Two Ways To Protect Your Stock Investments

Protecting your stock investments is one of the most important things you can do as an investor. So we’re going to look at two techniques to do that. One of them is quite simple, and will protect you from a major loss. The other is a little more involved, but believe it or not, it can sometimes get you out of a falling stock position at a profit.

These techniques are important since most investments involve risk. And that certainly applies to stock investments. Because there’s always the chance that once you’ve bought a stock, the price begins to fall, and you start losing money.

So you need to protect your investment funds and control that risk. Or as the legendary investor Warren Buffett says, there are two great rules for investing. They are …

Rule 1: Don’t lose the money.

Rule 2: See Rule Number 1.

Now, virtually all investors lose money from time to time. But the successful investors make more money than they lose. So when a stock trade starts going down, successful investors know how to stop their losses before they get out of hand. In other words, they know when to bail out and sell a losing stock. And they do this using various “stop loss” techniques.

We’ll look at two of these stop loss techniques. I use them both to control my risk, and they can help you too.

So what are we really doing when we set a stop loss? Well, we’re actually deciding up front, when we buy a stock, just how much we’re willing to lose before we throw in the towel and sell it. Of course we hope the stock will go up after we buy it, and that often happens. But since none of us can predict the future, we have to face the possibility that the stock we’re buying could go down.

And making the selling decision up front is the best time to do this. That’s because you have no money on the table yet, so you’re more objective. Let me say that another way. When you’ve bought a stock, i.e. you have money on the table, it’s emotional. So the idea here is to get the emotions out of the process before buying the stock.

So here’s the first technique, and that is to use a simple 25% stop loss. What this means is if you buy a stock, and the price goes down 25% from you purchase price, you sell it.

I call this a simple technique because many online stock accounts actually show you your percent loss or gain on their positions screen. So if you see your stock showing a -25% or worse loss, you know to sell it.

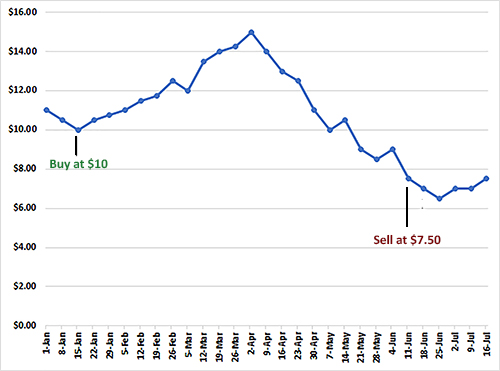

Or you can use this shortcut to calculate the stop loss stock price by just multiplying your purchase price by .75. For example, if you bought a stock for $10 a share, your stop loss price would be $7.50 ($10 X .75 = $7.50).

So let’s just go with that as an example. Looking at our chart, let’s say you bought 100 shares of ABC stock at $10 a share on January 15. So you’ve invested $1000. And if the stock goes down to $7.50 a share, like it did on June 11, you sell it. You’ve lost $250 and thrown in the towel. Okay, so you hate losing the $250. But you’ve also preserved $750 of your investment money and lived to invest another day.

And that’s far better than having no exit plan and possibly riding the stock on down and losing even more money – which is what many beginning investors do. They turn a small problem into a bigger problem.

And here’s another thing to consider. Looking at our chart again, we see that the ABC stock started turning back up again after you sold it. So you might be tempted to hindsight yourself and regret that you sold.

But don’t do that. Because at the time you sold, you had no idea it was going to go back up. And it could have kept going down for a bigger loss. So best to cut your losses and bail out at the 25% loss.

And finally, by just doing this simple 25% stop loss technique, it puts you ahead of the average investor. So that’s the simple stop loss technique for you.

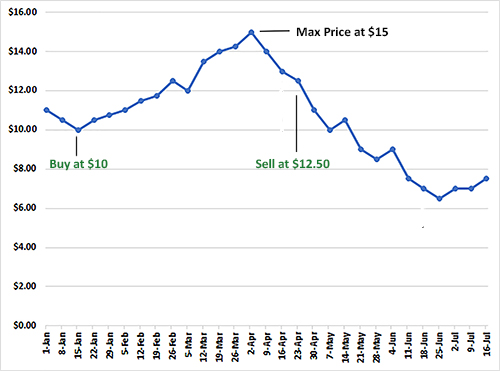

But looking at our chart again, we see that after you bought ABC stock at $10 a share, it went all the way up to $15 a share. Wow – that’s a pretty nice 50% profit you had going on there.

Hmmm… but the simple 25% Stop Loss rule means you rode it all the way down from $15 a share to $7.50 a share. That seems kind of inefficient, doesn’t it?

So here’s a thought. What if we calculate our 25% stop loss from the highest price it’s ever been since we’ve owned the stock. For example, on Jan 15 when we bought it at $10, the stop loss amount would be $7.50 like in our earlier case. But skipping across the chart to Mar 5, we see the stock has gone up to $12 a share. So now our stop loss, the price we would sell at, would be $9 ($12 X .75 = $9).

