An Options Murder Mystery – Theta The Greek Did It

No single thing abides, but all things flow.

Epictetus – Greek sage and Stoic philosopher AD 55 – AD 135.

Here’s a mystery for you.

Sometimes you buy an option, let’s say it’s a call option, and the underlying stock is going up, just like you want it too, but your option isn’t.

It’s supposed to be making you money, but it’s losing value instead. It’s like someone is trying to murder your option. Okay, that’s a stretch maybe, but it sure feels like someone is stabbing it in the back.

That someone could be a Greek named Theta. As they say, beware of Greeks bearing gifts.

Here’s that culprit named Theta …

Hey, don’t black out on me here!

I just threw that formula in for fun. We won’t be using it. But that’s the formula for time decay of a call option, called the Greek symbol Theta. It’s what we’ll be discussing in this post – although in much simpler terms.

The reference material where I got that formula from called it one of the “vanilla” Greeks of options trading. I gather by vanilla they meant easy. These guys are not without a sense of humor.

That said, believe it or not, at the end of this post I’m going to explain that formula to you in one simple sentence you will immediately understand. Just go with me on this.

But here’s the thing. Read the rest of this entry »

Option Sizing, Dean The Grinch And A Funny Story On Him

“I have heard there are troubles of more than one kind. Some come from ahead and some come from behind. But I’ve bought a big bat. I’m all ready you see. Now my troubles are going to have troubles with me!” — Dr. Seuss

When I was a licensed broker and financial consultant in Coral Gables, Florida, my office was right next to another broker’s named Dean.

Dean was about 6’ 6” and wore kind of a friendly scowl on his face, which matched his cynical sense of humor to a tee. He always reminded me of the Grinch in the Dr. Seuss book, although he was a much nicer variety — and never stole Christmas that I was aware of.

But Dean knew a lot about the business. I always suspected he started as a broker around the age of two. And he traded some pretty heavy duty accounts, by which I mean in the million dollar variety. And some of the transactions were options plays.

His advice was to not go crazy with options. By that he meant Read the rest of this entry »

Uncle Sam’s Play Dough

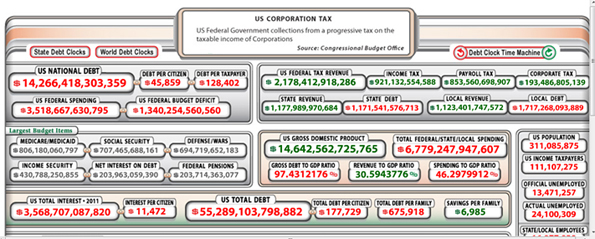

Here’s a great web site I found that you will want to check out. It’s the US Debt Clock. It’s real time so as you watch it you see how much we are adding to the budget deficit every second.

It’s fascinating to watch, and you will see how fast we are spending dollars into oblivion. Talk about a “Green Site.” This is the ultimate … or is that a red site? You decide.

Click here to see the budget deficit grow.

Have a nice day – John

Silver Can Be A Volatile Investment

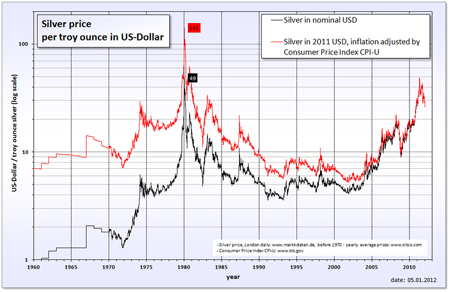

I first started investing in silver in 1980 and have been involved with it off and on since then. That has given me some sense of market history about the metal.

And one of the things I will tell you is that the price can be quite volatile. In my personal history with it, the price has been as low as $11 an ounce to about $48 an ounce. This is why one of my preferred, although not only, ways of investing is in buying physical silver in the form of pre-1965 U. S. coins and pure bullion — like Mercury dimes, American Silver Eagles, Canadian Silver Mapleleafs, etc. When you own it physically, you can just buy less when the price is high, and buy more when it goes down.

Also, when the price is low, you have staying power, i.e. the silver you own is not going to go away. And you can add more to your position at the discount prices.

A few points about the silver chart pictured above are of interest. One that stands out is the big spike around Read the rest of this entry »

A More Likely Silver Survival Scenario

There are many doom and gloom scenarios about the breakdown of economic society. I recently read a great book on one that described what would happen if there was a high altitude nuclear event. This would cause what is known as an Electromagnetic Pulse Event.

