Are Plastic Duck Feet Such A Crazy Investment?

Or have I just turned into another Quack investor?

If I were to suggest that investing in plastic duck feet was an investment with big profit potential, you well might think I had gone a bit daft.

Or perhaps I had watched that old classic movie The Graduate once too often – which, as you’ll recall, showed the confused graduate being told by an older family friend that the future was in “plastic.”

Yet in a sense I am saying just that, or more specifically, that investing in a game-changing technology that can produce plastic duck feet shows great promise.

So today I’m going to tell you a story about a little duck named Buttercup. And his webbed feet. And you can decide just Read the rest of this entry »

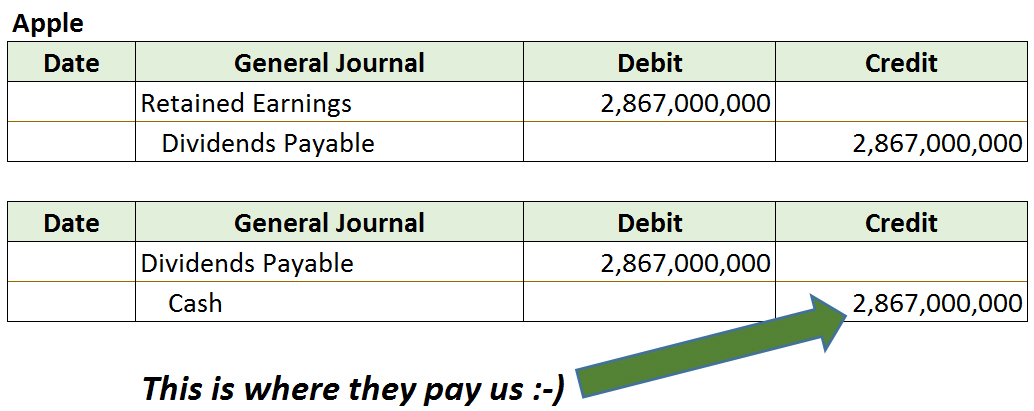

This Apple Computer Accounting Not So Boring

For those of you who think accounting is boring and complicated, well, I suspect you are in large company with that opinion. And I’m not going to try to change your opinion, even though I personally think aspects of accounting are interesting.

But I do want to show you some accounting that is quite interesting. And tell you why.

And I think you’ll agree with me when I’m done. Now that’s some brave talk, don’t you agree.

In any event, just look at the accounting entries in the illustration above. Can you guess what they are about?

If you own Apple Stock, or want to own Apple stock, they are incredibly interesting.

Because these are the accounting entries (known as journal entries) that someone in the accounting department just made recently. And here is what they say – in plain English — not accounting jargon.

“The board of Apple looked at the big pile of billions of dollars they have laying around from all their profits and decided to give about 3 billion (yes, that’s with a B) to the people that have owned Apple stock the past three months.”

Yup – that’s what all of that says.

And Apple has some much cash laying around, and such good prospects of making oodles (not an accounting term) of money in the next three months, that they will probably do the same thing all over again.

Now, who says accounting isn’t interesting. Especially if you own Apple stock and are about to get a nice dividend check in the mail.

By the way, Apple seems to be priced right for buying in my opinion – so I put my toe in the water and bought a few shares.

To you health and prosperity – John Roberts

Get A Clue From Insider Buying

Here’s a stock buying tip for you.

Find out if there is any insider buying going on when you are thinking about buying a stock.

Many forms of insider buying are completely legal and this is another investment clue. You can improve your odds of successful investing by knowing when it’s happening.

Insiders sell and buy shares of their company all of the time.

Now there are many reasons why insiders might sell, i.e. they think the stock might go down, or they have a child’s college tuition coming due or they just need the cash.

But there’s only one reason why insiders buy stock in their company. And that’s because they Read the rest of this entry »

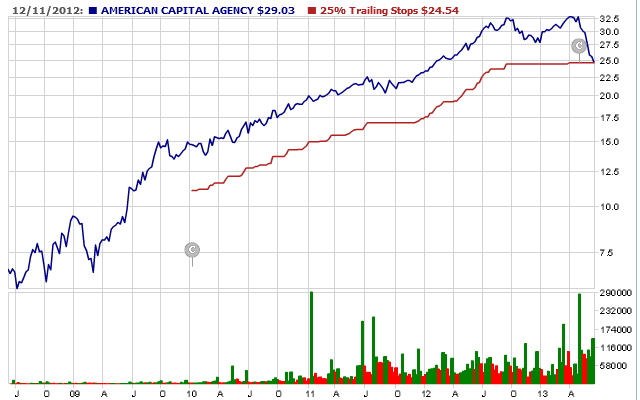

How To Make Money Even When Your Stock Goes Down – Part 2

In my last post I mentioned I would probably sell my AGNC stock because it was dropping rapidly (see blue line in chart above).

But that’s not the only reason I sold. I sold because it had dropped below a limit I had set in the past. In other words, I knew when I bought the stock what price I would sell it at if it fell.

This is key to investment success. Because it keeps you from taking a small loss and turning it into a big loss. And I use a special method that often allows me to make a profit when the stock starts dropping.

