Make Sure Your Dividend Stocks Have Good Covfefe!

Okay, so President Trump made a new word in a recent tweet. He ended the tweet with the word “covfefe.”

Some are suggesting this was a typo and he meant to say “coverage.” Others say he meant to create this new word and a limited number of people know exactly what he meant.

Controversy abounds.

But assuming he meant coverage, there is no controversy at all when it comes to your dividend stocks. Because you want to make sure they have good coverage. Or put another way, that they can keep on paying you dividends.

Because great dividend stocks consistently pay dividends, and increases too. But can they keep doing it? That’s the big question.

This is important to you because you don’t want your dividend checks to suddenly stop in the future. You want them to keep coming, showing up in your mailbox, quarter after quarter, year after year.

So how do you check this out?

Well, there are a couple of ways. One is to simply look at their past performance. And the other is to look at their finances to understand their ability to pay. Kind of like how credit card companies look at your ability to pay.

Looking at their past performance is the simplest way to do this. And while past performance is no guarantee of future results, it can be a good indication. Or as Mark Twain is reputed to have said, “History doesn’t repeat itself, but it often rhymes.”

So, if you just do this simple check before you invest, you will be way ahead of most stock investors.

But it’s good to go even further with this if you can. And look at their financial performance to get a clue if they are making enough money to keep paying their dividends. The way we do this is to look at how much money they make, compared to how much they pay out in dividends.

For example, if good company ABC has made $10 million in profits, and paid out $5 million in dividends, they are only paying out half of their profits. So they can probably keep doing this, year after year.

On the other hand, if bad company XYZ has made $10 million in profits, but they paid out $11 million in dividends, they are paying out more than their profits. So they simply can’t keep doing this, year after year. Something is going to have to give.

They can’t keep covering that dividend with the money they make. They can’t keep making that payout, year after year.

So you can see that the ratio between those two numbers is very important. And if we divide how much they paid out by how much they made, we get something called a payout ratio, or a coverage ratio.

And that ratio, that one number, will tell us what we need to know.

Figuring out the payout ratio looks like this. Money Paid / Money Made = Payout Ratio. So let’s compare our two companies.

ABC Company: $5M Money Paid / $10 Money Made = .50 Payout Ratio

XYZ Company: $11M Money Paid / $10M Money Made = 1.10 Payout Ratio

The ABC Company, with a payout ratio of .50, is only paying out half of their money made. So, like we said, they can probably keep doing that. So a ratio of .50 is a good thing.

But XYZ Company, with a payout ratio of 1.10, is paying out more than they are making. They can’t keep doing that for long. We can say a ratio of 1.10 is a bad thing.

So here’s a general rule of thumb for you. You want to invest in companies whose payout ratio is not greater than .70. Because that means they are paying out less than they are making, and have money left over. That money left over gives you a bit of a cushion to assure your dividend checks will keep coming.

NOTE: Acceptable payout ratios can vary by industry. And certain types of investments like Real Estate Investment Trusts (REITS) and Master Limited Partnerships (MLPS) are required by law to have a payout ratio of at least .90. And in those cases, it’s not a bad thing. But exceptions like that aside, a .70 coverage ratio or less is a good guide to use.

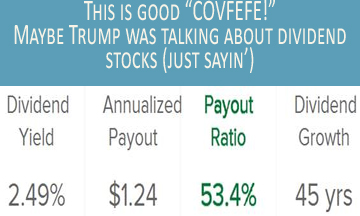

So how do you find out the payout ratio? Here’s an easy way for you to do it. Just go to the website http://www.dividend.com/dividend-stocks/. Then enter the stock symbol in the search box at the top and click. For example, if you search SYY (Sysco), you will see something like this.

See where Sysco is paying out 53.4% of their profits? That’s about half, like our good company ABC at .50. And 53.4 is less than our .70 payout ratio rule of thumb. So Sysco definitely passes the test. The odds are good they can keep paying their dividend.

See where Sysco is paying out 53.4% of their profits? That’s about half, like our good company ABC at .50. And 53.4 is less than our .70 payout ratio rule of thumb. So Sysco definitely passes the test. The odds are good they can keep paying their dividend.

So that’s how easy it is to check out the payout, or coverage ratio before you invest.

Hmmm… I wonder if Trump was talking about dividend stocks. Don’t know for sure, really. But if he was, make sure yours have good covfefe!

To your health and prosperity – John

P.S. To get started in stock investing, so you can buy dividend paying stocks with good covfefe (coverage), you might want to check out my latest book entitled Stock Investing For Beginners. You can browse through it for free right here.