Doing A Straddle – One Of My Favorite Stock Option Plays

One of my favorite stock options trades to do is called a straddle – or a related trade called a strangle

When we do a straddle we are buying a call AND a put on the same stock at the same strike price. In other words, we aren’t choosing if the stock will go up or down, we are choosing both directions. We are straddling the fence, so to speak.

So if the stock goes up, our call makes money but our put loses money. If the stock goes down our put makes money but our call loses money.

When you net this out it sounds like we will never make money, right? So why would we do a crazy thing like this?

Because if the stock moves enough in one direction, the profit will outweigh the loss and we will make money.

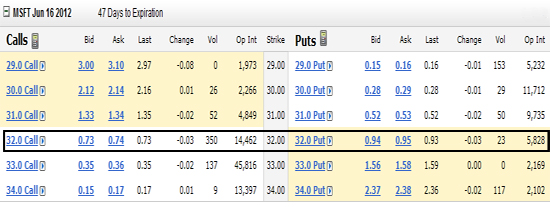

Look at the option chain where the$32 strike price is highlighted. Using the Ask Price, if we buy a 32 strike price call for $74 and a 32 strike put for $95, then our trade cost us $169.

Now if the stock price moves enough, one of the options will probably go worthless, but the other may increase in value beyond our original cost of $169. And that would make us money.

If the stock just moved a little bit, we would make a little bit on one option and lose about the same on the other. So theoretically we would not lose money.

And if the stock did not move at all, our options would stay the same and we would not lose money.

Sounds interesting, doesn’t it? There are only three things the stock can do – go up, stay the same or go down. But the only thing (again, theoretically) that can happen to us is 1) make money or 2) not lose money.

I do like the sound of that, don’t you?

Now we don’t want to have this trade on for too long, because as time passes both options will start to lose money. Remember our old Greek friend Theta and time decay.

But if you know of a big event coming up, like a company is going to announce earnings in the next week or so, you can put a trade like this on. And if the earnings announcement is big news (good or bad, we don’t care because we are proud fence straddlers) the stock will make a big move and you will probably make money.

Many times you will start making money before the announcement because other options traders will be eager to buy call or put options. They are making a direction bet, but you may benefit because they may be driving the option prices up they are so eager to get in the game before earnings.

So sometimes I have seen both the calls AND the puts increase in value at the same time. And yes, sometimes they can both decrease in value. But overall, the thing plays out like we described.

I recently put on an OIL ETF option trade where I bought calls, betting the price of oil would go up in the near future. I toyed with the idea of doing a straddle, just to be safe, but went ahead, picked a direction and bought the calls.

Unfortunately, the price of oil didn’t go up and I lost on the trade. Had I done a straddle I can tell you I actually would have made money on the trade.

I mentioned a strangle as a related type of options trade earlier. So what’s a strangle? A strangle in our example would be if I had bought a 31 call and a 33 put. I’m still betting on both directions, just out of the money on both sides.

So you might try putting on a straddle or strangle some time. If the stock moves nicely you may make some money. And if it doesn’t, you live to play another day.

Just remember to do these short term before our old friend time decay starts eating away at both your calls and you puts.

To your health and prosperity – John