So let me ask you a question. Do you Read the rest of this entry »

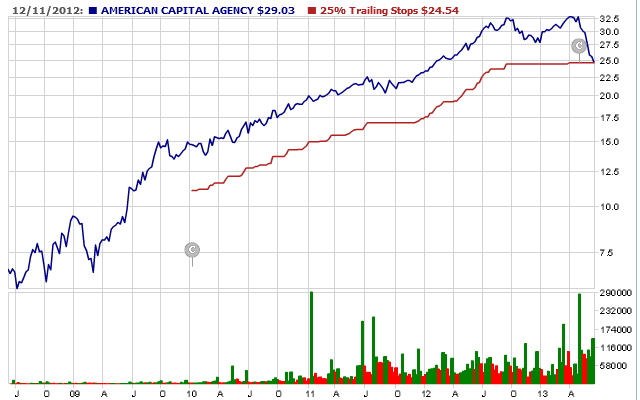

How To Make Money Even When Your Stock Goes Down

Here’s a great example of the value of using trailing stops.

Take a look at this chart. It’s for a stock, American Capital Agency (AGNC) that I’ve been invested in since 2010. It’s been very profitable. But it has now gone below the trailing stop, so I will sell it today if it doesn’t turn around.

But I will be selling at a profit — even though the stock has gone down.

Much more on this later. And I’ll let you know what I did today. Did I sell or hold. Did it recover or not.

To your Health and Prosperity – John Roberts

P.S. To learn more about stock investing, check out my latest book Stock Investing For Beginners. It’s written in a simple, easy to understand, conversational style, and full of more profitable stock investing tips. You can browse through it for free right here http://a.co/0kJOvww.

Stock Market Going Great? Here Are Three Things You MUST Do

When the stock market is going great, and most of your stocks are up, it’s all too easy to get carried away with enthusiasm and get reckless. Which is what most investors do in this situation.

Why would they do this? Why would you do this?

I’ll tell you why. Because it just feels like the good times will never end. And you’re getting reinforcement on that “good times feel good” story from everywhere.

The news channels talk about how great the market is. Their experts start making extraordinary predictions about how much higher it is going. There are effusive headlines the newspapers. And even a few of your friends, who have shown no previous interest in the market are talking about getting in. And every day your portfolio seems to be worth more.

But when you find yourself in this happy situation, there are three things you must do or you are going to find yourself in an unhappy losing situation in the future.

First, try to Read the rest of this entry »

Dividend Stocks Protect You From Bad Management Decisions

There are many advantages to owning dividend paying stocks. One of these you may not have thought of is how they can protect you from bad management decisions.

You see, the CEO’s and top management of corporations are people too, which means they make mistakes and can get caught up in emotion and ego, rather than rational reasoning, just like the rest of us.

Which can lead to bad management decisions.

Which can lead to you losing money in their company stock.

But by knowing they have to pay dividends to you and me as owners, every quarter, they have to keep focused on making a profit by spending the company’s money wisely. This is exactly what you and I, as stock investors and business owners, want them to do.

So what kind of bad decisions can dividend paying stocks protect us from?

I would say we’re protected from a loss of Read the rest of this entry »

Get Paid In Retirement

You’ve probably thought about retiring sometime in the future. And perhaps you’ve been saving and investing toward that goal — that time when you no longer go to work every day.

But if you’re like many people you only have a vague idea about how all of that works. Sure, you’ve seen all the complicated retirement calculators, future cost of living formulas, anticipated expenses questionnaires and other nebulous projections that all of the retirement articles seem to go into.

And these have their place in retirement planning.

But let’s get real basic and concrete about this.

When you retire, just how are you going to pay your bills?

Or put another way, how are you going to get paid?

Here’s an easy way to think about this that I’ll bet you already Read the rest of this entry »

Orlando Coin Exchange – Best Coin Dealer Ever

As a follow-up to our series on investing in silver, may I make a suggestion?

And that is to get to know your local coin dealer. It’s a smart move, and I think you’ll find the experience rewarding and enjoyable.

I visit Orlando Coin Exchange just about every Saturday. And Jason, Jerry and Harry are always ready to help with any questions I might have about silver, gold and coins in general. They’re also a congenial lot, with a great sense of humor.

But don’t let that fool you. They’re serious about the coin business and really know their stuff.

Here’s the thing. If you know your local coin dealer, it’s simple to Read the rest of this entry »

Why Many Bond Holders Are Going To Lose Money

Many people have run for the “perceived” security of owning bonds since the stock market crash in 2008. But bonds aren’t quite as safe as the general perception out there.

Here’s why.

Let’s look at two bonds and you tell me how much you would pay for them. First, there’s Bond-A. Let’s say you paid $1000 for it and it pays $50 a year in interest. Ok – that’s not bad so you are feeling pretty good about yourself for the moment.

Then along comes Bond-B. You can pay$1000 for it and it pays $100 in interest every year.

Which bond do you want to buy – Bond-A or Bond-B?

I’m thinking Bond-B, aren’t you? Because it pays twice as much interest for the same $1000 investment. Everyone will want Bond-B, actually.

Which means no one will want Bond-A. That is to say no one will want to spend $1000 to buy Bond-A.

So is Bond-A worthless? Read the rest of this entry »