So what it would that do? It would disrupt electrical circuits in an area about 1000 miles wide. And because it would fry much of our electrical transmission system, and the system is so fragile, it could take as long as ten years to get society back up to speed – at least. Silver coins would probably become the currency de jour in a scenario like this.

And there are the scenes where we are hit with a large meteorite, or a massive volcano eruption in Yellowstone national park that would be even worse. These all make for exciting reading – if you are into that kind of thing. But they are not likely in our lifetimes. So much for exciting disasters.

A more likely survival scenario, although not nearly so dramatic, is Read the rest of this entry »

Silver For Survival And The Y2K Incident

Some people buy silver as a protection against a serious breakdown in the economy.

While I take a moderate stand on this, there is a whole range of survivalist attitudes out there ranging from putting away a certain amount of emergency stores all the way through people running weekend, end of the world exercises dressed in camouflage military uniforms, weapons, target practice, and enormous stores of food cached away in hidden cellars on their multi-acre property.

I even see there is a television series on survivalists now.

I‘m no survivalist to this degree, but do think it prudent to have some modest amount of provisions available in case there is a multi-day disruption in the economy. This is just common sense. For example, if you live in the in Midwest, or further north, a large snow and ice storm can cause you to lose power and not get out of your house for a couple of days.

And there could be disruptions longer than this. We’ve been lucky and dodged most of these so far. But I recall one, just twelve years ago that had me worried. I saw it coming, as did Read the rest of this entry »

Fly High Investing In American Silver Eagles

I mention in an earlier post that you can start investing in silver for just three dollars by buying Mercury dimes – actually any dimes minted before 1965 including the Roosevelt dimes – see http://livelearnandprosper.com/start-investing-for-one-thin-dime.

There are many practical reasons to invest in these junk silver coins. One is that they are universally recognized because they are currency produced by the U.S. Mint. There are other practical reasons as well, which we will explore in a future post.

But these coins are kind of plain in my view. So, while they are a smart and affordable investment, there is another silver coin investment I get much more excited about. It is Read the rest of this entry »

Start Investing For One Thin Dime

Here’s a simple, fun and cheap way to start investing. And while there are no guarantees, there are many indications this investment could go up 100%, 200% or more over the next few years.

I’m talking about dimes. But they have to have been minted before 1965. They contain 90% silver. And silver, as I write this post, is going for about $33 an ounce. And there are reasonable predictions that it could go to $50 to $100 dollars an ounce in the next few years. It has gone from $17 an ounce to $33 in the past eighteen months.

It is very unlikely that you will ever find any of these in your pocket change. That’s because when the United States stopped making the dimes out of silver in 1965, smart people started pulling them out of circulation.

So if you aren’t going to find them, why the heck am I recommending them?

Because they are Read the rest of this entry »

When Selling Stock Options You Have Many Choices

When selling stock options the odds are that you will win about 80% of the time.

What do I mean by winning exactly?

Well, for example, let’s say you own 100 shares of Microsoft stock. It’s $31.99 a share right now and you sell someone an option to buy your 100 shares for $33 anytime they want to in the next 71 days. They might pay you something like $68 (known as a premium) for that right.

Essentially, they are betting you that the price will go over $33 a share – and that’s their side of the bet. Of course they aren’t dummies, so they aren’t going to buy your shares for $33 unless the stock goes over $33. So if the shares never go over $33 in the next 71 days, you win and keep your 100 shares AND the $68 premium they paid for the option.

That’s what I mean by winning.

But you may be wondering, is my only choice to sell my options for $68 if the price goes above $33 a share in the next 71 days? Read the rest of this entry »

What It’s Like To Sell A Stock Option

We know this fact – that people who buy stock options lose their money 80% of the time because their stock options expire worthless. They ran out of time.

So it’s not a great leap to figure out that the people who sell them those options win 80% of the time. They get to keep the money the people paid them for the option. This money is called a premium, by the way

So it seems like the smart thing to do is to sell options instead of buy them. The odds of winning are much better.

So what is it like to sell an option?

Let’s do one right now and find out. Let’s sell an option on Microsoft stock.

The first thing we want to do is to buy 100 shares of Microsoft stock. Let’s say Microsoft stock is selling for $32 a share. So we pay $3200 dollars, and buy 100 shares of Microsoft stock.

Why do we do this? Because we do NOT want to Read the rest of this entry »