An Easy Way To Invest In Silver

100 Oz Silver Bars – About 7 Pounds Each

Silver is one of the least appreciated precious metals investments in today’s markets. And that can be a buying opportunity. So I want to share with you a great way to invest in it… it’s convenient, automatic and online. And I’ll share with you my favorite online company that I use. Come to think of it, it’s the only online company that I currently use.

So more on that in a minute, but first a little context.

In our last issue we talked about a powerful investing technique called asset allocation, and how it’s the single most important factor to your investing success. Ignorance of this technique has probably ruined more investors than any other factor. See http://livelearnandprosper.com/use-this-oldest-investment-trick-in-the-book-2.

The good news is that asset allocation is just common sense, really. It’s how you invest without putting all of your eggs in one basket. And you do this by allocating your investments across different assets like stocks, bonds, cash and precious metals.

We’re going to focus on precious metals in this issue because most investors don’t have ANY precious metals in their portfolio. Indeed, in a recent survey of 1,500 Americans between the ages of 18 and 65+, when asked if they owned any silver or gold, 82.4% of respondents indicated that they didn’t own either.

Most investors should have at least 5% to 10% of their portfolio in precious metals. So if you don’t have any precious metals in your portfolio, that’s a gap you might want to start filling.

The best precious metal for most people to start with is silver (instead of gold). That’s because silver probably has a better profit potential in the future. Also, it’s more affordable for beginning investors.

And beginning investors should start with physical silver first. By that I mean real, hold in your hand, silver coins or silver bars. Once you’ve accumulated some real physical silver, you can branch out to other silver investments like silver related stocks, funds and ETF’s if you want. But many experts agree that physical silver is where you should begin.

And a simple way to start buying physical silver is from your local coin dealer. I found my local dealer years ago by doing a Google search on “Coin dealers in Orlando, Florida.“ So you can do the same, searching for “Coin dealers in Your City, State.“ Then you can visit their store, check them out and start buying silver from time to time.

| For many beginners, the best things to buy are US Silver Eagles and Canadian Maple Leafs. Or, you can buy silver bars and rounds, which have less commission. But the key is to buy strictly for the silver content. You are not buying coins that are scarce, or have a collectable value, or are in mint condition or uncirculated. You’re buying strictly for the silver content, also known as “melt value.” As in, theoretically speaking, if you melted the coins down (not recommended), you would have the same value as before. |

However, for those of you that just don’t want to visit a store, you can also buy silver online. Just be careful to check out any dealer before you buy. At a minimum, be sure to read their customer feedback and Better Business Bureau (BBB) rating and comments.

My favorite online dealer is OWNx, a company based in Lawrence, Kansas, just outside of Kansas City. They are a precious metals custodial dealer and the only online dealer I use today. You can check out their site at www.OWNx.com.

OWNx can handle small and large investors. Their minimum purchase is $25 to get started, so they are a good site for beginning investors. But you can make purchases of over $100,000 as well, so that’s quite a wide range they offer.

One of my absolute favorite services that OWNx offers is their automatic purchase program. With this program you can set up an automatic dollar amount of silver that you want to buy on a regular basis (monthly, weekly, etc.). And they will take the funds from your checking account and buy the silver for you automatically at the current price.

Automatic purchasing is one of the very best ways for people to invest. That’s because your money is automatically invested for you before you ever see it. And you don’t forget to invest it because it’s done automatically. So you just keep adding to your account, and over time, you can accumulate a sizeable investment.

And buying the same dollar amount each month makes an investment genius out of you. Because when the silver price is high (unfavorable to you), you are only buying a small amount of silver. But when it’s low (a bargain and favorable to you) you’re buying more silver. By doing this you’re actually using a great buying technique called dollar cost averaging. So this is yet another advantage to the automatic buy service.

Back to OWNx, I find their web site and screens to be fairly easy to use and understand. And they give a clear accounting of your holdings and activity. Below are a number of screens similar to those you will find on their site.

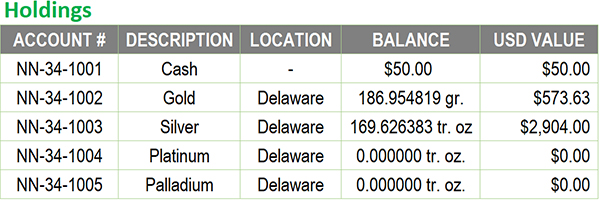

For example, check out the sample customer screen below. We’ll say the customer’s name is Joe, and the screen shows Joe’s accounts and what he has in them, i.e. his holdings.

And it looks like Joe is off to a good start. Looking at the third line in the table, we see he has over 169 troy ounces of silver in his account. So he could already take delivery of one of those big. impressive 100 oz bars we showed at the beginning of the article if he wanted to. And he’s well on his way to owning a second one.

