Start Your Dividend Income For Retirement Now

Let’s take a clear-eyed view of how stocks are going to pay for your retirement.

Because I think most people have kind of a muddled view.

Indeed, there’s a muddled view about stocks in general. That is to say, the most common view seems to be that you get some kind of hot tip on a stock, you buy it, it goes up a gazillion dollars, and you have arrived.

All you have to do is quit your job and spend the gazillion dollars a bit at a time … hmmm … until you are done retiring, ah, put delicately; you have passed on and presumably don’t need any more of the gazillion dollars.

I think this is how people keep losing money in the stock market. And how they keep missing their retirement income goals. They just keep trying to hit the jack pot buying stocks that go up. And more often than not this doesn’t work out.

So here’s a question for you. If it’s not working out before you retire, are you still going to be doing this when you retire? And somehow get better results?

I think not.

So let’s look at this another way.

When you are buying stocks, you are really becoming Read the rest of this entry »

How To Stop Losing Money In The Stock Market

With the markets moving up and down these days, we want to protect ourselves and try to keep from losing our money when things start going south.

So one way we keep our money is we “stop” our losses. This activity is actually called setting a stop loss, so that’s a new term for you here.

In order to set a stop loss, we actually decide, up front, when we buy a stock, how much we are willing to lose before we throw in the towel and sell it.

This is the best time to do this because we have no money on the table yet, so we are more objective.

Let me say that another way. When you have bought a stock, i.e. you have money on the table, it’s emotional. So the idea here is to get the emotions out of the process before Read the rest of this entry »

Trading Your Stocks Online – It’s Easier Than You Think

I think many people are a bit intimidated about trading their own stock account online. And I can understand that. It seems easier to call your broker and let him worry about placing your order – correctly.

But it’s really not that hard to do. And after you’ve done it a few times, it’s actualy much easier and convenient.

And it can save you a great deal in commissions over the year.

So here’s what it’s like to place a buy order, that is to say, buy a stock, in an online account. I walk you through it step by step.

Just read through it and see Read the rest of this entry »

Tax Fairness, The 1% And A Dinner Party

Much is being said these days about tax fairness and the 1% not paying their fair share. I kept hearing so much about this that I decided to do something quite radical, and unusual, in our national discourse on the subject.

I hope you’re sitting down for this.

What I decided to do was actually check the facts. From the IRS no less.

I know. Call me crazy in a world where facts are optional.

So anyhow, I got the 2010 IRS tax figures, updated them just a bit to get them current, and wrote a little story to illustrate how much different members of our society are paying toward the total tax bill.

So here’s my story about a dinner party. Pretend that you are Read the rest of this entry »

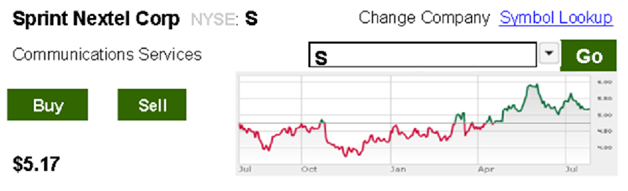

Use Good Til Canceled To Buy Stocks At A Discount

Rather than rushing out to buy a stock I’m excited about at the market price, I use the Good Til Canceled method of placing an order.

For example, if you wanted to place your order for the Sprint stock at $4.50 a share, even though the market price was $5.17, you could do it by using the good til canceled option in the Time In Force box.

Instead of choosing the Day option, you could choose the Read the rest of this entry »

My Favorite Financial Newsletters

Using quality financial newsletter recommendations can greatly enhance your investment success in the stock market. Here are some of the newsletters I‘ve used off and on through the years. In my opinion, these guys are some of the rock stars of the financial newsletter business.

I’m sure there are many other good ones, but it would be impossible to research them all. Of course, you will have to decide which recommendations work well for you and your specific circumstances. But these have Read the rest of this entry »

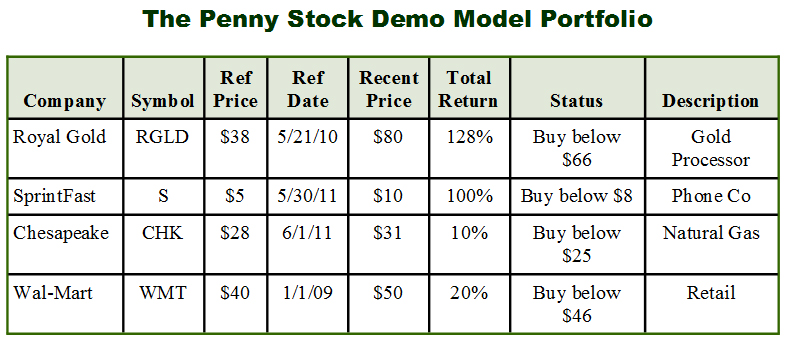

What I Look For In A Good Financial Newsletter

Good financial newsletters can be a real key to your stock investing success. But not all newsletters are created equal.

I look for a few key items in a newsletter. They are …

- A story

- The recent and historical company performance

- The researcher’s rational for why it should do well in the future

- A specific buy recommendation at the end

Below is a sample newsletter I paraphrased to illustrate all the key points I look for. Please note that the newsletter is a mockup, and the companies are fictitious, so don’t Read the rest of this entry »

My Source For Great Stock Investments

For my money, I go with paid financial newsletters — every time.

There are many knock off newsletters out there that are not good, so I’ll go into detail reviewing the ones I have had good success with in future posts. You might want to consider some of them too.

But before we get into the specific newsletters, lets look at a sample one to get started. A good newsletter has certain characteristics which I will point out.

One of the characteristics I look for will give you the ability to Read the rest of this entry »

How Do I Know What Stocks To Buy?

Remember that when you invest in a stock, you are buying a business. You are becoming a business owner.

No smart business person would buy a business without doing some serious research first.

They would want to know what the sales were, if the sales were increasing every year, how much profit those sales were creating, if profits were increasing every year, if the company was badly in debt, and many other things.

You need to know this too before you buy a stock.

Don’t get discouraged about all this research because there is an easy way to get this done for you. Let someone else do it. This is what I do.

I don’t have hours per week to spend researching the companies I want to invest in, so I get the Read the rest of this entry »

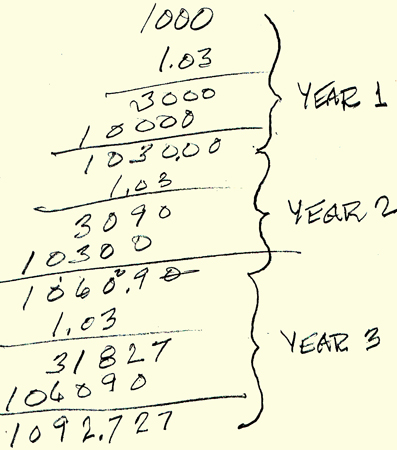

Free Bank Toasters Won’t Build Wealth – But This Might

When I was in my early twenties I began wondering how people made money. No, not “made money” as in at a job. I had a job as a computer programmer back then. So I knew how to earn a wage.

But I was trying to figure out how people accumulated real wealth.

I knew virtually nothing about investments back then, so the only thing I could think of was savings accounts earning interest. After all, I had seen plenty of bank advertisements on TV about how customer’s who opened a savings account were paid interest; their savings accounts grew; and they would get a free toaster.

Okay, so the free toaster idea probably wasn’t that relevant to wealth creation. But with that scanty idea of earning interest planted in my brain, I started Read the rest of this entry »