Get Paid A Great 6% Dividend By This Aristocrat

I recently bought more stock in an old, durable company founded by the famous gentleman pictured above. He was a man of many talents, and did groundbreaking work in optical telecommunications, hydrofoils and aeronautics. And he had a strong influence on National Geographic, one of my favorite magazines.

Even better, he shared my annoyance with phone calls when he was working, considering the phone an intrusion, and refusing to have a telephone in his study.

Which I find rather interesting and amusing, since he is Alexander Graham Bell, the inventor of the telephone.

Also interesting is that back in the 1870′s, he even offered to sell his telephone patent outright to Western Union for $100,000. But the president of Western Union wasn’t having it. He thought that the telephone was nothing but a toy.

Little did he know that the $100,000 toy would turn into a giant $207,750,000,000 company by 2018. I guess it was just too hard back then to visualize people of today, glued to their mobile phones as they walk along, head down, bumping into walls – and other people.

So with his patent sale offer rejected, Alexander turned to his father-in-law, who helped him form the Bell Telephone Company in 1877. And through 141 years of complicated mergers and government mandated breakups, it became today’s AT&T, the world’s largest telecommunications company.

HOW BORING IS A BIG DIVIDEND?

So AT&T has been around for a while. And it’s safe to say the company is durable. Of course, in the age of flashy internet startups, that may sound a bit boring and not much to get excited about.

But AT&T (T) stands out today as an unusual stock for a number of reasons. The first is that it pays a high 6% dividend. In fact, it’s one of the highest stock dividend payers out there.

The second reason is that typically, old, well established companies like AT&T only pay a dividend in the range of 1-3%. That is to say, if you want to invest in stability, you won’t get paid much. That’s the price of stability.

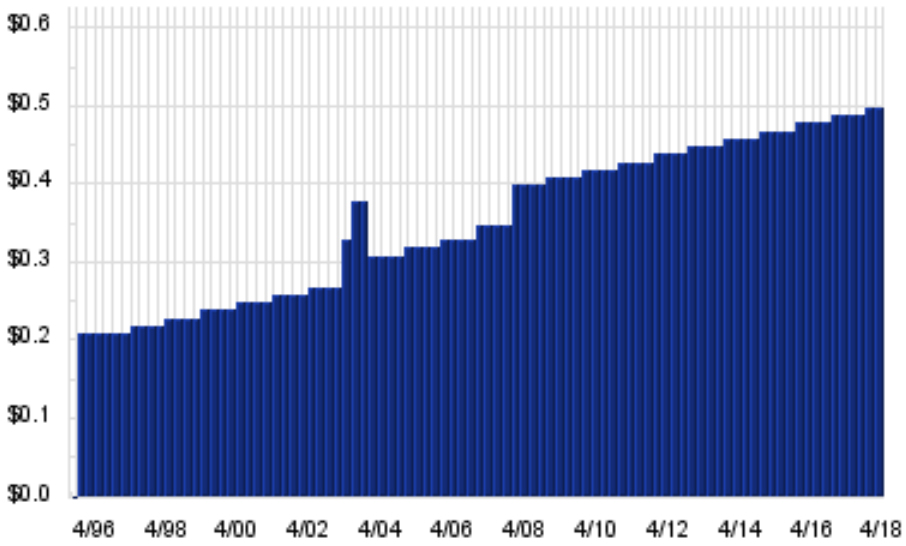

And the third reason is that AT&T has increased that dividend for 33 straight years. That puts it high in the rarefied group of stocks known as “dividend aristocrats.” These are companies in the top 500 U. S. corporations that have increased their dividend, through good times and bad, for 25+ consecutive years.

There are only 53 companies in this select group today. And AT&T stands tall in that list.

Here’s a chart of AT&T’s dividend increases to back up that claim. It’s pretty impressive. Especially when you see they increased their dividend right through the stock market crash in 2008 – 2009. Not many companies did that.

AT&T Dividend Increases – Chart courtesy of DividendChannel.com

AT&T Dividend Increases – Chart courtesy of DividendChannel.com

So as a stable company and dividend aristocrat paying a big dividend, AT&T offers us the best of all worlds. That’s durability with a big payout. And I find it most gratifying to see their outsized dividend payments show up in my account, quarter after quarter, year after year. And you may too.

Because today, AT&T will pay you $2.00 for every share you own, year after year (and probably more in the future). So if you own 100 shares, they will pay you $200. If you own 1000 shares, they will pay you $2000, etc.

Just like that.

And the dividend and future increases seem pretty secure. Because over the past four quarters, AT&T’s free cash flow has totaled $18.1 billion while it paid out $12.1 billion. That’s a lot of cash coming in the door. And plenty left over.

