In Challenging Times, Boring Is Beautiful

Between Covid-19, a dicey economy and a heap of election politics thrown in the mix, we are in some challenging times at the moment. However, as shaky as everything feels right now, I tend to think we’ll get through it all, as we usually do.

But the trip may be a bit bumpy from time to time.

Now, when you’re in for a bumpy ride, boring can be beautiful in the investment world. So I thought to share with you a number of boring things that I’m doing. Because you may find them useful, and in the end, think boring is beautiful too.

So let’s get started with my three boring things. And we’ll call them Mindset, Metals and More Dividends.

MINDSET

After the big drop in the stock market due to Covid-19, and through much of the recovery, I’ve kept a pretty unhurried attitude toward jumping all the way back into the market.

I call it my bus stop attitude. That is to say if I miss the bus, hey, no big deal, another one will come along in 10 minutes. So I’ve kept cool and been in no big rush to get more invested. Because things could go sideways again.

Now don’t get me wrong, I haven’t totally dropped out of the stock market. And while my portfolio is heavier in cash than before, I still own some dividend paying stocks. And I still buy on occasion when I see a dividend stock that interest me. So gradually, over time, I will become more invested.

And I happen to see a dividend stock that interests me right now, which I’m going to share with you.

Actually, I already own shares of this stock. But I’m going to buy more. Because it’s at a good price and pays an exceptional dividend. And it’s a pretty stable company that has been around since 1877. Some might even call it boring.

MORE DIVIDENDS

I’m talking about AT&T stock here. And to be a bit more precise, it started out as the Bell Telephone company, founded by Alexander Bell, and morphed over time into AT&T.

But there’s nothing boring about their 7.5% dividend. And better yet, the fact that their dividend has been rising steadily for over 15 years.

AT&T Dividends: Source DividendChannel.com

So as a stable company paying a big dividend, AT&T offers us the best of all worlds. That’s durability with a big payout. And I find it most gratifying to see their out-sized dividend payments show up in my account, quarter after quarter, year after year. And you may too.

Because today, AT&T will pay you $2.08 for every share you own, year after year (and probably more in the future). So if you own 100 shares, they will pay you $208. If you own 1000 shares, they will pay you $2080, etc.

Just like that.

And the dividend and future increases seem pretty secure. Because AT&T generates a lot of free cash flow – plenty more than the dividends they pay.

In fact, a common way to evaluate a dividend stock is to look at how much the company pays out in dividends compared to their free cash flow coming in. This measure actually has a name. It’s called the “payout ratio.”

So a company that paid out $70 in dividends for every $100 of free cash flow they took in would have a payout ratio of 70% (and $30 left over). And in the investment world, companies with a payout ratio of 70% or less are considered a good risk to keep paying their dividend. That’s because they have cash left over.

And the estimate for AT&T’s payout ratio this year is 57%, well under the 70% considered good. So AT&T should be able to continue paying their dividend, and keep increasing it as well.

A GOOD PRICE

And the price is right. Which is important because we don’t want to overpay. And right now AT&T stock is on sale.

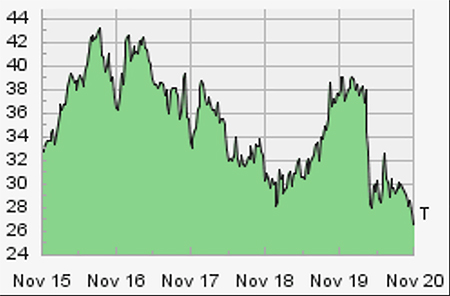

AT&T Stock Price: Source DividendChannel.com

So at $28 per share, it’s trading at its lowest level in five years. And that’s why I’m buying more of the stock. Because it’s on sale.

WHAT ARE THE RISKS?

Of course, all stocks and investments carry a risk, including AT&T. And the most obvious risk has been concern over their debt.

