How You Buy Stocks At A Discount

When it comes to stock investing, when you buy and how much you pay is critical. Indeed, the success of your trade most often hinges on these critical points. That is to say you win or lose at this early stage in the game.

Successful investors like the legendary Warren Buffett are quite aware of this fact. And they use methods to buy their stocks at a discount.

On the other hand, the average investor seems to pay little attention to this. And so they always seem to overpay and buy at the wrong time. So this is an important difference to learn from.

Buying stocks at a discount lowers your risk and greatly improves your odds for profit. This is why the successful investors pay so much attention to it. So since buying stocks at a discount is so critical to your success, the buying differences between the successful investor and the average investor are important to Read the rest of this entry »

Janitor From Vermont Leaves $8 Million Fortune

A former janitor and gas station attendant in Vermont, who died a few years ago, surprised everyone by leaving an $8 million fortune to his local library and hospital.

What was his secret, everyone wondered? And the answer turned out to be pretty basic. Because, besides being industrious and frugal, which you may have guessed, he had invested in the stock market throughout the years.

This is actually not as surprising as Read the rest of this entry »

Why Invest In Stocks… Because That’s What The Wealthy Do

So why bother investing in stocks? What’s in it for you?

And the answer is that stock investing can increase your wealth and income over time when done properly.

It does this for you in a number of ways.

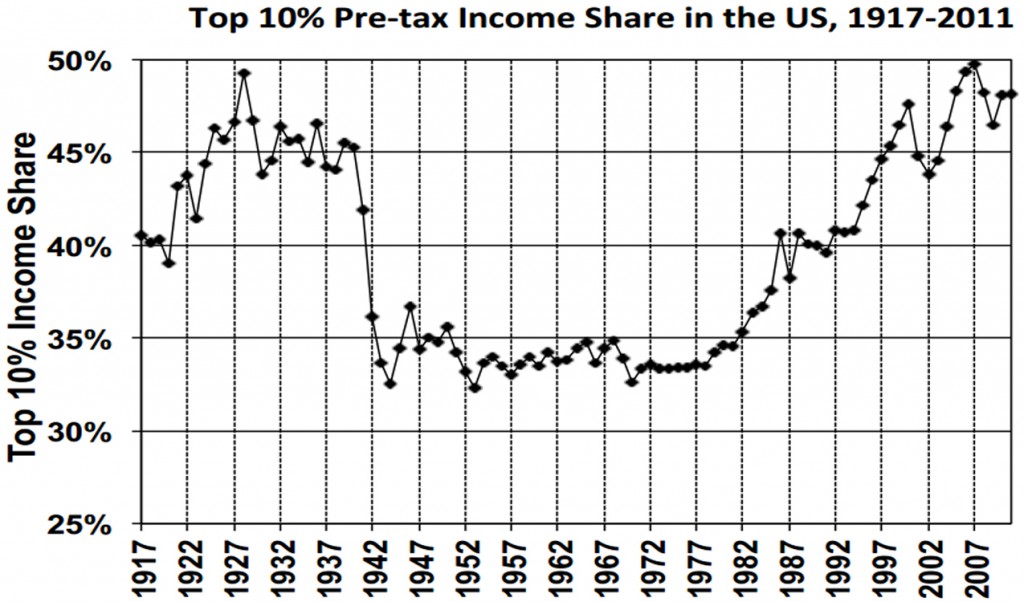

For example, much has been made of the fact that there is a widening wealth and income gap in the US. You hear this in the news all the time. What they are talking about is the widening gap between the people in the top 10 percent of income earnings, and the bottom 90 percent. And all the facts bear this out. There is, indeed, a widening gap.

Source: Piketty and Saez, UC Berkeley

Source: Piketty and Saez, UC Berkeley

The income gap is the highest it’s been since the early 1920′s. And the same can be said for the wealth gap, which has not been so high since 1927. So wouldn’t it be a good idea to do what the top 10 percent are doing — to tap into that wealth and income too?

So what are the wealthy doing to make this happen? Well, most of them are Read the rest of this entry »

Why Companies Pay You Dividends

Some of the best stocks to buy are dividend paying stocks. These stocks will send you a monthly or quarterly check for your portion of their profits in the business. So you get a nice income stream from them. And the stocks can go up in value too. So you get the best of both worlds – investing and speculation.