In fact, that’s a common way to evaluate a dividend stock – to look at how much the company pays out in dividends compared to their free cash flow coming in. This measure actually has a name. It’s called the “payout ratio.”

The payout ratio is kind of like if a person had an annual income of $50,000, and total bills of $35,000. You and I would think they had a pretty good chance of consistently paying their bills each year because they have $15,000 left over. So in this case, their payout ratio would be 70% ($35,000 / $50,000 X 100).

Similarly, in the investment world, companies with a payout ratio of 70% or less are considered to have a good chance to keep paying their dividend to you and me in the future. That’s because they have cash left over.

And with a payout ratio of 66.9% ($12.1 / $18.1 X 100), AT&T comes in under that guideline. So their future dividend payments seem safe based on that measure.

THE STOCK IS ON SALE

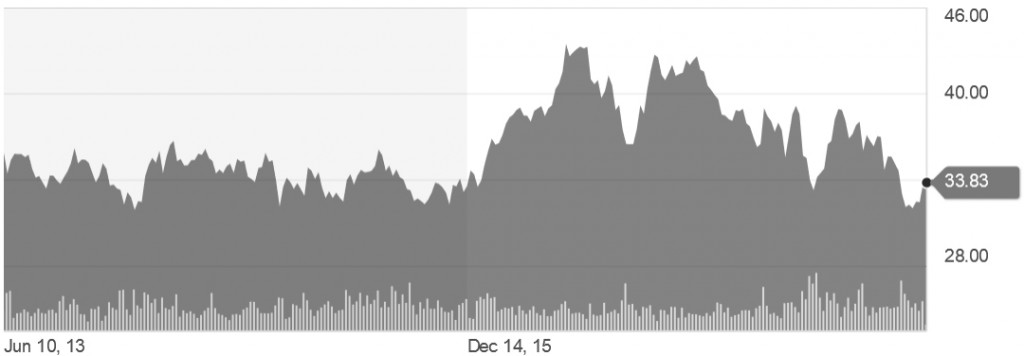

That said, we only want to buy stocks when they are selling at a good price. And right now AT&T stock is on sale. It’s price has fallen about 20% from last year’s highs due to uncertainty over the planned merger with Time Warner Inc.

Chart courtesy of Yahoo.com Finance

Chart courtesy of Yahoo.com Finance

So at $34 per share, it’s trading at its lowest level in five years. And that’s why I bought more of the stock. Because it’s on sale.

Also, AT&T’s stock price is in my sweet spot as well. While I buy stocks in all price ranges, I prefer stocks that are around the $40 range – more or less. And at $34 a share, AT&T fills the bill.

So AT&T seems to be well priced. And buying at this price wouldn’t seem to be overpaying for the stock.

WHAT ARE THE RISKS?

Now, there isn’t much in life that’s guaranteed. And all stocks and investments carry a risk. The most obvious risk with AT&T has been the uncertainty over the past months of the planned $85 billion acquisition of Time Warner (TWX). But that risk has gone away as of 6/12/18 when a federal judge gave the green light to this merger.

There has also been some concern over their debt, which is now at a massive $180 billion. But they have $188 billion in annualized revenues, so they seem to have the ability to begin to pay that down over time.

And we can control our risk by never investing more than 4% in any single stock in our portfolio. And selling it if it drops 25%. So the most we would lose is 1% of our investment portfolio, and live to invest another day.

And concerning risk in general, the great investor Warren Buffet has said, “Be greedy when others are fearful, and fearful when others are greedy.” And this seems to be the “greedy when others are fearful” case. Indeed, the risks mentioned above are probably why the stock price has dropped, offering such a great buying opportunity.

And that lower price is what makes the dividend percent so high at 6%. Because as the price goes down, the dividend percent goes up. Which is why AT&T trades at such a good investment discount right now.

WHAT TO BUY

So with all those things in mind, you might want to check out AT&T (NYSE:T) and see if it fits your unique investment needs and risk tolerance. Because at $34 a share, it’s on sale. And it’s paying a great 6% dividend. And it has a consistent record of increasing that dividend.

And for a small $100,000 patent and company started in 1877, that grew into a$207,750,000,000 giant 141 years later, I’d say it’s pretty durable too, wouldn’t you.

And I don’t see that changing with this dividend aristocrat anytime soon.

To your health and prosperity – John

P.S. To learn more about getting paid with dividend stocks, and stock-like investments, you may be interested in my latest book Your Future Paychecks And Raises: Get Dividend Checks In Your Mailbox paid to the order of YOU! You can check it out for free right here at http://a.co/6FwKPdc.