Get Paid A 7.5% Dividend With This Dynamic Dividend Fund

The stock fund I’m talking about is the Aberdeen Total Dynamic Dividend Fund (NYSE: AOD). Okay, that’s kind of a mouthful, but just focus in on the dynamic and dividend parts and you’ll get the idea.

Now you typically invest in this type of fund if you want dividend income from your stock investments. So that covers the dividend part of the fund name. And the dynamic part says they’re doing something special to juice up that dividend income.

AOD does the income thing in a particularly good way. For starters, they pay out their dividends to you monthly, as opposed to quarterly like most dividend stocks. So that feels like a real paycheck for those living off of their dividends, or supplementing their income.

And better yet, they pay a generous 7.5% dividend. Given that the average stock dividend today is around 2%, that’s quite generous. And overall, there just aren’t too many places you can get 7.5% on your money these days. So they stand out in that regard.

Okay, so the AOD fund pays well, but what’s in it? What are you really investing in?

THE FUND HOLDINGS

Well, the fund holds around 87 different stocks which are spread across many business sectors and industries. And some of the top ten stocks in their portfolio are familiar companies like Apple, Microsoft, Alphabet, AbbVie and Bristol-Myers Squib.

And no surprise, since AOD is a dividend fund, the stocks pay dividends. So you can imagine the fund collects these dividends and passes some of them on to you.

But just looking into some of these top stocks, their dividends aren’t even close to 7.5%. For example Microsoft’s (MSFT) dividend is just .86%. That’s nowhere close to 7.5%. And AbbVie (ABBV), which sports a very respectable 3.79% dividend, isn’t close to 7.5% either.

Hmmmm… so what’s going on here? How do they do that?

HERE’S WHERE THAT “DYNAMIC DIVIDEND” THING COMES IN

Well, this is where the special expertise and trading skill kicks in.

Because AOD is using a technique called dividend harvesting (or dividend capture). This helps them generate even more dividends than normal from the stocks in their portfolio.

So how do they do that? Hint: Some of you dividend stock investors may have thought of this in the past.

Well, to understand this technique, we need to look at what happens when a stock you own pays you a dividend.

The first thing that happens is that an announcement is made with some key information and dates. For example let’s say on December 3 that Company A announces a quarterly dividend. Here’s some key information they will give…

· The Amount of the Dividend - we’ll say $.31 per share in this example.

· The Announcement Date - December 3 in this example.

· The Ex-Dividend Date - February 17 – be sure and own the stock the day before.

· The Payable Date - March 12 – check is mailed to you – oh happy day!

Now, the most important date for you to pay attention to is the ex-dividend date. Because this is the date that determines if you get paid this specific quarterly dividend they are announcing. Anyone owning the stock the day before the ex-dividend date (February 16 in our example) will get paid that dividend.

But if you waited until February 17, the ex-dividend date, to buy the stock, you waited too late. You are not eligible to receive this dividend.

HOW THAT DIVIDEND HARVESTING / CAPTURE THING WORKS

Now, thinking about these key dates and zeroing in on the ex-dividend date, you may have thought, hey, I see where I can make a lot of money here. I can just buy stocks right before the ex-dividend date, collect the dividend, then sell the stocks the next day, and go buy some different stocks just before their ex-dividend dates. And I’ll be collecting all of their dividends too. Over and over again. Rinse and repeat.

And in fact, you can do this. There is nothing to stop you. And in theory, this sounds like a great idea. As we mentioned above there’s actually a name for this practice called “dividend capture” or “harvesting dividends.”

But in practice, actually doing dividend capture is a controversial topic. It’s not controversial because it’s wrong to do, or anything like that. But just that there’s no consensus that this actually works for most people.

Here’s why. It’s because the main drawback to this idea is that the value of a stock typically drops on the ex-dividend date – the day you would sell it. And it drops by about the amount of the dividend that will be paid. So when you sell the stock, you will sell it at a loss of about the same amount you gained capturing the dividend. So you net out to zero.

This is because the current stock buyers you are selling to realize they will not get the most recently announced dividend. So they are not willing to pay as much for the stock.

Three months later they will likely buy it from you at a higher price, because they know they will get the next quarterly dividend. But you want to own it then too, so you can get the next quarterly dividend. So this defeats the purpose of the dividend capture strategy altogether.

Additionally, by churning through all of these transactions to capture more dividends, you are going to be paying more commissions on them. That could eat into any slim dividend profit you can theoretically make. And there are tax implications as well, based on how long you have held a stock. So those may cost you even more.

So, great idea, but probably a bit too challenging for most of us to execute.

However… there are some skilled professionals and specialized organizations that really can make this work. They can because the stock market isn’t perfect, and so some stock values don’t always drop by the full value of the dividend on the ex-dividend date.

And these folks know how to identify those situations and other anomalies. So where most people would just buy one stock and get four quarterly dividends, they may be able to work multiple stocks and get five dividends per year. All by using the same amount of funds but jumping around from stock to stock, working those dividend dates.

Just think about that – getting five dividends instead of four. That’s kind of like if you figured out a technique where every fourth paycheck you could get your boss to give you a fifth one for free.

