Why Bond Investments Seem So Confusing

Investing in bonds today could be hazardous to your financial health. Unfortunately, many people are doing just that.

People are literally moving billions of dollars out of their stock and stock mutual funds into bonds and bond mutual funds.

They are doing this because bonds give them a false sense of safety. And they are doing it because they really don’t understand bonds.

Both of these thoughts are a recipe for disaster, i.e. the false sense of safety and lack of understanding.

This post is one in a series on bonds to help you overcome this drawback. Now there is nothing wrong with bonds, used in the right way and the right time. But first you must understand them.

So why the confusion over bonds? I can tell you in two simple sentences.

- People usually think of investments by their price

- People think the price of bonds won’t change

So let’s talk about price. People are used to Read the rest of this entry »

Stocks, Stop Losses And A Cat Named Klingy

When I was a boy, my neighbors had a little black kitten they kiddingly named Klingy. He was a feisty, cool little cat and I used to enjoy walking next door and playing with him.

One morning I went to see him and my neighbor Warren told me Klingy was no longer with us. Klingy had been snoozing in the sun on the front car tire when Warren backed the car out into the street.

Apparently, sensing the tire he was sitting on was rolling back and moving down, Klingy had dug his claws in and hung on tight instead of jumping off to safety.

The next time you are tempted to not sell a stock that has dropped below your stop loss limit, I want you to remember Klingy.

Because hanging onto a tire rolling down (or a stock) can be hazardous to your (financial) health.

To your health and prosperity – John

Only Trade Three Or Four Options At A Time

One of the mistakes beginning options traders make is they put on too many different options trades. So they may wind up trying to manage options for six, ten or even twelve different stocks.

That’s certainly manageable if you were just trading or investing the stocks. But options are different.

For starters, they move quicker. So the can increase or decrease in value much more dramatically. It’s not unusual that an option can double, or lose half its value in a day. Now I’m not saying that is always the case, but it happens more often than you can imagine.

Now think about stock prices. This is almost unheard of. I can’t recall any stock trade I’ve done that ever doubled, or lost 50% in a day.

And they can reverse direction just as quickly. Now it is true that stocks typically Read the rest of this entry »

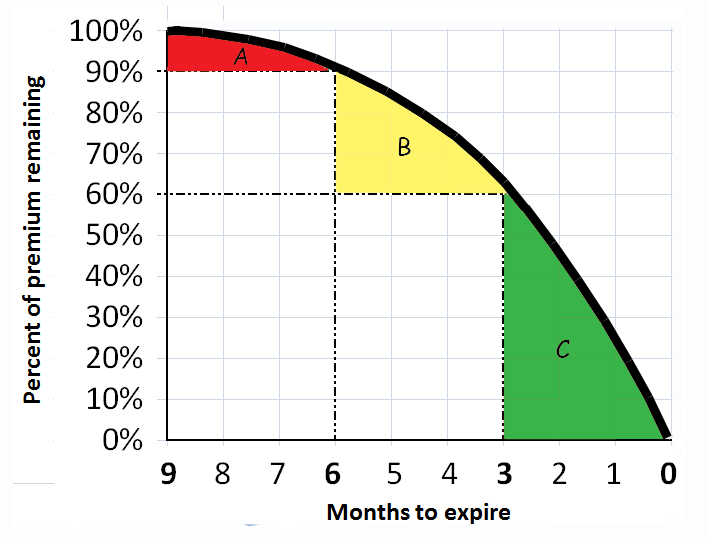

When Selling Options Time Decay Is Your Friend

You’ll recall from an earlier post that when we buy options (either calls or puts), we want to buy as much time as possible. Because the more time we have, the better our odds that something good will happen – as in the underlying stock makes a big move in the direction we want it too, and our option becomes much more valuable.

Put another way, when we buy an option, we don’t want it’s value to decay rapidly. Time decay is not our friend.

But what if we are selling options?

Let’s get a little bit competitive here. Trading options is a zero sum game. That means for every winner there is a loser. We want to win.