But why would companies pay you dividends? Let’s look into that question.

Let’s say that you own shares of Hershey stock. And for the next three months Read the rest of this entry »

With Dividend Stocks, Boring Is Beautiful

So you’ve zeroed in on a nice dividend paying stock. And you’ve done your due diligence. The stock pays a nice dividend. Better yet, it has a good history of dividend increases. And you’ve determined they can keep paying the dividend. Your stock has passed all your tests.

That’s great! Now just do this one final gut check before you buy it.

And the gut check is simple. Here it is. Do you understand what the Read the rest of this entry »

Mind Your Ps And Qs In This Market

We’ve all hear the admonition to mind our P’s and Q’s.

It means to stay on your best behavior, or to stay at the top of your game or to pay attention to the details.

So where did this phrase come from?

There are many theories, but I’ll give you one of my favorites. And that is from English Pubs in the Read the rest of this entry »

How To Generate Your Own Microsoft Cash By Selling Puts

Here’s another way to play the Microsoft trade for investors familiar with American style options (which can be exercised at any time before expiration date).

You can sell puts on Microsoft stock to generate income. Selling puts can be a lucrative way to invest, and interesting, too, because you make money by trying to NOT own the stock. And Microsoft is a good candidate to generate this kind of income by selling puts on their stock – over and over again.

At a current price of around $31.89 a share, you can Read the rest of this entry »

Is Microsoft Still A Good Investment?

Is Microsoft still a good investment? Or is it the beginning of the end for the software company?

Are they about to go the way of the Dodo bird? Or Eastman Kodak? Or Wang Labs – one of the biggest office computer makers of the eighties – long since sunk without a trace.

These are great questions to ask because the news about Microsoft of late hasn’t been that great. Consider this…

· Microsoft’s profits at $0.59 were lower than the lowest estimate ANY analyst had for it at $0.61 a share.

· Their share price recently took a whopping 10% dive – all in one day.

· The Surface Tablet version 1 was a failure that cost nearly $1 billion to write off.

· Windows 8 is considered a dud, and market research firm Gartner says that 90% of companies globally have no plans to deploy it in a big way.

· Even university adoption rates of Windows 8 have been Read the rest of this entry »

Get Real Silver Money Or Wooden Nickels

I’m going to buy some real money today.

It’s something I do most weekends. I visit my local coin dealer and buy a few 1 ounce pure silver rounds. And it’s something I kind of enjoy doing, too… it always gives me a feeling of satisfaction when I’m done.

Because I know I’ve made a good long term investment. And I’ve beaten Helicopter Ben at his game. You know, Ben Bernanke, the head of the Federal Reserve who’s known to have said he could drop money out of helicopters to stimulate the economy.

And then there’s social aspect of the transaction. I always kid the coin shop owner as I pay him for the real, hold in your hand silver – as I hand him paper dollars. I tell him I feel bad about trading him worthless pieces of paper for silver. And he good-naturedly listens to this every time. It’s a standing joke we have.

But I don’t feel that bad – certainly not bad enough to stop. It’s the federal government who should feel bad about foisting their worthless pieces of paper on us in the guise of money and something of value.

After all, this type of activity is normally called counterfeiting. Except when the government does it, of course.

Now you may think I am being overly harsh in my criticism, but read on because I’m going to support this with a story about how machines used to be smarter than counterfeiters, an interesting man named Merrill Jenkins, detecting and preventing counterfeiting, how he was duped by a federal agent, and the Read the rest of this entry »

How 3D Organic Printing Started From A Simple Sheppard’s Harp

3D printing promises to revolutionize our lives. And 3D printing of living cells even more so. But such an advanced technology had a rather humble beginning by today’s modern standard.

You see, many advances in human history come from taking an existing invention and then changing it in some way to make a new thing.

My favorite example of this is the evolution of the harp into something much more sophisticated. Just imagine a harp, something a simple sheppard may have played to his flock of sheep thousands of years ago – maybe to keep them calm, or perhaps to entertain himself in that lonely job.

Now, a few thousand years later, someone in Europe took a harp like that and turned it on its side, put it in a wooden box, and Read the rest of this entry »