Dividends Can Add Much To Your Total Return

S&P 500 Historical Dividend versus Non-Dividend Returns

S&P 500 Historical Dividend versus Non-Dividend Returns

I mentioned in an earlier post how a dividend paying stock investment I made gained over half of its value from the dividends alone. The remainder was from the increase in the stock price.

Okay, but that was just one stock investment. Maybe I just got lucky, right? That’s a fair question.

Here’s the answer. It works out that dividends quite often contribute close to half of the total investment return of a stock over time when those dividends are reinvested.

And this is no recent phenomena. It has been true for a long time.

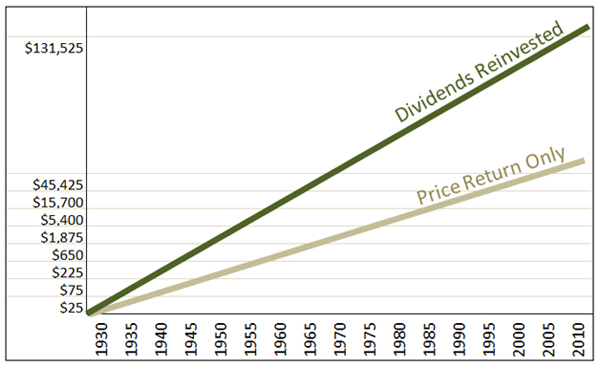

The chart above shows the return from the stocks in the S&P 500 from 1930 to 2010. It shows two lines. One is with no dividends. The other is with dividends that were reinvested.

The differences are striking. Stocks paying dividends that were reinvested averaged a 9.4% return on investment. Stocks not paying dividends only returned 5.2%.

So even historically over the past 80 years, dividends can account for close to half of your investment return. And in another study, 40% of the S&P 500’s total return came from reinvested dividends between 1935 and 2007.

Things get even more dramatic when you look at what that difference would have made to your investment dollars over time. Investing $100 in 1930, with no dividends, and returning our aforementioned 5.2%, would have grown to over $5800 by 2010.

Not bad.

But investing the same $100 with dividends reinvested would have returned over $142,000.

Wow! Some difference, yes.

But here’s the thing. It gets even better.

Because dividend paying stocks often hold up better in a down market than their non-dividend cousins. That’s because the dividends act as sort of a cushion to the price of the stock.

Of course, dividend stocks can go down in price too, but owners of them may be inclined to think, “Hey, the stock is down a bit but I’m still getting paid my dividend.” And so they may be less inclined to sell in a down market.

Similarly, others holding non-dividend paying stocks may also be more inclined to switch over and buy dividend paying stocks in a down market as well.

So do you see what’s going on here? Having less people inclined to sell and more people inclined to buy dividend paying stocks in a down market keeps the demand up to some extent. This tends to support the price of dividend paying stocks in this situation.

This is why buying dividend stocks are often considered a defensive investment play.

But dividend stocks are not necessarily just defensive. They can work well in rising and falling markets. Take this fact, for instance. When everyone was so interested in all the high flyer stocks during the bull market from 1982 to 2000, dividend paying stocks actually outperformed non-dividend stocks by a considerable margin.

These facts make it clear that dividend paying stocks can make a significant improvement in your investment success, and maybe help you sleep a bit better at night.

So the next time you’re thinking about buying some high flyer stock with no dividend, take a self-imposed time out and think back to this post and the chart.

And during your time out, you might idly consider the difference between $5800 and $142,000 while you’re at it.