Get Paid A 6% Dividend With This Enhanced Income Fund

There are any number of ways you can invest in the stock market. And two of the more common ways are through individual stocks and stock funds. Not surprisingly, both ways have their own advantages and disadvantages.

One of the clear advantages of investing in stock funds is diversification. That is to say, since a typical fund is invested in many different stocks, if you own the fund, then you are invested in those many stocks too (see https://livelearnandprosper.com/rocks-stocks-or-etfs-which-are-better).

But today I want to show you a stock fund that offers another type of advantage. This fund allows you to tap into a special trading skill that most stock investors don’t have. But by investing in it, you get the benefit of this special expertise for free.

By the way, that benefit is more income. And the stock fund I’m talking about is the Eaton Vance Enhanced Equity Income Fund (NYSE: EOI). Okay, that’s kind of a mouth full, but just focus in on the Enhanced and Income parts and you’ll get the idea.

So you typically invest in this type of fund if you want income from your stock investments. And the enhanced part says they’re doing something special to juice up that income. So more on that trick in a minute.

Now EOI does the income thing in a particularly good way. For starters, they pay out their dividends to you monthly, as opposed to quarterly like most dividend stocks. And better yet, they pay a generous 6% dividend.

Given that the average stock dividend today is around 2%, that’s quite generous. And overall, there just aren’t too many places you can get 6% on your money these days. So they stand out in that regard.

Okay, so the EOI fund pays well, but what’s in it?

THE FUND HOLDINGS

The fund holds around 60 different stocks which are spread across a number of industries. And many of these stocks pay dividends. So you can imagine the fund collects these dividends and passes some of them on to you.

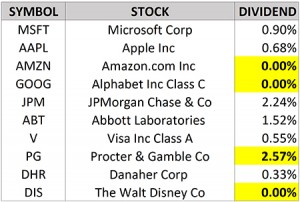

So looking into the stocks and dividends, here are the top ten stocks and what each one pays.

Hmmmm… that’s interesting. The EOI fund pays us 6%, but these dividends aren’t even close to 6%.

Looking through the list, the stock paying the highest dividend is Proctor & Gamble (PG). It pays just 2.57%. Okay, so that’s a respectable dividend, but a long way from the 6% the EOI fund pays out. And more puzzling, three of the top ten stocks pay no dividend at all.

So what’s going on here?

HERE’S WHERE THAT “ENHANCED INCOME” THING COMES IN

Well, this is where the special expertise and trading skill kicks in. Because EOI is selling stock options, using a technique called selling covered calls. This helps them generate even more income from the stocks in their portfolio – over and above the dividends paid or the stock values going up.

Basically, they’re selling options (rights to buy) on their stocks. And people pay them money for these options (called premiums). Then, when the options expire, which they do about 80% of the time, EOI just turns around and sells more options – mostly on the same stocks.

How’s that for a neat trick! EOI just keeps selling options on their stocks, collecting premiums, and doing it over and over again.

Okay, so a couple of points here before we go further. First off, trading options is pretty technical and nuanced, so my explanation above was very simplified, and just gave an overall description. But second, and more importantly, you don’t need to understand this option technique to take advantage of it.

All you need to do is buy the fund. Then you sit back and collect that nice dividend, while the experts at EOI do all of that option selling thing for you.

HOW THAT OPTION THING WORKS

Now if your curiosity is up a bit, here’s what the EOI folks are doing behind the scenes. We’ll take a specific example and show how you could sell options, just like EOI does.

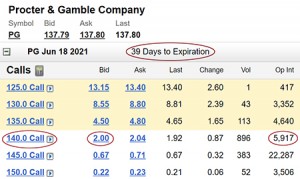

So let’s use the Proctor and Gamble stock (PG) since this is one of the stocks EOI has. And let’s say you own 100 shares of PG stock. And the stock is currently at $137 a share.

Your neighbor Fred wants to buy your shares because he thinks the PG stock price is going up real soon. So you tell him okay, if you pay me $200 now (known as a premium) I’ll hold my 100 shares for you. And I’ll sell them to you for $140 a share any time in the next 39 days, no matter how high the share price goes.

Even if the price goes up to $150 or more a share, I’ll sell them to you for $140 if you want to buy them in the next 39 days.

