How And When To Sell Your Stock

Sometimes the smart thing to do is to sell your shares of stock.

So it’s good to know how to do this beforehand and take the mystery out of the process.

I assure you the process is pretty routine and a lot like buying it. But we’ll walk through it step by step and you’ll see it’s not really that big of a deal.

Now, when to sell your stock is a different story. The most sophisticated investors have trouble with this one, including legendary investor Warren Buffett. So don’t feel too bad about yourself if you puzzle over this one.

That said, there are two times when you should sell your stock.

One is when it hits your 25% trailing stop. So you sell in this case to limit your losses. The other time is the happier occasion when you have made money and want to take your profits.

So let’s say a few months have gone by and your Sprint stock, which you bought for $5.17 a share, is now going for $10.00 a share.

Wow. Nice profit. So you decide to sell your 10 shares for $10 a share. You bought them for a total of $517. And you are going to sell them for $1000. That’s a happy story.

To do this, log in to your stock account and then click on the Accounts —> Balances and Positions tabs. Look for the Sprint stock and it’s symbol, carefully noting how many shares you own (which is 10 in this example).

You can do this by clicking on the stock directly on that screen, or you can click on Research and Ideas —> Stocks tabs and enter the symbol S in the box.

Either way will get you to the screen that shows the current value of the stock. Remember, this is exactly the same screen you went to when you were getting ready to buy the stock.

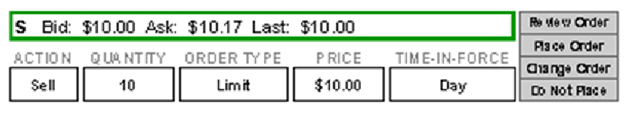

You will see something like the screen that follows. This screen should look familiar. So what does this tell us?

First, that we got the right stock (Sprint). This is the one we want to sell. And second, that the stock’s value is now $10.00 a share.

That’s all we need to know. So now we click the Sell button. That will bring us to a screen like this one.

So what does all of that mean?

Well, you see something that says Bid $10.00. That’s the price everyone else in the world that wants to buy the stock is willing to pay for it at this moment.

The next thing you see says Ask $10.17. This is the lowest price anyone in the world that is trying to sell the stock is asking for it. But you’ve already decided on $10.00, and that’s what people are willing to pay, so no matter.

Finally, you see Last at $10.00. This tells you how much someone sold the stock for in the last transaction, probably in the past seconds or minutes. That works out just fine. That’s what you are going to sell for.

Remember that these prices are constantly changing – that this is an auction going on. The current price “right this minute” is $10.00.

So you get ready to sell by filling in the boxes.

Here’s how you do that.

Make sure the ACTION BOX says Sell. Do not chose Sell To Close. That is for stock options. Just use Sell.

Enter 10 in the quantity. That’s the number of shares you are going to sell.

CAUTION! Make sure you DO NOT accidently enter more shares than you own. Be very careful with this box when you are selling. If you enter more shares than you own, you have created a “short sale.” This can create an unlimited liability for you. By that I mean you could lose much more than your investment. Theoretically it could be a huge loss – think more like losing your house, car, etc.

Next make sure the ORDER TYPE says limit. That means you don’t want to sell for less than $10.00 a share, i.e. you are limiting the downside on the price.

Then enter the price of $10.00 in the PRICE box. This means you want to sell your shares at $10.00 a share (or better). And then in the TIME-IN-FORCE box pick Day.

This means you want the order to stay in affect all day until the stock sells. If the stock does not sell by the end of the day then the order is canceled.

Now click the Review button and check the display carefully to make sure the order is correct. It should say something like Sell 10 shares of S Sprint at $10.00 a share for a total of $1000.00.

If the order is not correct, press the Change Order button and make the appropriate changes.

Then press the Review Order button one more time to check again. If everything looks okay, press the Place Order button.

Your sell order just went out to the New York Stock Exchange along with millions of other orders and the exchange is trying to match your sell order to a buy order so it can sell the stock for you at the price you specified (or better).

For most stocks this will only take a few seconds, minutes at the most, and you will see a screen pop up that says your order has been successfully filled.

Congratulations! You just sold your first shares of stock.

Now go back to your Balances and Positions screen and you should see that your 10 shares of stock are no longer listed. You will also see where your cash total just went up by $1000.

Nice.