Stock Options, A Customer Sensitive Phone Company, And A Happy Story

Many people don’t understand stock options and so they never use them. That’s understandable, because just about every explanation I’ve read is pretty complicated.

But I don’t think it has to be that way, so let’s give it a go, you and I. If nothing else, I promise that you will fantasize about the phone company I describe … perhaps even dream of it tonight.

Stock options can often be profitable when used correctly. Indeed, one common way to use them can often boost your stock returns by 10% to 20%. We won’t get into that just yet, but that should get your attention.

And you won’t be an expert when we’re done, or even know how to trade them. But you’ll have an idea why people would want to. And that’s a good start. We’ll build on that in future posts.

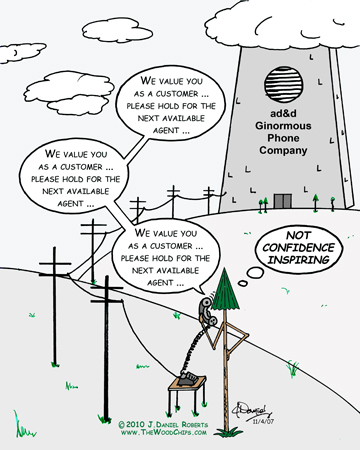

So what if you knew of a wonderful phone company, let’s call it SprintFast, that was better than all the phone companies out there – ummm … not that stodgy old ad&d company pictured above (not their real name). Their cells phones never dropped calls and their modem cards always connected you to the internet at smokin ‘high speed with five bright, glowing bars showing,

The sound quality of your phone calls was so clear that sometimes you actually got confused and thought the person you were talking to was in the same room with you. Whenever you had a question about your phone, or a little problem, which was very rare because it was simple to use and the software always worked, you dialed their help number and a real human, with a real voice, answered the call immediately.

And they knew the SprintFast system inside out and gave you a clear, friendly, helpful answer to your question, or fixed your problem on the spot without transferring you to five other people. Meaning, and this is quite important, that you never had to listen to scratchy, loud, phone company elevator music.

Also, their rates were reasonable, and the company absorbed all the tariffs, fees, surcharges, government taxes, local taxes, and silly extraneous line charges into their rate. So your billing statement was simple and understandable. It was just one sentence and read …

Dear valued customer Carla (or Dan – whatever), Please send us $45.00 for your phone usage this month. Thanks, and have a nice day. SprintFast (the communications company that really acts like it cares).

You may be wondering what planet I live on about now, and that is understandable, but just go with me on this.

Back to the options. So you find yourself in the following situation.

You just checked, and SprintFast stock (symbol SF:-)) is $20 a share. And you have the option, the right, to buy 100 shares of SprintFast for $5 a share any time this month.

You are in a good place. Because you can go out and buy 100 shares of SprintFast stock for $500 ($5 X 100 shares) and immediately sell it for $2000 ($20 X 100 shares). Which means you just made $1500 in less than a month.

But it gets better.

Why bother even buying the shares and then selling them. Because other people have seen how valuable SprintFast shares have become and they want to buy your option from you because they think it will go even higher.

They are willing to pay you $1500 for your option, just you option, your contractual right, to buy SprintFast at $5 a share.

So you take the easy way out, and sell them your $5 option for $1500.

You just made $1500 on SprintFast stock, AND YOU NEVER EVEN OWNED IT!

I find that interesting, don’t you?

So how did you get in this happy situation.

Well, one evening, let’s say you and I were having drinks after work and you started telling me how wonderful the SprintFast Phone Company was, and all your friends were starting to switch their phone service to it also, and you were sure the company’s stock was just going to explode and go up to $20 a share.

And me, being rather cynical about phone companies, and just happening to own 100 shares of SprintFast at the time, when it was $5 a share, said, “Yeah, right – ain’t gonna happen.”

But you kept going on and on about SprintFast until finally I said, probably just to shut you up, “Okay, if you’re so sure about that, put your money where your mouth is. I’ll make a bet with you. You give me $100 right now, and if Sprint goes up to $20 a share in the next month, I’ll sell you all of my 100 shares for $5.”

You gave me the $100 on the spot. And I promised to sell you my 100 shares at $5 if Sprint went up to $20 in the next month – my side of the bet.

Guess what? You just bought an option.

An option is the right to buy a stock for a certain price within a certain time. It’s a right, but not an obligation. If the stock had gone down to $3 a share, you would not have had to buy it from me for $5. That was not the bet. You just would have lost your $100.

As it turns out, you were right, and I was wrong, and you made me sell you my 100 shares for $5 a share when the stock was worth $20 a share. You collected on your bet.

Ummm … I didn’t tell the whole truth earlier when I said you made $1500. Actually, you only made $1400, because you had to pay me $100 for the option. Said another way, you had to pay me $100 to place the bet.

So do options seem interesting? Do you understand why people want to buy them? And are you going to have a fantasy dream about the customer friendly SprintFast Phone Company tonight?

To your health and prosperity – John.

P.S. Hundreds of thousands, if not more, of stock options are bought and sold every day. As I wrote this article, 5000 bets were placed (meaning options were bought) that the Bank of New York stock would go up to $25 a share by June,

You can also bet a stock will go down. 14,000 bets were placed today (meaning options were bought) that Yahoo would go down to $14 a share by April.

None of these people had drinks after work and made bets with each other. But they did make the bets on the options market. Which is the same kind of deal we made, really. And some of them probably had drinks after the market closed, because their bets weren’t going so good.

So don’t race out and buy options. Because sometimes the story ends badly. But it’s interesting, isn’t it. We’ll talk about options going bad next time. Then we’ll talk about the right way to use them, that puts you in the winner’s circle 80% of the time. If that interests you.