But after 39 days, the deal is off. And I keep the $200 premium you gave me, whether you decide to buy them from me or not.

And Fred is so sure the stock price is headed up over $140 in the next 39 days that he takes the deal, and pays you the $200 premium.

Congratulations – you just sold you first option!

Now before we move on you may be wondering, why doesn’t Fred just go buy 100 shares of PG stock at $137 a share? And the reason is that he would have to pay out $13,700 to do that. And then he owns the stock – which could go up, or… could go down.

But this way he can just put up $200 (vs. the $13,700) and see how it plays out. Then if it doesn’t work out, he can just walk away… it’s his option (which is why these things are called options).

Now – only three things can happen.

1. The stock stays less than $140 a share in the next 39 days. So Fred doesn’t buy your shares for $140 (because he could just go out and buy them in the market cheaper if he wanted to). But you keep the $200 premium.

2. The stock goes to $140 a share. So Fred doesn’t buy your shares because he could just buy them for $140 in the market if he wanted to). And you keep the $200 premium.

3. The stock goes over $140 a share (let’s say to $145 a share). Fred buys (calls away) your 100 shares for $140 a share for a total of $14,000. Then he sells them in the market for $145 a share for a total of $14,500, and pockets a nice $500 profit. Fred has risked $200 and made $500 – so he made 2 1/2 times his money in 39 days or less… Fred’s happy.

You sold your stock (which was $137 when you made the deal) for $140, so you made a $300 profit on your 100 shares ($14,000 – $13,700 = $300). Plus you keep the $200 premium Fred paid you. So you made $500 in 39 days or less as well. You’re happy too.

So the deal you just did with your neighbor Fred (selling a call option) is what EOI is constantly doing with the stocks in their portfolio, and collecting all those premiums. That’s how they “enhance” the income.

Now a few more points on this example. Do you see in situation 1 and 2 that you keep the premium and still own the stock? So when the deal expires (39 days in this example), you can just turn around and sell another option on the stock to someone else like Fred, and collect another premium. Or maybe Fred wants to have another go ![]() .

.

And in fact, this is how these types of options tend to work out about 80% of the time. They just run out of time and expire because the stock doesn’t get high enough to cause the option buyer to exercise them. But you still get to keep the premium, and the stock.

And even in situation 3, when you had to sell your $137 a share stock for $140, you still made a $300 profit, and kept the $200 premium. So how bad is that?

And now that you sold your shares, if you want, you can just go out and buy another 100 shares and… you guessed, sell another option on them.

Also remember that all the time you’re generating all of this premium income, you’re still collecting the dividends paid by PG, so you’re generating income two ways with your stock.

So that’s a pretty good game to play, right?

And that’s what EOI is doing. And then paying you their nice dividend.

Okay, one more thing and then we’ll move on to a final snapshot of the EOI fund.

HOW REAL WORLD IS THIS REALLY?

Now if selling covered calls is a new concept to you, you might be incredulous that people will actually pay money to buy these things. After all, when you sell them you’re often asking people to pay you a premium for the privilege of buying your stock shares at a higher price than they are in the market.

But believe it or not, people really do buy these options.

I actually based the illustration above on real world data as it was on 5/11/21. I did simplify the price to $137 (from $137.79). But the rest of the data was totally real, i.e. option buyers paying $200 for the privilege of buying a 137.79 per share PG stock for $140 in the next 39 days.

Totally real.

So just for fun, take a guess at how many people in the world thought that was a good idea?

And the answer is 5917 people. On 5/11/21, 5917 people had already bought these call options. You can see that in the real world data table below (called an Option Chain).

Note the Bid price shows $2.00, but each option contract is for one hundred shares – hence the $200 premium for the option.

EOI Call Options (Option Chain)

See the column on the far right that says Op Int. That’s short for Open Interest, or said in simple terms, how many people have bought that $140 Call Options.

So these option deals really take place. Now, like we said, you don’t need to learn how to do them. But even if you never buy or sell an option in your life, isn’t it interesting to see the option technique EOI is doing behind the scenes?

EOI FUND BASICS

Okay – so enough of the behind the scenes magic, now how about the basics?

