The Top Exchange Traded Fund (ETF) Providers

When you own an individual stock, your focus is simply on that one company. That is to say, the company you own the stock in. Your interest is in how it is performing, the quality of the management team, financial standing and performance, etc.

But when you are invested in an exchange traded stock fund (ETF), you have many more things going on. For one, you’re dealing with more than one company’s stock. You might have fifty, or a hundred, or even thousands of stocks. And that’s because the fund you’re invested in owns some of all of those stocks. Now you don’t necessarily have to research all of those stocks because the ETF provider has selected them.

But that highlights the fact that now you have a third party involved, which is the ETF provider. This is the company, the provider, that puts together and manages the ETF funds. The provider is the company that you bought your fund shares from.

So you will be interested in the ETF provider company. Of interest will be their size, the expenses they charge you and the historical performance of their funds – particularly their fund(s) you’ve invested in.

Now there are many ETF providers. And like in most industries, there are a few of them that rise to the top. Just like in the automobile world, General Motors, Ford and Chrysler are often referred to as the “Big Three” automakers because they are the largest automobile manufacturers in the United States.

Similarly, in the ETF world, we can think of the “Big Four” ETF providers as BlackRock, Vanguard, State Street and Invesco, because they have the largest assets under management in their ETF’s.

As mentioned, it’s good to know something more about them. Because some providers are known to be very inexpensive to invest with, while others are more traditional and charge larger expenses. So let’s look at some of the ETF providers you could be dealing with.

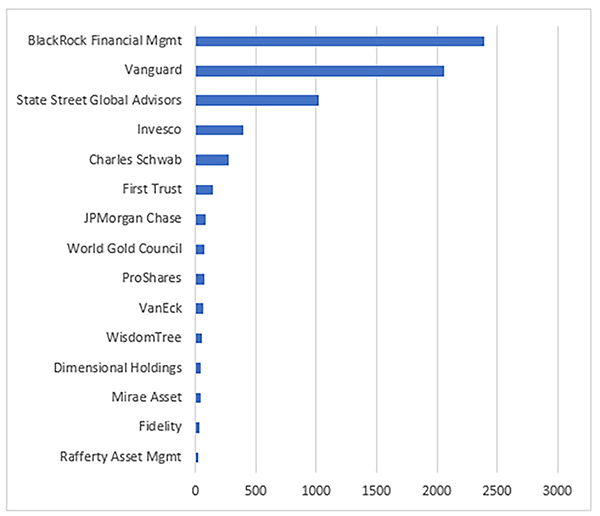

In total, there are over 200 of them, and they have created thousands of ETF’s that you and I can invest in. The chart below shows the top 15.

Largest U.S. Exchange Traded Funds (ETF’s) Providers.

Looking at the chart, it’s clear that of those fifteen, the four major players are BlackRock, Vanguard, State Street and Invesco PowerShares. So those are the main ones, the “Big Four,” that we mentioned. And they each have many ETF’s you can invest in.

So with that said, let’s take a high level look at the big four, starting with the biggest one, which is BlackRock iShares.

BLACKROCK iShares

BlackRock’s iShares is the leader in ETF’s with $1.8 trillion in assets under management. That’s a lot of investment money people have trusted them with.

So it’s not surprising that the parent company, BlackRock Inc., is the world’s largest asset management firm. At writing they offer over 370 different ETFs to choose from. Here are a couple of their largest ones.

IVV – iShares Core S&P 500 ETF. This fund includes stocks of 500 large companies listed on stock exchanges in the United States. It tracks the S&P 500 Index, one of the most commonly followed stock indices.

AGG – iShares Core U.S. Aggregate Bond ETF. This fund includes U.S. Investment Grade Bonds.

BlackRock’s overall average Expense Ratio is a respectable .19%, which is pretty low. That’s $1.90 per $1000 invested, so most of your money is going toward your investment instead of expense.

VANGUARD

Vanguard is also a leader in ETF’s, with $1.3 trillion in assets under management, and second only to Blackrock.

Vanguard is one of my favorite ETF providers because they have extremely low expenses. The average Expense Ratio of all their ETFs is an incredible .06%.

