From Pills To Profits: A 4.7% (And Growing) Dividend Stock

Sometimes when looking for new investments, it’s good to just buy more of a winning stock that you already own. And that’s what we’re doing in this issue as we look at

Illinois-based healthcare giant drugmaker AbbVie, Inc. (ABBV).

AbbVie is known for innovation and performance, and with its strong track record, offers investors the potential of three good things. These are stock growth, dividend growth and high-yield dividends. But more on that in a minute.

AbbVie is actually a spinoff of Abbott Laboratories, which traces its origins back to 1888 and Dr. Wallace C. Abbott. He was a practicing physician and drug store owner at the time. And his innovation was to make tiny pills from the active part of medicinal plants (like morphine, quinine, strychnine, and codeine). These were called “Dosimetric granules.”

This made for more accurate dosing of his patients, and demand for these granules soon exceeded his needs. Innovation continued and by 1910 Abbott had over 700 new products. Finally, Abbott Laboratories was born and was involved in many other leading edge drug advances, including their antiseptic agent Chlorazene in World War I, anesthetic development in the 1920′s, 1941 anti-infective penicillin, 1985 HIV antibody assay, 1996 antiretroviral agents for the treatment of HIV, and much, much more.

Ultimately, in 2013, AbbVie, Inc. as we know it today was spun off from Abbott Laboratories as a separate company focused on biopharmaceuticals and new drug development.

I’ve actually owned AbbVie (ABBV) stock since 2016 and been quite happy with it and the generous dividends it’s paid. Indeed, by March of 2020, when the pandemic hit, my dividends had already paid for a fourth of my original shares.

But when the stock market dropped due to Covid, and ABBV shares with it, I hit my stop loss limit and sold out. Eventually, as the market came back, I eased back into the stock, but only bought half as much as I had owned before.

This week I finally bought back the rest of my position.

A GOOD DIVIDEND WITH BIG GROWTH

I did so because AbbVie pays a generous 4.7% dividend. That compares quite favorably to the larger market dividend average of 1.85%, i.e. the stock market’s biggest companies listed in the S&P500 – the top 500 stocks.

But even better than the dividend is the strong dividend growth. AbbVie has raised their dividend every year since 2013, when they were spun off from Abbott Laboratories.

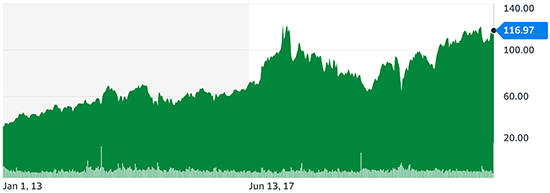

ABBV Dividend History. Courtesy of DividendChannel.com

ABBV Dividend History. Courtesy of DividendChannel.com

And just looking at the chart, you can see where they have increased their dividend by a whopping 250% since becoming that new, independent entity.

So at the current dividend, a hundred shares would pay you $564 a year, or $47 a month. Now ABBV actually pays out quarterly, like most stocks, so that would be $141 every 90 days. And important to note, in order to get the next dividend, you will need to own the stock by January 13, 2022 (the Ex-Dividend date).

A FAIR PRICE

Currently, the drugmaker’s stock price is right at $117 per share. And that’s trading at less than nine times 2021 projected earnings, which is below the industry average. So shares could be bought at this price.

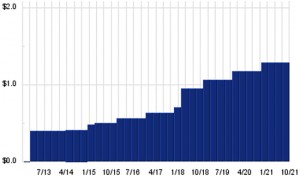

ABBV Price History. Courtesy of Yahoo Finance

Or for the more thrifty, you could hold out and wait for a 10% pullback, and see if you could buy in at around $105. Of course, that may or may not happen. As you can see from the price chart, AbbVie has remained fairly flat over the past year.

WHAT ARE THE RISKS?

Now, there isn’t much in life that’s guaranteed and all stocks and investments carry risks. And AbbVie is no different in that regard. The most obvious risk is that its top-selling drug Humira will face competition against a biosimilar in about a year. Humira has been a big revenue producing autoimmune drug for AbbVie, and the companies sales will take a hit from the competition.

| WHAT’S A BIOSIMILAR? A biosimilar drug is to a biologic drug as a generic drug is to a brand name drug. This is a rough analogy and there are other differences. For example, a generic drug is an exact chemical copy of a brand name drug, but a biosimilar comes from the same natural source and is “the same in certain ways.”None the less, the biosimilar and generic typically come on the market after some protected time period, and are typically cheaper and reduce the sales and profits of the original biologic or brand name drugs.A biosimilar is made from a biologic (natural) source that cannot be copied exactly because they come from very complex living systems whose environments can change.The biologic drug is made from proteins or pieces of proteins (either natural or artificial). So biologic drugs must be made in a living system, such as yeast, bacteria, or animal cells.Contrast that to a generic drug, which is an exact copy (exactly the same in chemical make-up) of its brand name drug. |

Additionally, AbbVie’s payout ratio is at 122%, which could throw it’s great yield in doubt, unless revenues grow more in the future. The payout ratio is simply how much more money the company made than it paid out i.e. Money Paid / Money Made = Payout Ratio. Typically you would like the ratio to be 70% or lower, so they have some work to do there.

However, AbbVie still has 11 blockbuster drugs. And they’ve acquired newer products, such as the psoriasis drug Skyrizi, and so should eventually get back to revenue growth in the future.

Also, a total of 129.3M shares of AbbVie are held in 269 different U.S.-traded Funds (ETF’s).

Some of the funds with the greatest exposure (over 5%) are…

- First Trust Nasdaq Pharmaceuticals ETF (FTXF)

- First Trust Morningstar Dividend Leaders Index Fund (FDL)

- WisdomTree U.S. High Dividend Fund (DHS)

- Shares Evolved U.S. Innovative Healthcare ETF (IEIH)

and a number of others.

Also, interestingly, the ETF with the largest allocation to ABBV stock is in the First Trust Nasdaq Pharmaceuticals ETF (FTXH), with a portfolio weight of 7.75%.

So that speaks to a lot of fund managers feeling good about AbbVie’s prospects. And overall, 65% of AbbVie’s stock is owned by institutions, which indicates the professionals have confidence in the stock.

And finally, the company management has a track record of guiding it through challenging times since the company started. And they’ve placed emphasis on growing the dividend over the past eight years as well. So there’s no reason to believe they’ll lose focus on that, even with the current challenges.

And with those risks and challenges in mind, we can also control our risk by never investing more than 4% in any single stock in our portfolio. And selling it if it drops 25%. So that the most we would lose is 1% of our investment portfolio, and live to invest another day.

WHAT TO BUY

So considering all these things, you might want to check out AbbVie (NYSE:ABBV) and see if it fits your unique investment needs and risk tolerance. At $117 a share and just 9 time future earnings, it seems to be going for a reasonable price. It’s paying a great 4.7% dividend, and has a consistent record of healthy increases to date.

And for a small drug store owner / physician in 1888 inventing tiny pills from medicinal plants, to a $205,500,000,000 giant 133 years later, I’d say it’s pretty durable too, wouldn’t you.

And I don’t see that changing anytime soon.

To your health and prosperity – John

P.S. To learn more about getting paid with dividend stocks, and stock-like investments, you may be interested in my latest book Your Future Paychecks And Raises: Get Dividend Checks In Your Mailbox paid to the order of YOU! You can check it out for free right here at http://a.co/6FwKPdc.