Free Bank Toasters Won’t Build Wealth – But This Might

When I was in my early twenties I began wondering how people made money. No, not “made money” as in at a job. I had a job as a computer programmer back then. So I knew how to earn a wage.

But I was trying to figure out how people accumulated real wealth.

I knew virtually nothing about investments back then, so the only thing I could think of was savings accounts earning interest. After all, I had seen plenty of bank advertisements on TV about how customer’s who opened a savings account were paid interest; their savings accounts grew; and they would get a free toaster.

Okay, so the free toaster idea probably wasn’t that relevant to wealth creation. But with that scanty idea of earning interest planted in my brain, I started calculating how long it would take to double a savings account balance by compounding the interest.

I have a distinct memory of that evening exercise to this very day. I can still picture myself sitting on the deep red colored sofa, with paper and pencil in hand, in front of the coffee table in the living room of my Swiss Chalet apartment in South St. Louis, Missouri.

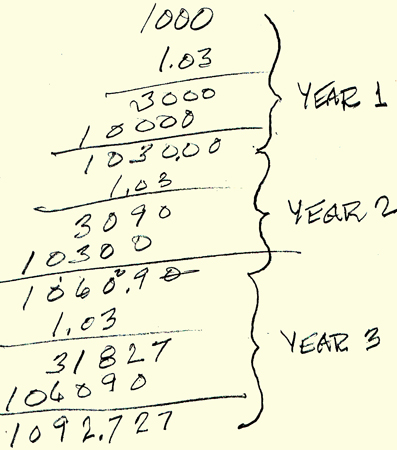

So there I was, laboriously calculating how long it would take $1000 to grow into $2000 if the bank paid me 3% interest. Mind you I’m not kidding when I say laboriously calculating. This was before the time of hand held calculators, and PC’s with spreadsheets hadn’t been invented yet.

Also I was ignorant of a simple rule I will tell you about in a minute. Many of you already know this rule, which has to do with the important number 72, so you can have a good laugh on me, starting about now.

So anyhow, I was literally scrawling manual multiplications, year after year, all over my paper, just like you see in the image above. I filled up a number of pages with my calculations to get to my final answer.

Which I was quite disappointed in.

Because, according to my calculations, it would take twenty-four years for my $1000 to double to $2000. As a twenty year old, that seemed like forever. So, feeling rather discouraged, I sat my calculations aside.

Now it so happens that during this time, I was also going to night school, working on my business degree. And not so long after the “night of the endless calculations,” I took a course that introduced me to the rule of 72. Those of you who know about this rule can stop your laughing now (chuckle).

The rule of 72 is very simple. It says if you want to know how long it takes to double your money at a certain interest rate; you just divide the number 72 by the interest rate. That result will tell you how many years it takes to double your money.

Sounds a lot like the problem I had been working on, doesn’t it?

In other words, I could have just taken my bank savings interest rate of 3%, divided it into 72, and known immediately that it would take 24 years to double (72 / 3 =24). Hmmm … I could have saved the time of doing all of those manual calculations, couldn’t I?

A little knowledge is a powerful thing.

So armed with this powerful tool, let’s try a current example. Let’s say banks are paying about 1% on savings these days. That means it will take you 72 years to double your money (72 / 1 = 72). That was easy enough, right? But we can safely say it’s not the road to wealth, at least for me and you. It’s more like the road to wealth for the bank, who loans the money out at a higher interest rate.

Now the rule of 72 isn’t just for interest payments on savings accounts. You can use it for dividends paid on stocks as well.

So how about a stock that pays a 3% dividend? Well, now we’re back to the 24 year thing, aren’t we? That still doesn’t feel like the road to wealth, although in fact, over time it might be, depending on the stock. Particularly if the dividend is increased 10% per year, every year, and the stock goes up in value too. But we’ll talk about that another time. For now let’s just stick with dividends and compounding.

So let’s move on to a more obvious case. What if there was a stock that was paying a 15% dividend today, as we speak? That would double your money in less than 5 years (72 / 15 = 4.8).

Now that is interesting. And that can make you wealthy over time. Because your money doubles in 4.8 years. And then it doubles again in 4.8 years, and again and again, for as long as you own the stock.

And here’s where it gets even more interesting. That’s because I know of two stocks that are paying that kind of dividend today, as we speak. It might not surprise you that I am invested in them.

And here’s the irony of the whole thing.

They are a certain type of bank stocks.

Wow. It’s almost like one of those circle of life things, isn’t it? That I started out years ago trying to figure how to create wealth and was so disappointed in banks and their interest payments.

But along the way I learned a few things, and I wound up right back where I started – with banks as a means to answer my original question of how to create wealth.

I’m finishing up a special report about this entitled Two Banks That Pay More Than A 15% Dividend. I’ll be posting this for you shortly. So stay tuned. You might want to get a copy of it and save yourself all the trouble and disappointment I went through.

Because ignorance about investing can cost you a lot of time and money.

But a little bit of knowledge can be a powerful thing.

To your health and prosperity – John