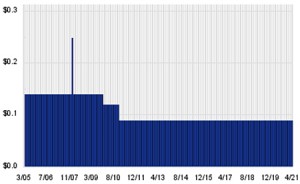

Well, as you can see in the dividend history chart below, the EOI fund has been around and paying dividends for 15 years. And the dividend has been quite steady for the past 11 years.

EOI Dividend History – Chart courtesy of DividendChannel.com

Now, I normally try to invest in dividend stocks that increase their dividend year over year. But as you can see, the dividend has been pretty flat for the past ten years or so.

Actually, there was a slight increase from $.086 per share monthly ($1.03 annual) to $0.09 per share ($1.08 annual) starting in February, 2019. That’s too small to register in the chart, but technically, it did go up slightly a couple of years ago.

But regardless, the 6% dividend is an attractive yield. And for me this is a pure income play. So that works, especially if the dividend seems fairly secure. And steady dividends for 11 years seems to indicate that.

But let’s cross check that another way too. Let’s ask the question, are they straining to make the dividend payments or making them with ease? And in fact, this is a common way to evaluate dividend stocks – to look at how much the company pays out in dividends compared to their free cash flow coming in.

This measure actually has a name. It’s called the “payout ratio.”

The payout ratio is kind of like if a person had an annual income of $50,000, and total bills of $35,000. You and I would think they had a pretty good chance of consistently paying their bills each year because they have $15,000 left over. So in this case, their payout ratio would be 70% ($35,000 / $50,000 X 100).

Similarly, in the investment world, companies with a payout ratio of 70% or less are considered to have a good chance to keep paying their dividend to you and me in the future. That’s because they have cash left over.

And with a payout ratio of 63.7%, EOI comes in under that guideline. So, while there are no guarantees, their future dividend payments seem fairly safe in that regard.

THE STOCK PRICE

That said, we only want to buy stocks when they are selling at a good price. We don’t want to overpay. And one way to evaluate this is to look at the 52 week price range, which is $12.67 – $18.27.

EOI Price Chart – Courtesy of Yahoo.com Finance

Okay, so at $17.40 per share, it looks to be trading a little higher than I would like. But probably not excessively so, since the low end of $12.67 is around the time of the Covid-19 related market drop. And as you can see from the chart, it’s not higher than the highest price for the life of the fund.

Also, I’ve owned the fund off and on for five years, and wanted to get back in it after getting stopped out during the Covid-19 downturn. So I kind of compromised and recently bought a half position, and put in a low bid order of $17.01 for the other half of my position.

We’ll see if the market drops and I get filled on the second part. In the meantime, I’m getting a 6% dividend, paid monthly, from my half position while I wait.

WHAT ARE THE RISKS?

Now, there isn’t much in life that’s guaranteed. And all stocks and investments carry a risk. The most obvious risk with EOI is a market downturn, and / or a significant number of the fund’s stock holdings going down. But that’s a pretty normal market risk that we all have if we’re invested in stocks.

And we can control our risk by never investing more than 4% in any single stock in our portfolio. And having a stop loss – which means selling it if it drops by 25%. So using those guidelines, the most we would lose overall is 1% of our investment portfolio, and live to invest another day.

That said, it would seem EOI can keep collecting the dividends on their portfolio of stocks, and keep selling call options and collecting premiums. And sharing the rewards of that expertise with those of us who own the fund.

CONCLUSION

So with all those things in mind, you might want to check out the Eaton Vance Enhanced Equity Income Fund (NYSE: EOI). $17.40 a share is an affordable price for most investors. And a consistently paid 6% dividend is a nice investment return.

But it’s up to you to decide if it fits your unique investment needs and risk tolerance. The decision is yours. But if you do buy, don’t put all of your eggs in that basket, and be sure and have a stop loss in case the market turns against you.

And finally, isn’t the covered call technique these guys use to enhance the income kind of cool? And isn’t it great we can tap into their expertise by just buying their fund!

To your health and prosperity – John

P.S. To learn more about getting paid with dividend stocks, and stock-like investments, you may be interested in my recent book Your Future Paychecks And Raises: Get Dividend Checks In Your Mailbox Paid To The Order Of YOU! You can check it out for free right here at http://a.co/6FwKPdc.

P.P.S. Feel free to share this post with your friends.