Buy Stocks At A Discount – The Tom Sawyer Whitewash

In our last post on buying stocks at a discount, we talked about the method of setting a trap, like a mousetrap, for when the price of a stock came down to our discounted price. We used a buying technique called a limit order. And the best part of this method was that it was free.

It’s hard to beat free.

But in this post we are going to do just that.

The method we are going to describe always reminds me of the scene in Tom Sawyer where his Aunt Polly tells him he has to whitewash the fence in the front of the house. Tom was rather averse to work like this. So he came up with a rather theatrical strategy to get out of it – and get paid.

Whenever he saw one of his friends approaching, he would put on a big show of slathering on a brush of white paint on the fence, and then stand back and examining it critically, like this was a highly specialized skill that had to be done just right.

And he would tell this to his friends as they approached and watched him. He also slyly mentioned what a great pleasure it was to whitewash the fence.

Eventually, the inevitable happened, as he knew it would, and one of them said, “Say, Tom, let me whitewash a little.” Tom would act very reluctant to this suggestion, saying, well, he didn’t know because t took a very special person and talent to whitewash a fence.

Eventually, he would give in by saying the only way he could let them try it was for them to pay him for the privilege. And before you know it, he had many of his friends all working to whitewash the fence for him. When all was said and done, the fence had been whitewashed three times over, and his Aunt Polly was quite pleased with him.

And his friends had all paid him for the privilege of doing his work for him.

Which is what our Tom Sawyer Whitewash method of buying stocks at a discount is all about. We are going to let people pay us for the privilege to buy their stocks at a discount.

I told you it was better than free, didn’t I?

Now this method is more advanced than the Set A Trap method because it involves options. But for those of you who have used options before, I will describe it. Those that have not may be interested in my book Beyond Stock Options For Beginners to be released this Fall. And you might want to follow along here as well, because this will expose you to future possibilities.

What we are going to do is sell a put option. This obligates us to buy 100 shares of stock at a certain price if the option buyer chooses to sell it to us. We will pick a price lower than the market price. And this is how we will get our discount.

For consistency in this series, I’m going to continue to use Microsoft stock in my examples, although there are stock option opportunities with even greater discounts and larger payments out there.

So let’s say that Microsoft stock is going for $30.02 a share in early mid-June. We want to look up the options on Microsoft to see what people will pay us for them.

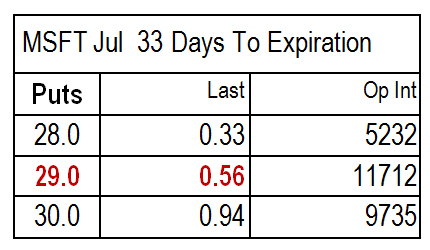

When we look up the options, we will see a list of prices like that shown in the table below (this is known as an option chain in options parlance).

See the red 29.0 on the left. That stands for $29 a share. So we could enter into an agreement with another trader to buy his hundred shares for $29 a share ($1.02 less than today’s price). And he will pay us to do this.

How much will he pay? Well, see the red 0.56 in the table. That stands for $.56 a share. Since options are always for a hundred shares, that says he will pay us $56 for the privilege of buying his shares for a $1.02 a share discount.

How good is that?

So we sell a Microsoft July 29.0 put and $56 is immediately deposited in our account. Now here’s what can happen in the next 33 days.

The stock price can drop to $29 a share or lower, and the option buyer requires us to buy his 100 shares for $29. Oh darn, we had to buy his shares at a $102 discount from today’s price. Oh, and we also get to keep his $56.

Or the stock price doesn’t drop to $29 or lower, so the option buyer won’t sell us his shares. But we get to keep his $56.

And in this case we can sell another put option to someone else, for something like $56 (more or less). And we can keep doing this over and over again. Just like Tom Sawyer convinced his friends to pay him for the privilege of whitewashing the fence – three times over.

Those are not bad choices if you ask me.

So do you see why I do this often when I have decided to buy a stock? Not only do I have a chance to get it at a discount, but someone pays me for the privilege.

Using my Bus Stop mentality, I don’t care if I ever get the stock or not. I’ll just keep selling people the right to pay me to buy it at a discount.

Now, a couple of things to be aware of. First, make sure this really is a stock you want to buy. Because you really will have to buy it if the option buyer decides to sell (called putting the shares to you – hence the term put).

And second, you need to make sure you have funds available for the full price (in this case $2900 – $29 a share X 100 shares) in case that happens.

Those things considered, this seems to be a pretty good way to buy a stock at a discount, don’t you think?

To your health and prosperity – John