Anyhow, that pleasant thought aside, AOD is one of these skilled organizations. And their expertise also extends to keeping their transaction costs and tax implications low while they work those dividend dates to generate extra dividends.

And we can benefit from their skill just by buying their fund. And let them do all of the tricky work, which makes more dividend money. And also allows them to pay us a generous 7.5% annual dividend.

AOD DIVIDEND BASICS

Okay – so enough of the behind the scenes magic, how about the basics?

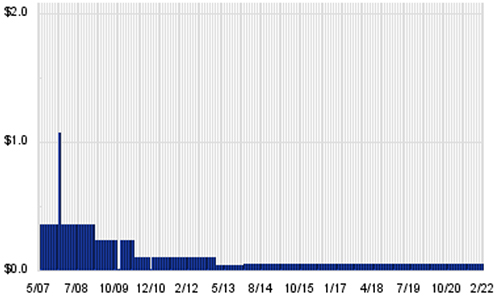

Well, as you can see in the dividend history chart below, the AOD fund has been around and paying dividends for 15 years. And the dividend has been quite steady at .058 per share per month for the past 7 years. Of course, that’s no guarantee of the future dividends, but it’s an encouraging indication.

AOD Dividend History – Chart courtesy of DividendChannel.com

One thing that stands out is I normally try to invest in dividend stocks that increase their dividend year over year. But as you can see, the dividend here has been pretty flat for the past seven years or so.

But regardless, the 7.5% is an attractive yield. And for me this is a pure income play. So that works, especially if the dividend seems fairly secure. And steady dividends for 7 years seems to indicate that.

THE STOCK PRICE

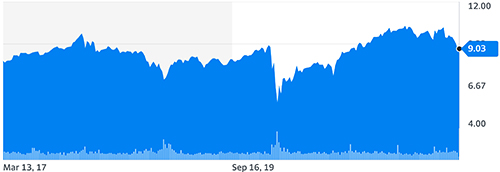

So all that said, we only want to buy stocks when they are selling at a good price. We don’t want to overpay. And one way to evaluate this is to look at the 52 week price range, which is $8.93 – $10.50.

AOD Price Chart – Courtesy of Yahoo.com Finance

At writing, AOD is at $9.03 per share, so it looks to be trading at a low price. It’s actually right at its 52 week low, so for buyers, that makes for a reasonable price.

It seems the fund has had a pullback over the past weeks. Why so low? Well, it could be because the stock portfolio contains about 50% international stocks. And there has been some turmoil on the international scene. So that could have pulled it down.

TRADES AT A DISCOUNT – SPEND $9 TO GET $10

And here’s another view of the stock price. And that is that the fund is trading at a 9.7% discount.

How do we know that? Well, AOD is a special kind of fund called a closed end fund. Which means it was created with a certain, fixed number of shares. And today, the price of a share is $9.03. But when you add up the value of all the different stocks shares the fund owns (called the NAV – Net Asset Value), per share it comes out to $10.00.

So the fund is underpriced by almost ten percent. So buying a share is like someone selling you a ten dollar bill for nine dollars. I’ll take all of those trades I can get, won’t you?

WHAT ARE THE DOWNSIDES / RISKS?

Now, there isn’t much in life that’s guaranteed. And all stocks and investments carry a risk. The most obvious risk with AOD is a market downturn, possibly fueled by even more international turmoil and / or a significant number of the fund’s stock holdings going down.

But aside from the current international aspect, that’s a pretty normal market risk that we all have if we’re invested in stocks and stock funds.

And we can control our risk by never investing more than 4% in any single stock in our portfolio. And having a stop loss – which means selling it if it drops by 25%. So using those guidelines, the most we would lose overall is 1% of our investment portfolio, and live to invest another day.

Just one final point on risk, and that is that 32% of the stock is held by institutions. So they seem to think the risk is acceptable.

So all that said, barring some downturn, it would seem AOD can keep collecting the dividends on their portfolio of stocks, and keep harvesting those extra dividends with their special skills. And sharing the rewards of that expertise with those of us who own the fund.

CONCLUSION

So you might want to check out the Aberdeen Total Dynamic Dividend Fund (NYSE: AOD). $9.03 a share is an affordable price for most investors. And overall, a share price of $9 to $10 would seem to be a reasonable buy price. And a consistently paid 7.5% dividend is a nice investment return. Which is why I own a normal sized position in the fund.

But it’s up to you to decide if it fits your unique investment needs and risk tolerance. The decision is yours. But if you do buy, just stick to the 4% or less risk guidelines above, don’t put all of your eggs in that basket, and be sure and have a stop loss in case the market turns against you.

And finally, isn’t the dividend harvesting technique that these experts use to enhance dividend income kind of interesting? And isn’t it great that we can tap into their expertise by just buying their fund!

To your health and prosperity – John

P.S. To learn more about getting paid with dividend stocks, and stock-like investments, you may be interested in my latest book Your Future Paychecks And Raises: Get Dividend Checks In Your Mailbox paid to the order of YOU! You can check it out for free right here at http://a.co/6FwKPdc.

P.P.S. Feel free to share this post with your friends.