Two Ways To Protect Your Stock Investments

Protecting your stock investments is one of the most important things you can do as an investor. So we’re going to look at two techniques to do that. One of them is quite simple, and will protect you from a major loss. The other is a little more involved, but believe it or not, it can sometimes get you out of a falling stock position at a profit.

These techniques are important since most investments involve risk. And that certainly applies to stock investments. Because there’s always the chance that once you’ve bought a stock, the price begins to fall, and you start losing money.

So you need to Read the rest of this entry »

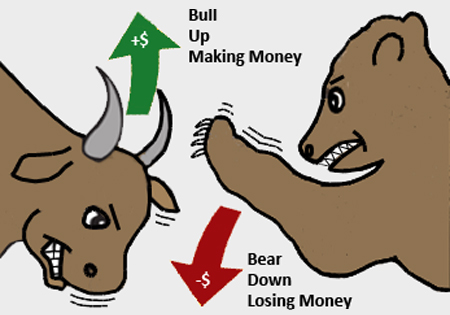

What Do Bull And Bear Markets Mean To You?

With all of the wild swings in the stock market recently, there’s been much speculation about whether we’re in a bear market or a bull market. That is to say, is the market going to go further down from here, or turn around and go back up?

And there have been many questions on how investors should be handling their individual stocks and overall portfolios in this uncertain situation. So more on that in a moment, but first, just what are Read the rest of this entry »

How A Janitor Became A Millionaire

Ronald Read, a former janitor and gas station attendant in Vermont, who died a few years ago, surprised everyone by leaving an $8 million fortune to his local library and hospital.

What was his secret, everyone wondered? And the answer turned out to be Read the rest of this entry »

Get Paid To Tap Into This Silver Stream

Most investors should have a portion of their investments in precious metals like silver and gold. And that’s because precious metals can offer you unique protection from inflation over time. After all, precious metals cannot be inflated. That is to say, you can’t just print more of them like you can dollars and other paper currencies.

And precious metals may protect your portfolio from wild market swings (known as volatility) by Read the rest of this entry »

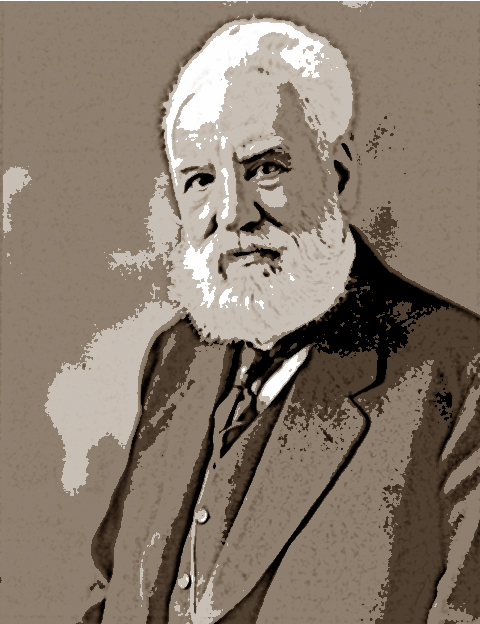

Get Paid A Great 6% Dividend By This Aristocrat

I recently bought more stock in an old, durable company founded by the famous gentleman pictured above. He was a man of many talents, and did groundbreaking work in optical telecommunications, hydrofoils and aeronautics. And he had a strong influence on National Geographic, one of my favorite magazines.

Even better, he shared my annoyance with phone calls when he was working, considering the phone an intrusion, and refusing to have a telephone in his study.

Which I find rather interesting and amusing, since he is Read the rest of this entry »

How Much Silver Should You Own?

In our last post we made the case that most people should own some silver.

And that fits with most financial advisor’s recommendation’s that people own some precious metals in their investment portfolio. But just how much in precious metals, and silver, should you own?

Opinions vary rather widely on this, so let’s look into it and narrow down the choices.

One advisor, who is very concerned about the risk to currencies right now, feels that Read the rest of this entry »

Free Chocolate Or Silver: Which Would You Choose?

On January 18, 1980, the price of silver had rocketed upward 724% in less than a year, from $6 to $50 an ounce. The price had risen so high and so fast that people formed long lines outside their local coin and pawn shops to cash in their silver. Ladies were selling their tea sets, families were hocking their silverware, and coin collectors were cashing in their collections.

As dramatic as that sounds, leading experts today think silver prices could eventually dwarf that 1980 event. Some see future increases as high as 5000% and they are Read the rest of this entry »

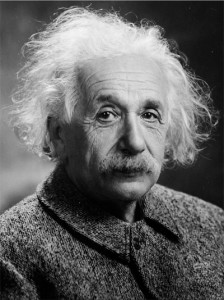

Einstein’s Secret Formula To Wealth

You probably know of Albert Einstein, the genius physicists with a bad haircut, shown in the picture above. His famous relativity formula, e=mc2, showed how much energy can be released from matter. And it was related to the development of the first atomic bomb in the 1940′s.

By the way, the formula computes an astounding amount of energy from matter. For example, I weigh 190 pounds. Einstein’s formula says if the total nuclear forces of my body mass were released, it would be like exploding 1,860,000,000 tons of TNT. That’s 88,403 times more explosive energy than the bomb that destroyed the city of Nagasaki, Japan in World War II… plus or minus a few kilotons.

Okay, so me exploding aside, what you may not know of is another one of Einstein’s formulas, t=72/r, called the Rule of 72. It is one of the simplest rules to learn how to accumulate wealth. And it shows how quickly you can double your money by Read the rest of this entry »

Get Paid 9% Dividends With This High-Yield Stock-Like Investment

Some of my favorite dividend investments will pay you exceptionally high yields. I find it most gratifying to see their outsized dividend payments show up in my account, quarter after quarter, year after year.

And you will too.

Because high yield dividend paying investments really build up your account. You can see real wealth and income effects from them.

Government Properties Income Trust (NASDAQ: GOV) is one such high dividend payer. As the name implies, they own properties that they rent to the government. And as of this writing, they own 93 such buildings, located on 73 properties.

Now, there isn’t much in life that’s guaranteed. But here’s a pretty safe bet you can make. And that is that Read the rest of this entry »

How To Increase Your Stock Gains And Minimize Your Losses

The legendary investor Warren Buffett has two great rules for investing. They are …

Rule 1: Don’t lose the money.

Rule 2: See rule number 1.

This is a huge key to successful investing. So protecting your stock investments is probably one of the most important things you can learn and do. This is how you make money and keep from having big losses. You know, losses like you may have heard other investors have taken, or may have experienced yourself.

Now there are two main things you need to do to protect your portfolio. And both are simple to understand. So if you just do these two things, Read the rest of this entry »