When we last wrote about them in June, 2018 their debt was at $180 billion. See http://livelearnandprosper.com/get-paid-a-great-6-dividend-by-this-aristocrat. But now, just a couple of years later, it’s less at $171 billion, and they have plans to keep paying it down. And they have also refinanced $60 billion of that debt at lower interest rates.

So while there’s still some significant debt, we can control our risk by never investing more than 4% in any single stock in our portfolio. And selling it if it drops by 25%. So the most we would lose is 1% of our investment portfolio, and live to invest another day.

And concerning risk in general, the great investor Warren Buffet has said, “Be greedy when others are fearful, and fearful when others are greedy.” And this seems to be the “greedy when others are fearful” case.

Indeed, the risks mentioned above are probably why the stock price has dropped, offering this buying opportunity. And the lower price is what makes that attractive dividend percent of 7.5%.

So with all those things in mind, you might want to check out AT&T (NYSE:T) and see if it fits your unique investment needs and risk tolerance. Because at $28 a share, this boring investment is paying an exciting dividend. But do limit how much you buy and watch your stop loss, because like all investments, it can go south.

So that covers Mindset and More Dividends. Now how about Metals?

METALS

I’ve also continued to accumulate the precious metal silver. And I think most people should have at least a small portion of their portfolio in precious metals. Because this may give protection against inflation and a loss of dollar purchasing power.

Which is all brought on by excessive government spending, and printing dollars to cover it. Which pretty much dilutes the value of the dollars.

And last I checked, the government was still spending quite a bit of money. Wow, that was some kind of an understatement, yes? Like they say, a trillion dollars here, and a trillion dollars there, and pretty soon it adds up to a lot of money.

But anyhow, you’ll recall from past issues that I have set up an automatic purchase of silver with a company called OWNx. So every month they automatically buy a set dollar amount of silver for me.

This is a great service, by the way. And you can check them out here at www.ownx.com if you like (please note that I have no interest in them aside from being a satisfied customer).

In any event, buying a set dollar amount is the best way to do this (as opposed to a set number of ounces) because that automatically buys the least ounces of silver when the price is high, and the most ounces of silver when the price is low.

Also note that between silver and gold, silver is still the best buy today at a price of around $25 per ounce.

An even better clue on the silver price is to look at it in comparison to the price of gold.

And right now, with gold approaching $2000 an ounce, that means that gold is so high that just 1 ounce will buy 80 ounces of silver ($2000 gold / $25 silver = 80).

So that’s an 80:1 silver-to-gold ratio. So silver is cheap and gold is relatively expensive.

Now, were the ratio to drop down to 30:1, where it only took 30 ounces of silver to buy an ounce of gold, like in 2012, I would switch over to buying gold, because gold would be cheap, relatively speaking. I might even take some of my silver and exchange it for gold in that situation.

But for now, silver continues to be the best buy, as it has for some years now.

So that covers our third topic of the Metals. So where does that leaves us?

MINDSET, METALS and MORE DIVIDENDS

Well, to summarize, here’s what we did.

We kept plenty of cash and a casual mindset toward buying back into the stock market.

We bought some more of an ancient phone company dividend stock – so it wasn’t even a new stock in the portfolio.

And we didn’t even lift a finger, while automatically buying some more silver.

Boring, boring, boring!

But wait a minute, let’s take another look here, because…

We’re in a good portfolio position if the market goes sideways again.

And we’re getting even more of those big AT&T 7.5% dividends.

And many experts predict our $25 an ounce silver could go to $100 someday.

So all things considered, not too bad for these challenging times. I might just say boring is beautiful.

How about you?

To your health and prosperity – John

~~~~~

P.S. To learn more about silver investing, you can check out my latest book Silver Investing For Beginners. You’ll learn…

• Why the price of silver could explode in the future.

• Why silver offers greater profit potential than gold.

• How silver could help protect you in a financial crisis.

• How to find and buy your first silver bullion.

• The best silver coins to invest in when you start.

• How you can even open an automated silver buying account.

• How to invest in silver related stocks and funds.

• And how to protect your silver investments.

If these topics interest you, you can preview the book for free right here.