In other words, we follow, or trail, the price of the stock if it’s going up, and use that new higher price to calculate our new stop loss. And we never reduce that new stop loss amount. It can only go up or stay the same.

This technique is called a trailing 25% stop loss. So if the stock dropped to $9 after Mar 5, then we would sell, instead of waiting for it to go all the way on down to $7.50. Hey, that’s better already, because getting out at that point would only lose $100 instead of $250.

Now skipping across the chart again to Apr 2, we see the stock has gone all the way up to $15 a share. So our stop loss price trails the stock price up even more. And with the stock price at $15 a share, our new stop loss amount is now $12.50. So if the stock price in the future drops below $12.50, we would sell the stock.

Wow – that’s better yet. Because that means that even if our stock starts losing and going down from that point, we get out at a profit. We bought at $10 a share and sold at $12.50 a share for a nice 25% profit of $250.

That’s a pretty nice turn of events for a stock that started going down precipitously after April 2, wouldn’t you say. And that’s the advantage of trailing stop losses. They can reduce the amount you lose. And sometimes, you even get out of a losing stock AT A PROFIT.

Nice.

Now the disadvantage to this technique is that it’s a little trickier to do. You have to keep recalculating and evaluating what your new stop loss is every time your stock goes higher – up to the highest point since you owned it.

Contrast that to the simple 25% stop loss technique where you just calculated your stop loss once in the beginning based on your purchase price. And like we said earlier, most stock accounts actually show you your percent loss anyhow. So you can just look at your trading account screen and see any time that it shows -25% or worse then you need to sell. No calculation is required on your part.

So which technique should you use?

Well, the decision is yours. Ask yourself which one you realistically will do? Because consistently doing a simple technique is better than inconsistently doing a more sophisticated technique.

And here’s another consideration for you. I mentioned earlier that I use both techniques, depending on the stock. So here’s how I decide. When I’m buying a stock as a speculation, I use the trailing 25% stop loss. By speculating, I mean the main reason I’m buying the stock is I think it will go up in value, but it doesn’t pay me any dividends.

But when I’m “investing,” meaning I’m buying the stock because it pays me to own it, by sending me cash dividends, I typically use the simple 25% stop loss. Especially if the stock is paying me a big dividend.

Why? Because I want to hang on to that stock and keep getting paid, month after month, or quarter after quarter.

For example, I currently own a small stock position in one of my trading accounts called Annaly Capital Management Inc (NLY). It pays a whopping 11.6% dividend. That dividend is so good, the stock will actually pay for itself in a little over 6 years. Meaning it will buy itself for me with the dividends and become a free stock. And keep paying me dividends after that.

Now I’m currently down 3% on that stock. But do I care? Not really. Because per my latest dividend, it’s paying me $150 per quarter, or about $50 a month. So I want to keep that going.

Ditto with another stock I’m invested in called Two Harbors Investment Corp (TWO). It’s paying a whopping 13.3% dividend. I’m down 10.7%. Again, do I care? No, not really. It’s paying me $94 per quarter.

Now, to put these small positions in perspective, you can’t live on $94 or $150 every three months. But as you keep adding dividend paying stocks to your portfolio, the sum of these dividends starts adding up to some significant income. And that’s passive income too – as in, you don’t have to work for it – it just shows up in your account.

So that’s why I typically use the simple stop loss technique with these stocks. I don’t want to get stopped out of these stocks unless I absolutely have to. So, while I would prefer they go up, I’m willing to take a bit more loss. Because I want to keep getting their dividends. And keep building passive income.

But if either of these stocks dropped to a loss of 25%, would I care? Yes – most definitely. As much as I would want to keep getting their income, I would bail out of them. Because at that point I want to control my risk and stop any further losses.

So that’s how I use both stop loss techniques. I use the trailing stop loss for speculative stocks, and usually use the simple stop loss for dividend paying stocks. That’s my preference.

Of course you can use the trailing stop loss on dividend stocks as well, and some advisors suggest that. Or you can use the simple stop loss on all of your stocks. It all depends on your personal circumstances. And what you think you’ll really execute consistently.

Because like we said, a simple, less efficient method executed well is still better than a more involved but efficient method executed poorly. So both of these tools are available to you, and the choice is yours.

But however you chose, be sure to consistently use a stop loss to control your risk.

To your health and prosperity – John

P.S. Most of my stocks are dividend paying stocks, because I really like that passive income thing. You know, income you don’t have to work for – it just shows up in your account.

And as you keep adding dividend paying stocks to your portfolio, these dividends start adding up to some significant income.

To learn more about dividend stock investing, you may be interested in my latest book Your Future Paychecks And Raises: Get Dividend Checks In Your Mailbox Paid To The Order of You! - and how they can help you build your wealth and future income too. You can browse through the book for free right here.