An Options Murder Mystery – Theta The Greek Did It

No single thing abides, but all things flow.

Epictetus – Greek sage and Stoic philosopher AD 55 – AD 135.

Here’s a mystery for you.

Sometimes you buy an option, let’s say it’s a call option, and the underlying stock is going up, just like you want it too, but your option isn’t.

It’s supposed to be making you money, but it’s losing value instead. It’s like someone is trying to murder your option. Okay, that’s a stretch maybe, but it sure feels like someone is stabbing it in the back.

That someone could be a Greek named Theta. As they say, beware of Greeks bearing gifts.

Here’s that culprit named Theta …

Hey, don’t black out on me here!

I just threw that formula in for fun. We won’t be using it. But that’s the formula for time decay of a call option, called the Greek symbol Theta. It’s what we’ll be discussing in this post – although in much simpler terms.

The reference material where I got that formula from called it one of the “vanilla” Greeks of options trading. I gather by vanilla they meant easy. These guys are not without a sense of humor.

That said, believe it or not, at the end of this post I’m going to explain that formula to you in one simple sentence you will immediately understand. Just go with me on this.

But here’s the thing. You need to understand the concept. Because, strange as it may seem, sometimes you can buy options where the underlying stock goes your way but your option loses value.

How can this happen?

That’s the mystery we are going to solve. As I said, it has something to do with Theta, and is related to the strike price of the option you chose when you put the trade on – and it’s time decay.

So what do I mean by time decay and options – and what does this formula mean? Simply put, all other things being equal, the value of you option goes down with the passing of time.

Your options start rotting from the first day you buy them.

Okay, so that wasn’t so delicately put, but I wanted to leave a strong image in your mind. Or more delicately, as I mentioned earlier in the book, when you buy an option, it’s like buying an ice cube sitting out in the hot sum. It’s melting, minute by minute. Or as Epictetus said 2000 years ago, “no single thing abides, but all things flow.”

And different options you can choose from melt faster than others. Which leads to one of the biggest mistakes beginning options traders make – which is …

• They don’t know about this (Theta) and

• They buy options with too fast of a decay rate because

• They are cheaper – MUCH cheaper.

So this may be the mistake you made – the one where I said the stock was moving up but your option was losing money.

I was perhaps a bit dramatic about the murder mystery we are trying to solve, but here’s another thing about options … hmmm … which truly is dramatic. Not only do they lose value over time, but the closer they are to expiration, the faster they lose value – as in MUCH FASTER.

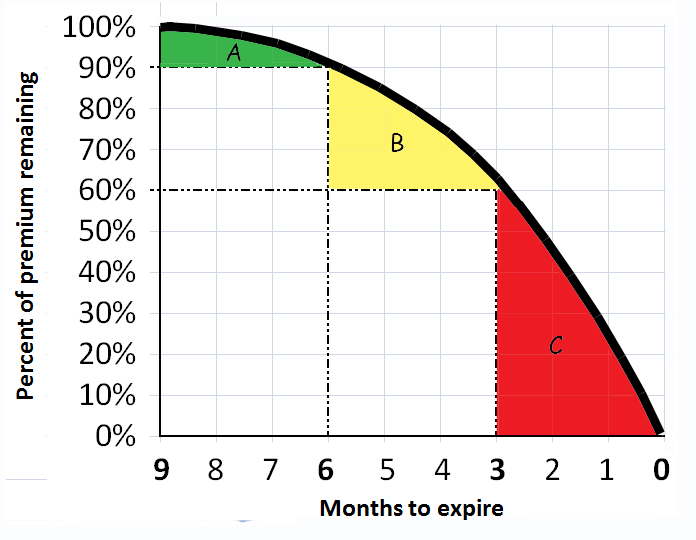

Look at the following chart. It’s a simple graph of how fast an option loses value over time. Note that the graph goes for nine months. That’s because most options are for nine months of time when they are first created.

You can see that in the first three months, if the underlying stock stayed at the same price, the option would only lose 10% (from 100% down to 90%) of its value.

Things start picking up a bit in the next three months. Look at the yellow area labeled B. The curve gets steeper, and the option loses much more value.

It drops another 30% in that three month time period – from 90% down to 60%. Still, that’s over half of its life, but in total it still hasn’t lost half of its value — yet – just 40%.

But by the time we get to the last three months, the red area labeled C, the curve starts heading down in a fast, vertical and dramatic fashion.

The option’s value is virtually melting before your eyes. It will lose fully 60% of its value in its last three months of life, until it expires worthless.

So there’s a big clue for us on our mystery option, yes? I wonder if you didn’t buy an option that probably only had a month or so of time remaining. And maybe you did this for the same reason most beginners do – it was cheap, really, really cheap.

But it was cheap because as time goes by, the probability of the underlying stock making a big move up gets less and less. So people are less and less interested in buying it from you.

So the price goes down. Toward the end, rather dramatically.

As a general rule, try to buy an option with a reasonable amount of time remaining. This will greatly increase your odds of success. I’ll be more specific about how long of a time later.

And here’s the good news. I’ll show you how to know, in advance, how quickly the ice cube will melt – that is to say, how quickly your stock option can lose value. Before you buy it.

And it’s in simple terms.

As simple as dollars and cents, not that wing-ding “vanilla simple” Theta formula I showed you (can you believe these guys?).

To your health and prosperity (and simplicity) – John