a bit aggressive for many.

So at 5% on a $100,000 portfolio, that would be no more than $5000 invested in precious metals. And all of that should not be in just one stock like Wheaton. Most investors should have physical silver and other precious metals investments too.

However, all that said, the company sure seems to have a great business model. So you may want to consider investing in it.

And if you do, you can smile, like me, every time you think about how you’re helping take all of that pesky, bothersome silver off of those poor miners hands.

To your health and prosperity – John

P.S. I have invested in Wheaton Precious Metals (NYSE: WPM) in the past when they were known as Silver Wheaton. And I have an open order to buy them at $19.75 a share to try to buy the stock at a discount.

I’m also invested in the similar companies Franco-Nevada (NYSE: FNV) and Royal Gold (NASDAQ: RGLD). So I eat my own cooking, so to speak. And you may gather from those positions that I like the Streamer / Royalty business model.

P.S.S. To learn more about getting paid with dividend stocks, and stock-like investments, you may be interested in my latest book Your Future Paychecks And Raises: Get Dividend Checks In Your Mailbox paid to the order of YOU! You can check it out for free right here at http://a.co/6FwKPdc.