A Profitable Investing Secret So Simple …

Here’s a profitable investing secret that I use that is so simple you are going to wonder why I bothered to write it.

Here’s a profitable investing secret that I use that is so simple you are going to wonder why I bothered to write it.

But before you pass judgment, let me tell you one other thing. It’s simple, but for some of you, and sometimes myself, it is not always easy. It should be, but often it is not.

And I’m going to tell you the easiest way to do it. So here it is.

A large part of your success as an investor comes from buying stocks at a low price. You really make or break the deal at the very beginning of most investments. Because even when you buy a good stock, if you buy it at a high price, you will often lose money.

So I set myself up to buy stocks at a discount. I do two things to make this happen.

First, I always use buy recommendations from quality financial newsletters. The key word here is “quality” newsletters. They have done all the research and fact finding for me. So a good newsletter will then end the investment article with a specific recommendation, like “Buy Sprint up to $5 per share.”

Now you will often be tempted to pay even more to get into that stock. After all, you have just read a compelling case on why this is such a great investment. You are all fired up and don’t want to miss out, right?”

But don’t do it.

The analyst has already calculated the highest price you should buy at in order NOT to pay too much. So never pay more than the buy up price, no matter how much your mouth is watering at the investment prospects of the stock being recommended.

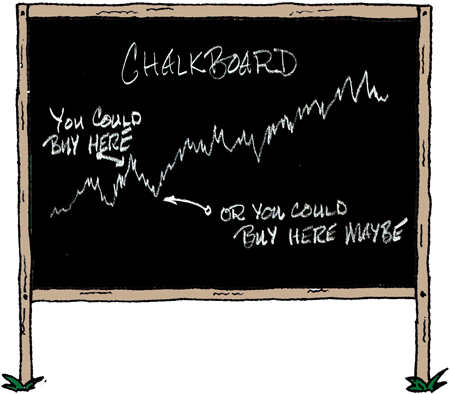

Now, here’s my better idea. There is nothing wrong with trying to buy it for less – maybe much less. This increases your odds of a profitable trade even more. So often, I will put in an order for a stock at 10%, 20% or even 40% less than the recommended buy price. You would be surprised how often, over time, your order will eventually get filled. Because the markets fluctuate up and down on a daily basis.

So if you have put an order in (these are called good til canceled orders) that is in effect, lets say, for the next 30 days, then just through normal market ups and downs it may briefly come down to your discount price. And there sits your order, just ready to pounce on that fabulous discount and buy at the cheaper price.

I first thought about this concept years ago when I was trading commodity options. Back then, I noticed many of my option purchases had a nasty habit of dropping 40% right after I bought them. So I decided to be more patient and wait for that to happen – then buy.

Try this on your next stock purchase. Put in an order for 10% less than the recommended price, or 10 % less than the market price. And wait and see. Yes, you will miss making some investments, because they won’t come down to that price.

But that’s the beauty of using financial newsletters to guide your next investment. Since you know there will always be new recommendations coming, you avoid the feeling you must buy this stock, that it’s the last good investment in town.

And that keeps you from investing with a desperate mentality.

And that’s always a good thing.

Have a nice day – John

P.S. I told you this was simple. But lets see if you can really bring yourself to do it. Because you may find that that part isn’t so easy.