So when we sell an option, someone pays us a premium for the right to buy our shares at a certain price over a certain length of time. We really prefer that doesn’t happen, and that their option Read the rest of this entry »

J. Paul Getty, Physical Silver and Staying Power

Money isn’t everything but it sure keeps you in touch with your children

J. Paul Getty

I was recently reminded of the story of J. Paul Getty and a trick he did on the floor of the New York Stock Exchange. It seems J. Paul decided to stand prominently out on the floor of the exchange where everyone could be sure and see him. Then he very openly, not secretly, sold a large amount of stock in one of his oil companies – we’ll just say Getty Oil for the purposes of this story. And let’s say he sold them for $10 a share.

Now all of the other traders got really nervous. After all, if J. Paul was selling his own shares he must know something bad, so they all started selling some of their shares – maybe for $8 a share.

Then J. Paul sold some more of his shares for $7 a share. And the traders around him started to panic. They couldn’t get rid of Getty Oil shares fast enough. Selling was so desperate the price went down to $2 a share.

Can you guess what happened next?

J. Paul very coolly Read the rest of this entry »

Get To Know Your Local Coin Dealer

As a follow-up to our series on investing in silver, may I make a suggestion?

And that is to get to know your local coin dealer. It’s a smart move, and I think you’ll find the experience rewarding and enjoyable.

I visit Coins and Currency of Orlando just about every Saturday. And Gino, Bob and Nick are always ready to help with any questions I might have about silver, gold and coins in general. They’re also a congenial lot, and not without a sense of humor.

But don’t let that fool you. They’re serious about the coin business and really know their stuff.

Here’s the thing. If you know your local coin dealer, it’s simple to go buy a silver round or two. You can do this on a whim. And the key point is that you are more likely to actually Read the rest of this entry »

Don’t Make Me Think! By Steve Krug – Book Review

I don’t know about you, but I find many web sites a bit difficult to navigate. Maybe it’s just me – although from comments I read from time to time, others seem to have this problem too.

I particularly notice this in some of the social media sites. Like last night when I noticed a Facebook invite from a friend to join Goodreads – a social site where you can share your favorite books, ratings and reviews with fellow readers. Given the credibility of my friend, and my love of books and reading (I own a 3000 volume library) I joined.

So I joined and was immediately pulled into numerous prompts, screens and web page navigation that were tough to get around in.

I think I wound up rating one book before finally giving up for the night – thus giving my friend and the world at large the impression that I am a) illiterate or b) accidently hit a wrong key and actually rated a book by mistake. There are high odds the second option is correct – chuckle.

And my friend, who actually took the time to write a review (which I would like to read) found that it was Read the rest of this entry »

How Fast Does Your Stock Option Ice Cube Melt? Theta Knows

In an earlier post we talked about a most puzzling mystery. That was when you buy a call option, and the underlying stock is moving up, but your option and its value may not be. Or worse yet, your option may be going down.

We said that the culprit might be a Greek thing called Theta.

So all that said, what does this Theta thing have to do with it – you know, the one with the bodacious formula we looked at earlier – see An Options Murder Mystery – Theta The Greek Did It.

Well, you aren’t going to believe how easy this is. Be sure you are sitting down before you read the next sentence.

Theta tells you Read the rest of this entry »

Stocks Are The Easiest Way To Be A Business Owner

Many of the wealthiest people in the world have become so by owning businesses.

Two of the wealthiest people in the world are Bill Gates and Warren Buffett. They both own businesses. And this is no coincidence.

Stock investing is really much the same as owning a business.

And stock investing is the easiest way to own a business. So consider for a moment what it would take to start and run a business. We’ll contrast that to an investment in a business.

In order to own a business, you may need to have a store. This will involve a real estate purchase or lease and the complications and obligations that go along with it. You’ll need to make sure the store is opened on time and closed at the end of the day. The store will need to be kept clean and maintained.

But when you buy stock to invest in a business other people Read the rest of this entry »

The First Generation That Can’t Retire – What Can You Do

I flew up to St. Louis, my old stomping grounds, for an extended weekend. It was a great trip as I visited with old friends.

One evening their Baby Boomer conversation around the dinner table turned to investing and worries about not being able to retire. They had been on track until the downturn of 2008. Now they can’t see any progress in their 401k’s and the hopes of retirement are growing a bit dimmer.

Wil didn’t know what to do. He didn’t know where to invest because nothing seemed to work. His stocks were doing nothing, mutual funds the same, real estate a bust and government bonds just as bad.

I fear this may be the first generation that will not be able to retire.

So what can you do?

One option is to Read the rest of this entry »