Vanguard does this by being uniquely structured. It’s owned by its shareholders, so there are no outside investors. This allows them to charge those very low expenses.

At writing, Vanguard offers over 80 different ETFs to choose from. Here are two of their largest ETFs.

VOO – Vanguard S&P 500 ETF. The fund includes stocks of 500 large companies listed on stock exchanges in the United States. It tracks the S&P 500 Index, similar to BlackRock’s IVV we discussed earlier.

VTI - Vanguard Total Stock Market ETF. It tracks thousands of U.S. stocks of various sized companies – virtually all of the US stocks.

Note that both funds have an incredibly low expense ratio of .05%, even lower than the Vanguard average. That’s a mere fifty cents for $1000 invested. Contrast that to a traditional Mutual fund with an average expense ratio of 1%, or $10 per thousand invested ($1000 x .01 = $10.0 (1000 x .01 = $10).

So 50 cents expense or ten dollars – which would you prefer?

STATE STREET

State Street SPDR is another leading ETF provider with $771 billion in assets under management.

At writing they offer 139 different ETFs to choose from. Here are two of their largest SPDR funds.

SPY – SPDR S&P 500 ETF (Standard & Poor’s Depositary Receipt). This fund includes stocks of 500 large companies listed on stock exchanges in the United States. It tracks the S&P 500 Index, one of the most commonly followed stock indices.

GLD – Gold Trust ETF. This fund tracks the spot price of gold bullion. So many investors use it as a handy way to invest in gold.

State Streets overall average Expense Ratio is a respectable .17%, which is pretty low. So most of your money is going toward investment instead of expense.

INVESCO

Invesco is the fourth of our Big Four ETF providers with 260 billion in assets under management.

At writing they offer 218 different ETFs to choose from. Here are two of their largest ETFs.

QQQ – INVESCO QQQ ETF. This fund tracks the 100 largest non-financial companies listed on the Nasdaq. So the focus tends to be more on the technology companies instead of the overall market.

RSP – Invesco S&P 500 Equal Weight ETF. This fund includes stocks of 500 large companies listed on stock exchanges in the United States. It tracks the S&P 500 Index. It’s somewhat different in that it gives an equal weighted allocation of the 500 companies, where other S&P 500 funds may weight some heavier than others.

Invesco’s overall average Expense Ratio is .29%, so it’s the most expensive than the top four.

CHARLES SCHWAB

Okay, so I threw in a bonus provider and that is Charles Schwab. They are the fifth largest ETF provider and I really like their low average expense ratio.

They offer 25 ETFs, the fewest of the top providers. Here are two of their largest funds.

SCHX – Schwab U.S. Large-Cap ETF. This fund tracks the 30 large US companies listed in the Dow Jones Industrial Average. The Dow is a well-established group of stocks and you hear it mentioned every day in the stock reports.

SCHF – Schwab International Equity ETF. This fund gives you international exposure. It tracks many stocks of large-size and mid-size stocks companies outside the US operating in various developed markets.

As noted earlier, Schwab’s average Expense Ratio is quite low, coming in at .07%.

MIX AND MATCH

So that gives you a high level summary of the top five ETF providers. And some samples of their funds, which cover the 30 Dow industrial stocks, the S&P 500 stocks, International stocks, bonds and gold.

Note that it’s generally okay to invest in ETF’s from different providers and mix and match. You’ll just want to make sure you don’t have a big overlap in the underlying stocks they’re invested in. But aside from that, I don’t worry about investing in ETF’s from different providers.

CONCLUSION

So ETFs can provide a cost effective way to invest in many stocks (and other securities) all at once, depending on the provider. As you can see, these top providers range from very cost effective to not bad on average.

So if you’re investing in ETFs, it’s good to know something about the provider. Because you can find funds that are low cost to invest in. And that, combined with their other advantages of fast and easy to trade, make them good investments for many people.

And finally, note that the funds mentioned in this article are not investment recommendations and are simply used to illustrate a range of ETFs for educational purposes.

To learn more about ETFs, you may be interested in my new book Exchange Traded Funds For Beginners. You can click here for free preview.