Looking at his holdings information again, we see that his silver is stored in a vault in Delaware. And at the current silver price, his 169+ ounces are worth $2904. Very nice.

We also see in the second line that Joe is diversifying his precious metals with some gold too. That’s not a bad idea now that he has his silver investment started. Or he can just stick with silver.

But regardless, he currently has over 186 grains of gold in his account. That’s over a third of a troy ounce ( 186 grains / 480 grains per ounce = .38 ounces). And that third of an ounce of gold is worth $573.

| Grains are a very old unit of weight in history. Just visualize a grain of wheat and how much (or little) it would weigh and you’ll understand how this ancient unit of measure probably got started. Grains are still used today, although much more precisely defined than a grain of wheat or other cereal. A grain today is defined as 1/480 of a troy ounce, fixed at 0.06479891 grams under the metric system. The ability to buy gold at OWNx in grains is a nice advantage for beginning and small investors. Just about anyone can afford to get started because a grain of gold at today’s gold price is about $3.00 (with gold at $1460 an ounce). In any event, to keep it simple, just think there are 480 grains in a troy ounce. So divide your number of grains by 480 to get troy ounces. |

Grains converter - https://www.calculateme.com/weight/grains/to-troy-ounces/.

Joe’s got a great start with the precious metals part of his asset allocation. So since he’s clearly smarter than the average Joe, how is he doing this?

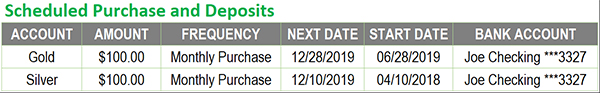

Well, he’s using OWNx’s automatic purchasing service. Here’s his scheduled purchases screen below…

Looking at the second line, it shows that back in April of 2018 he set up an automatic silver purchase in his account. It’s set to take $100 from his checking account and buy silver every month (note that the automatic withdrawal will show in his bank statement as “Electronic Withdrawal Mass Metal LLC”).

And looking at the first line, we see in June of 2019 that he added an automatic monthly gold purchase of $100 to diversify his precious metals holdings. And we can see the results of his automatic purchases in his recent activity screen below…

So month after month, these automatic purchases take place, adding to his total silver and gold accounts.

You can also see in the Amount column that his $100 bought different amounts of silver and gold. On 10/10/2019, based on the price of silver back then, his $100 bought 5.40 ounces. But by 11/12/2019 the price of silver had gone down a bit, so his $100 bought more, at 5.68 ounces.

So without any action or thinking on his part, Joe is a purchasing genius. He’s buying more silver when the price is lower, and less when the price is higher. That’s dollar cost averaging for you, like we mentioned before.

Nice, isn’t it? You just set it up and let it do the smart buying for you.

Another feature of OWNx that I like is that you can take delivery of your precious metals, or you can store them in OWNx’s vault. The choice is yours.

To take delivery you need to have accumulated at least 20 ounces of silver or 1 ounce of gold. Once you’ve hit that threshold, you can have your precious metals delivered to your house if you like. And you have a choice of what you would like delivered.

For silver, you can get one ounce coins (I prefer US Silver Eagles) or silver bars (1, 10 100 or even 1000 ounce – wow). Or you can get silver rounds as well. And for gold you can get one ounce coins or kilo bars.

Or, you can just leave it in OWNx’ s vaults and let them store it for you. Their premium and storage fees are quite reasonable, so that’s what I do. I let them worry about keeping it safe.

So to wrap up, here are the highlights of buying precious metals at OWNx.

- They have a convenient automatic purchase program.

- It makes you a buying genius through dollar cost averaging.

- You can start small and buy in fractional ounces and grains.

- Their web site and screens are pretty straight forward and easy to use.

- Their Better Business Bureau rating (at writing) is A+ with five star reviews.

And finally, I’ve always had a good experience with them and continue to use them today.

So if you’re looking to buy precious metals to fill out your asset allocation, you may want to consider OWNx. Or you can check out your local coin dealer. The choice is yours. In my case, I find it convenient to do both.

But whatever you decide, consider taking advantage of today’s historically low silver prices. Because silver is still one of the least appreciated precious metals investments out there. And while no one can predict future prices, the odds are that the price is going to go up someday and you’ll be glad you did.

To your health and prosperity – John

P.S. Please note that I have no affiliation with OWNx outside of being a satisfied customer.

P.P.S. Note that you can do dollar cost averaging when buying stocks too. And some of the best types of stocks to buy are dividend paying stocks. They actually pay you to invest by putting cash into your account every month or quarter, year after year.

To learn more about these cash generating stocks, you may want to read my book Your Future Paychecks And Raises: Get Dividend Checks In Your Mailbox Paid To The Order of You! You can preview it for free right here.